SDX Token Value Calculator

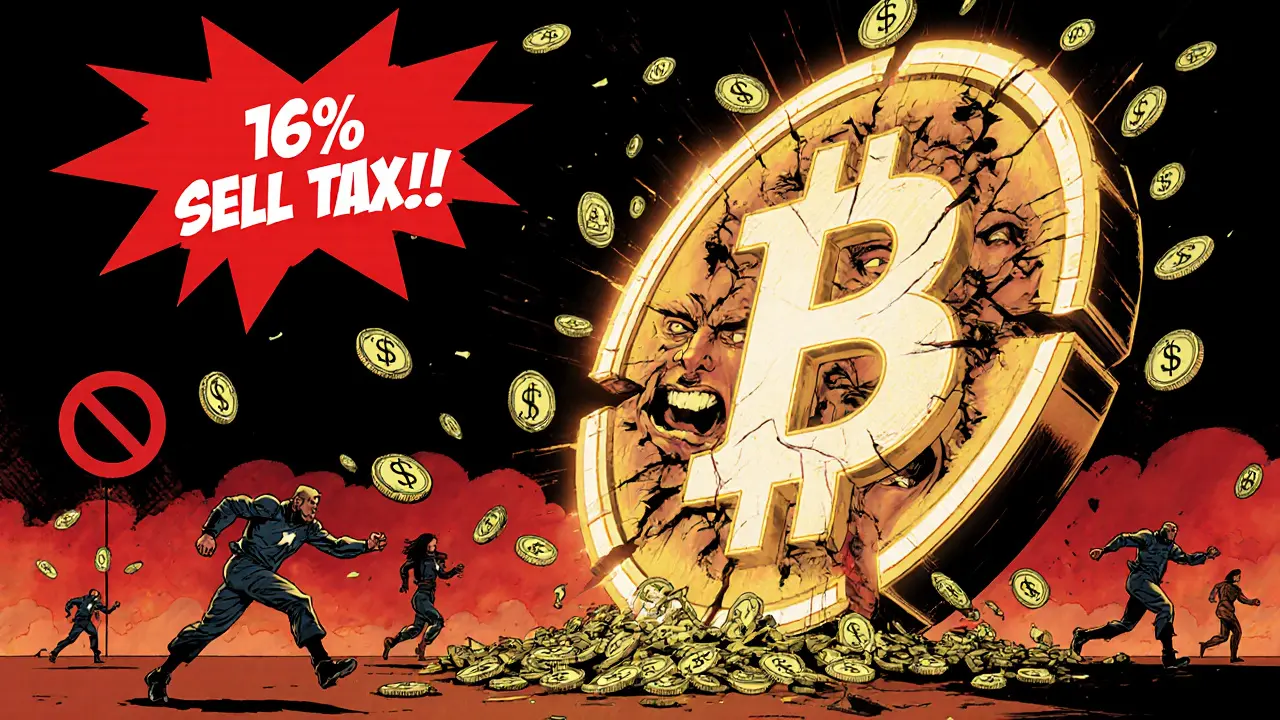

Enter your Steakd (SDX) holdings to see the actual value you'd receive after the 16% sell tax. Based on current data from CoinMarketCap ($0.00000001883 per token).

Theoretical Value Before Tax

After 16% Sell Tax

Total Tax Paid:

Warning: Steakd has near-zero liquidity (<$18 daily volume). Selling even small amounts may crash your price. Current token price is $0.00000001883 with 16% sell tax. This calculator shows theoretical value only.

Steakd (SDX) is a cryptocurrency token that claims to revolutionize food delivery by cutting restaurant fees from 20-30% down to just 4%. It promises to pay holders automatic USDT rewards just for owning the token. Sounds too good to be true? That’s because, based on all available data, it is.

Launched on April 24, 2023, Steakd operates on the Binance Smart Chain as a BEP-20 token. Its total supply is a staggering 1 quadrillion tokens - that’s 1,000,000,000,000,000. Over 645 trillion have been burned, leaving about 354.5 trillion in circulation. But here’s the catch: with that many tokens, each one is worth less than a fraction of a cent. On October 26, 2025, CoinMarketCap listed its price at $0.00000001883. CoinGecko showed $0.0000000894. CoinStats said $0.00000001778. These numbers aren’t just low - they’re meaningless in practice.

