When you hear SDX, a cryptocurrency token often tied to decentralized exchange platforms or liquidity protocols. Also known as SDX token, it’s one of many assets that power trading, staking, or governance on niche blockchain networks. Unlike big names like Bitcoin or Ethereum, SDX doesn’t always show up on mainstream exchanges. That means finding its SDX price isn’t as simple as checking CoinMarketCap. You might need to dig into smaller DEXs, liquidity pools, or community dashboards where it’s actually traded.

SDX often shows up alongside other tokens used in decentralized exchanges, platforms that let users trade crypto directly without a middleman. Also known as DEXs, these platforms rely on tokens like SDX to reward liquidity providers, pay for trades, or vote on protocol changes. If SDX is part of a DEX like Miaswap or ioBanker (both covered in posts here), its value isn’t just about speculation—it’s tied to how much activity that platform sees. More trades? More demand for SDX. Less usage? The price can drop fast. That’s why tracking its crypto market cap, the total value of all SDX tokens in circulation, calculated by multiplying price by supply. Also known as market capitalization, it helps you judge if the token is still gaining traction or fading out. A low market cap means high risk—and maybe high reward if the project picks up steam.

Many of the posts here focus on tokens that fly under the radar—like UZX, ABX, or BB—each with their own niche, risks, and trading patterns. SDX fits right in. It’s not a meme coin, but it’s not a blue-chip either. It’s in the middle: a utility token with real function but limited visibility. If you’re holding SDX, you’re probably tracking it because you’re active on a specific DEX or you believe in its underlying protocol. You’re not just betting on price—you’re betting on adoption.

What you’ll find below are real-world examples of how similar tokens behave: how their prices shift with exchange listings, how airdrops affect supply, how governance votes can change tokenomics overnight. Some posts break down how to track obscure tokens like SDX using on-chain data. Others warn about low-liquidity traps. None of them promise quick riches. But they do give you the tools to make smarter calls—whether you’re holding SDX, considering buying it, or just trying to understand why it matters in the first place.