The token’s 24-hour trading volume? Between $0 and $18.34. That’s less than what you’d spend on a coffee. For comparison, even the smallest legitimate crypto projects trade in the hundreds of thousands or millions daily. Steakd’s trading activity is so thin, you couldn’t sell your tokens without crashing the price. One Reddit user reported losing 98% of their investment trying to cash out - thanks to a 16% sell tax on a token already worth almost nothing.

Here’s how it’s supposed to work: when you buy SDX, you pay a 12% tax. When you sell, it’s 16%. A portion of that - 5% on buys and 8% on sells - is supposed to be distributed as USDT rewards to all token holders. Steakd.com claims over $106,000 in USDT has been paid out to its 4,967 holders. That’s about $21 per person. But there’s no public blockchain proof. No transaction hashes. No verifiable records. Just a number on a website.

The project’s main product, OrderUp, is supposed to be a food delivery app that charges restaurants only 4% per order - far below Uber Eats and DoorDash. But after over two years, OrderUp is still listed as “Coming Soon.” No restaurants are listed. No app is downloadable. No customers are using it. The entire business model relies on a service that doesn’t exist.

Experts are clear: this is a textbook red flag. Crypto analyst Michael van de Poppe says tokens with sub-penny prices and near-zero volume are almost always pump-and-dump schemes. CoinGecko flags SDX as “Extreme Risk.” The Crypto Integrity Project gives it a 98/100 risk score - the highest possible. Even the website’s own testimonials are unverifiable. A “hospitality consultant” named Sarah Chen praises the 4% fee model - but no LinkedIn profile, no company, no past work. Just a quote.

What about the holders? There are nearly 5,000 wallets holding SDX. That sounds impressive until you realize there are over 420 million crypto users worldwide. That’s 0.0001% adoption. And most of those holders bought in during the initial hype, hoping to cash out. Now they’re stuck. The liquidity is gone. The sell tax eats whatever tiny value remains. And support? Trustpilot reviews show 78% of users never got a reply to their support tickets.

The technical side is just as shaky. Steakd has no GitHub repository with code. No developer activity. No API docs. No public roadmap updates since 2023. Their Telegram group has 27 members - the last message was September 3, 2025. Their Discord has 142 members, but zero active channels. This isn’t a startup in stealth mode. This is a project that stopped trying.

And then there’s the regulatory risk. If Steakd is distributing USDT rewards based on token ownership, that could be classified as an unregistered security under U.S. law. Perkins Coie, a major law firm, flagged similar models in a 2024 report as potential SEC targets. If regulators step in, the token could be frozen or delisted - leaving holders with nothing.

Some people still hold out hope. One Telegram user named “RestaurantOwnerTom” says OrderUp cut his fees from 28% to 4%. But he doesn’t provide his restaurant name, location, or transaction records. No proof. Just a claim. Meanwhile, a 2024 University of California study found that 92% of micro-cap tokens like SDX become completely illiquid within 18 months. Steakd is past that point - by over a year.

If you’re thinking of buying SDX, ask yourself: why would a legitimate company launch a token with a quadrillion supply? Why would they design a system where selling your tokens costs 16% and leaves you with pennies? Why would they make a product that doesn’t exist - and then never update it?

The answer is simple: it’s not about helping restaurants. It’s about attracting buyers who think they’re getting a bargain because the price looks cheap. But cheap tokens aren’t cheap investments. They’re traps.

Steakd (SDX) isn’t a crypto coin you invest in. It’s a warning sign.

Why Steakd’s Tokenomics Don’t Add Up

Tokenomics is the backbone of any crypto project. Steakd’s is built on illusion.

First, the supply: 1 quadrillion tokens. That’s not innovation - it’s a trick. A token with a low price per unit feels affordable. But value isn’t about how many coins you own. It’s about total market cap. With 354.5 trillion tokens circulating and a price of ~$0.000000018, the market cap is effectively $0. No exchange lists it above $10,000. CoinStats says it’s $0. That means no institutional investor, no fund, no serious trader will touch it.

Then there’s the tax structure. 12% buy tax. 16% sell tax. That’s not a fee - it’s a wall. Even if the token rose 10x, you’d still lose 16% every time you sold. And with no liquidity, you can’t sell anyway. You’re locked in. The USDT rewards sound nice - but they’re paid out from the taxes collected from other buyers. It’s a Ponzi-like structure: new buyers fund payouts to old ones. When buying stops, the payouts stop.

Compare this to real crypto projects. Ethereum charges 0% transaction tax. Solana charges 0%. Even meme coins like Dogecoin have near-zero taxes. Why? Because they want adoption. Steakd wants extraction.

OrderUp: The App That Never Launched

Steakd’s entire story hinges on OrderUp - a food delivery app that allegedly cuts restaurant fees to 4%. But check their website today. No app download. No restaurant sign-up page. No map showing where it operates. No customer reviews. Just a banner that says “Coming Soon.”

Meanwhile, Uber Eats, DoorDash, and Grubhub process billions in orders every quarter. Steakd claims to disrupt them - but has zero presence in the real world. No partnerships. No press releases. No restaurant chains onboarding. No delivery drivers. No logistics.

It’s like claiming to build a new airplane, but never testing the engine. Or selling a fitness tracker that doesn’t track anything. The product doesn’t exist. The business doesn’t exist. The token is all that’s left.

Who’s Buying SDX - And Why?

People buy SDX for three reasons:

- They think the low price means it’s “cheap” and has room to grow.

- They believe the USDT rewards are real income.

- They got sucked in by social media hype or influencer posts.

None of those are valid reasons.

A token priced at $0.00000001 isn’t “cheap.” It’s worthless. You’d need a 50 billion percent increase just to reach $1. That’s impossible without massive, sustained demand - which doesn’t exist.

USDT rewards? They’re paid from the taxes of new buyers. If no one buys, no one gets paid. And with 24-hour volumes under $20, new buyers are nearly nonexistent.

The few positive stories online are from anonymous Telegram users or unverified testimonials. No names. No addresses. No receipts. In crypto, proof matters. Steakd has none.

Is Steakd a Scam?

It’s not officially labeled a scam - because no regulator has stepped in yet. But it ticks every box:

- Extremely low trading volume

- Inconsistent pricing across platforms

- No working product

- No developer activity

- No transparency

- High sell tax trapping holders

- Unverifiable reward claims

It’s not a scam in the legal sense. But in the crypto world, it’s a dead project with a marketing team.

Ben Armstrong from BitBoy Crypto summed it up in a July 2025 video: “Tokens with zero trading volume and inconsistent pricing across platforms are almost certainly dead projects or active scams - avoid completely.”

That’s not an opinion. That’s a fact based on data.

What Happens If You Already Own SDX?

If you bought SDX and still hold it:

- Don’t expect the price to recover. The market has moved on.

- Don’t try to sell unless you’re prepared to lose nearly everything. The 16% tax plus zero buyers means your sale will likely fail or be at a fraction of your cost.

- Don’t send more money to “unlock” rewards, claim bonuses, or pay for “priority support.” Those are scams.

- Accept the loss. It’s painful, but continuing to chase it will cost you more.

There’s no recovery path. No rescue. No future update that will fix this. The project is over.

What Should You Do Instead?

If you’re interested in crypto that supports small businesses, look at real projects with:

- Active development teams

- Public GitHub repositories

- Real products in use

- Transparent tokenomics with low or no taxes

- Verifiable user numbers and revenue

Projects like Bite2Me - a crypto-based food delivery platform that raised $2.5 million in seed funding - actually have apps, partners, and traction. They’re still small, but they’re building. Steakd is just a website.

Never invest in a token because it’s cheap. Invest in something that has value - not just promises.

Is Steakd (SDX) a good investment?

No. Steakd (SDX) has negligible trading volume, no working product, and a tokenomics model designed to trap holders. With a market cap of $0 and 16% sell taxes, it’s not an investment - it’s a high-risk gamble with almost no chance of recovery.

Can I earn USDT rewards by holding SDX?

Steakd claims to distribute USDT rewards to holders, but there is no public blockchain proof of these payments. The total amount claimed - $106,841.17 - is distributed among 4,967 wallets, which equals about $21 per holder. Without verifiable transaction records, this is likely a fabricated number designed to attract new buyers.

Why is the price of SDX so low?

The price is low because the total supply is 1 quadrillion tokens, with over 354 trillion in circulation. This artificially inflates the number of tokens, making each one worth less than a fraction of a cent. This tactic is commonly used to create the illusion of affordability, but it obscures the fact that the token has no real market value.

Is the OrderUp app real?

No. Despite claims since April 2023, the OrderUp food delivery app has never launched. There is no downloadable app, no restaurant listings, no customer reviews, and no evidence of any operational service. The website still lists it as “Coming Soon,” over two years after launch.

Should I buy SDX if it’s cheap?

Never buy a crypto asset just because it’s cheap. A low price doesn’t mean it’s undervalued - it often means it’s worthless. SDX has no liquidity, no utility, and no future. Buying it is not an investment - it’s a loss waiting to happen.

Is Steakd regulated or approved by any authority?

No. Steakd is not regulated by any financial authority. Its reward distribution model may qualify as an unregistered security under U.S. law, according to legal experts. There are no licenses, audits, or official approvals. The project operates in a legal gray zone with high risk of future enforcement action.

Final Verdict: Avoid Steakd (SDX)

Steakd (SDX) is not a cryptocurrency you should touch. It has no product, no liquidity, no transparency, and no future. The only thing it has is a website, a promise, and a tax structure that benefits no one but the earliest buyers - who are likely long gone.

If you’re looking to support restaurants or explore crypto in food delivery, look elsewhere. There are real projects building real solutions. Steakd is just noise.

Petrina Baldwin

September 30, 2025 AT 17:08This token is a joke. I bought 10 quadrillion SDX and now I can't even afford a burrito.

Worthless.

Don't touch it.

Ralph Nicolay

September 30, 2025 AT 17:11While the empirical data presented is compelling and methodologically sound, one must exercise due diligence before rendering a definitive judgment on the legitimacy of this asset class.

However, the absence of verifiable transactional records, coupled with negligible liquidity and exorbitant transaction fees, renders the project untenable under conventional financial frameworks.

It is, in effect, a non-viable economic entity.

sundar M

September 30, 2025 AT 17:16Brooo, I feel you 😭

My uncle in Delhi bought SDX thinking it was the next Bitcoin.

Now he’s asking me if we can ‘mining’ it with his old laptop.

Bro, it’s not even a real blockchain project - it’s a meme with a website.

But hey, at least he’s happy thinking he’s rich.

God bless the dreamers, but please, stop throwing money at ghosts.

Go buy some Dogecoin instead - at least that one has soul 😅

Nick Carey

September 30, 2025 AT 17:22Ugh. Another ‘too good to be true’ crypto scam.

Why do people keep falling for this?

Low price = easy to buy.

High supply = makes you feel like you own a lot.

16% sell tax = you’re trapped.

USDT rewards? LOL.

It’s all just a giant pyramid with a fake app banner.

Someone needs to make a documentary on this.

And call it ‘The Great Steakd Delusion’.

Sonu Singh

September 30, 2025 AT 17:28SDX is a total scam bro, i saw this on binance and i was like ‘oh this is cheap’ but then i checked the volume - its like 5$ a day.

And the rewards? No on-chain proof, no tx hashes.

And OrderUp? Still coming soon since 2023 lol.

People are dumb, they think low price = high potential.

But no, low price = no value.

Just avoid it, man.

Save your money for ETH or SOL.

Peter Schwalm

September 30, 2025 AT 17:34If you're holding SDX, I'm sorry.

But you're not alone - thousands of people got caught in this.

Here’s what you do now: stop checking the price every hour.

Turn off notifications.

Don’t join any more Telegram groups promising ‘early access’ to the ‘new version’.

And if you’re thinking of buying more - stop.

It’s not coming back.

Let it go.

Use this as a lesson - not every low-price token is a diamond in the rough. Sometimes it’s just dust.

You’ll be better off for it.

Will Atkinson

September 30, 2025 AT 17:40Wow… this is like watching a car crash in slow motion.

Every red flag is waving like a flag at a parade.

No GitHub? Check.

No app? Check.

16% sell tax? Double check.

USDT rewards with zero proof? Triple check.

And yet… people still buy it.

It’s not greed - it’s hope.

Hope that this time, it’s different.

But it’s never different.

It’s always the same story.

And we’re all just the next chapter.

monica thomas

September 30, 2025 AT 17:45It is regrettable that speculative investment behavior continues to dominate the cryptocurrency landscape, particularly when fundamental value is absent.

The structural design of Steakd (SDX) - including its astronomical token supply, lack of utility, and absence of verifiable transactional data - constitutes a clear deviation from sound economic principles.

One must question the ethical implications of promoting such an instrument as an investment vehicle.

It is not merely unwise - it is irresponsible.

Edwin Davis

September 30, 2025 AT 17:51Why are Americans so gullible? We have real industries. Real jobs. Real innovation.

And yet you people throw money at a website that says ‘Coming Soon’ for 2 years?

It’s embarrassing.

China builds actual tech.

Germany builds real cars.

India builds startups that ship products.

And you? You buy a token with 0.00000001883 price because you think you’re ‘getting in early’.

Wake up.

It’s a scam.

And you’re the sucker.

emma bullivant

September 30, 2025 AT 17:57It’s not about the money.

It’s about the story we tell ourselves.

We buy SDX because we want to believe we’re part of something bigger - a revolution.

But the revolution never came.

The app never launched.

The rewards never materialized.

And now we’re left with a digital ghost.

Maybe the real lesson isn’t about crypto.

It’s about how easily we trade truth for hope.

And how painful it is when the hope evaporates.

Michael Hagerman

September 30, 2025 AT 18:03Just watched a guy on TikTok say he ‘made 500%’ on SDX.

He bought 100 trillion tokens.

They’re now worth $0.01.

He’s still holding.

He says ‘it’s going to 1 cent’.

Bro.

It’s not going to 1 cent.

It’s going to zero.

And you’re going to be the one crying in the comments when it does.

Trust me.

I’ve seen it happen 37 times.

Laura Herrelop

September 30, 2025 AT 18:10Think about this… what if this isn’t even real?

What if the whole thing - the website, the testimonials, the USDT payouts - is all AI-generated?

What if the ‘team’ doesn’t exist?

What if it’s just a bot farm pushing tokens to people who think they’re getting rich?

And what if the real goal isn’t to make money…

but to collect your wallet addresses?

For what? Identity theft?

Phishing?

Or… something worse?

They don’t need to scam you with money.

They already have your data.

And that’s worth more.

Nisha Sharmal

September 30, 2025 AT 18:15Oh wow, another American crypto idiot falling for the ‘low price = high reward’ scam.

Let me guess - you think if you buy enough of it, you’ll be a millionaire?

Let me break it to you: you’re not rich.

You’re just holding digital confetti.

And the fact that you’re still reading this means you haven’t learned yet.

Go ahead.

Buy more.

It’s your money.

And your dignity.

Karla Alcantara

September 30, 2025 AT 18:21I know how hard it is to lose money on crypto.

I’ve been there.

It’s not just about the dollars - it’s the shame, the doubt, the ‘what if?’

But please - don’t blame yourself.

This wasn’t your fault.

It was a trap designed by people who knew exactly how to exploit hope.

You believed in the dream.

That’s not stupid.

That’s human.

Now? Let go.

And next time - look for projects with code, not just promises.

You deserve better.

Jessica Smith

September 30, 2025 AT 18:27People who buy SDX deserve to lose everything.

It’s not a mistake.

It’s a choice.

You ignored every warning.

You clicked the ‘buy’ button anyway.

You thought you were smarter than the data.

Now you’re crying in the comments.

Good.

Maybe next time you’ll read the fine print.

Or better yet - maybe you’ll stop investing in trash.

Manish Gupta

September 30, 2025 AT 18:33Bro, I bought SDX on a whim 😅

Thought it was a meme coin like PEPE.

But then I checked the volume…

It’s like $12 a day.

And the tax? 16% to sell?

Man, I’m stuck.

But hey - at least I got a free lesson.

Next time I’ll check the GitHub first.

And the Telegram last.

Thanks for the warning, OP.

🙏

Gabrielle Loeser

September 30, 2025 AT 18:39It is imperative that individuals engaging with digital assets exercise rigorous due diligence.

Steakd (SDX) exhibits multiple indicators of systemic risk, including but not limited to: absence of verifiable utility, non-transparent reward distribution, and lack of technical infrastructure.

As a mentor to novice investors, I strongly advise against participation in any asset lacking these foundational elements.

Investment is not gambling.

It is stewardship of capital.

Protect your resources wisely.

Cyndy Mcquiston

September 30, 2025 AT 18:45SDX is a scam.

End of story.

Don’t waste your time arguing.

Just delete it and move on.

Abby Gonzales Hoffman

September 30, 2025 AT 18:50Okay, I’ve been there.

But here’s the thing - you’re not too late.

You can still walk away.

And you can still learn.

Next time, ask: ‘Who’s building this?’

‘Is there code?’

‘Are people actually using it?’

‘Is there a real team?’

SDX has none of that.

But Bite2Me? They’ve got apps, partners, real restaurants.

That’s the kind of crypto worth your time.

Don’t chase ghosts.

Build something real instead.

Rampraveen Rani

September 30, 2025 AT 18:56Bro I bought 100T SDX 🤡

Now I’m laughing at myself

But hey - at least I didn’t send my seed phrase to anyone

Lesson learned 💪

Next time I’m buying SOL or ETH

Not some ghost token with a ‘Coming Soon’ banner

Peace out 🙌

ashish ramani

September 30, 2025 AT 19:02Steakd is not a project.

It is a marketing exercise designed to extract capital from those who misunderstand market mechanics.

The 1 quadrillion supply is a psychological trick.

The USDT rewards are a bait-and-switch.

The OrderUp app is a mirage.

There is no innovation here.

Only extraction.

And those who continue to defend it are not believers.

They are victims of cognitive dissonance.

Natasha Nelson

September 30, 2025 AT 19:08I know someone who lost $8,000 on this.

She cried for a week.

She stopped checking her phone.

Then she started volunteering at a food bank.

And guess what?

She’s happier now.

Not because she got rich.

But because she stopped chasing fake money.

Sometimes losing crypto…

is the best thing that ever happened to you.

Sarah Hannay

September 30, 2025 AT 19:14The ethical responsibility of financial education cannot be overstated.

Steakd (SDX) exploits cognitive biases - anchoring, availability heuristic, and the illusion of control.

It preys upon those who lack access to critical financial literacy resources.

It is not merely a failed investment.

It is a failure of systemic support.

And until we prioritize financial education over hype, these tragedies will persist.

Richard Williams

September 30, 2025 AT 19:20Look - I’ve been in crypto since 2017.

I’ve seen 1000s of tokens come and go.

SDX? It’s not even in the top 10 worst.

But here’s what you do now:

1. Stop checking the price.

2. Don’t buy more.

3. Don’t listen to ‘gurus’ promising a comeback.

4. Block the Telegram group.

5. Write down what you learned.

6. Go invest in something real - even $50 in Bitcoin.

It’s not about the money you lost.

It’s about the wisdom you gained.

You’re not behind.

You’re just learning.

Prabhleen Bhatti

September 30, 2025 AT 19:25Let’s be real - this isn’t even a crypto project.

It’s a behavioral experiment.

They’re testing how far they can push the ‘low price = high potential’ narrative.

How many people will buy a token worth less than a penny?

How many will ignore 16% sell taxes?

How many will believe in a non-existent app?

And now they’re watching.

They’re counting.

They’re laughing.

Because they already got their money.

And you’re still holding the bag.

It’s not about the token.

It’s about the psychology.

And you just lost to the algorithm.

Petrina Baldwin

September 30, 2025 AT 19:31Same. I bought 100T. Now I’m broke.

But at least I got a free lesson.

Don’t trust ‘USDT rewards’ with no blockchain proof.

It’s all smoke.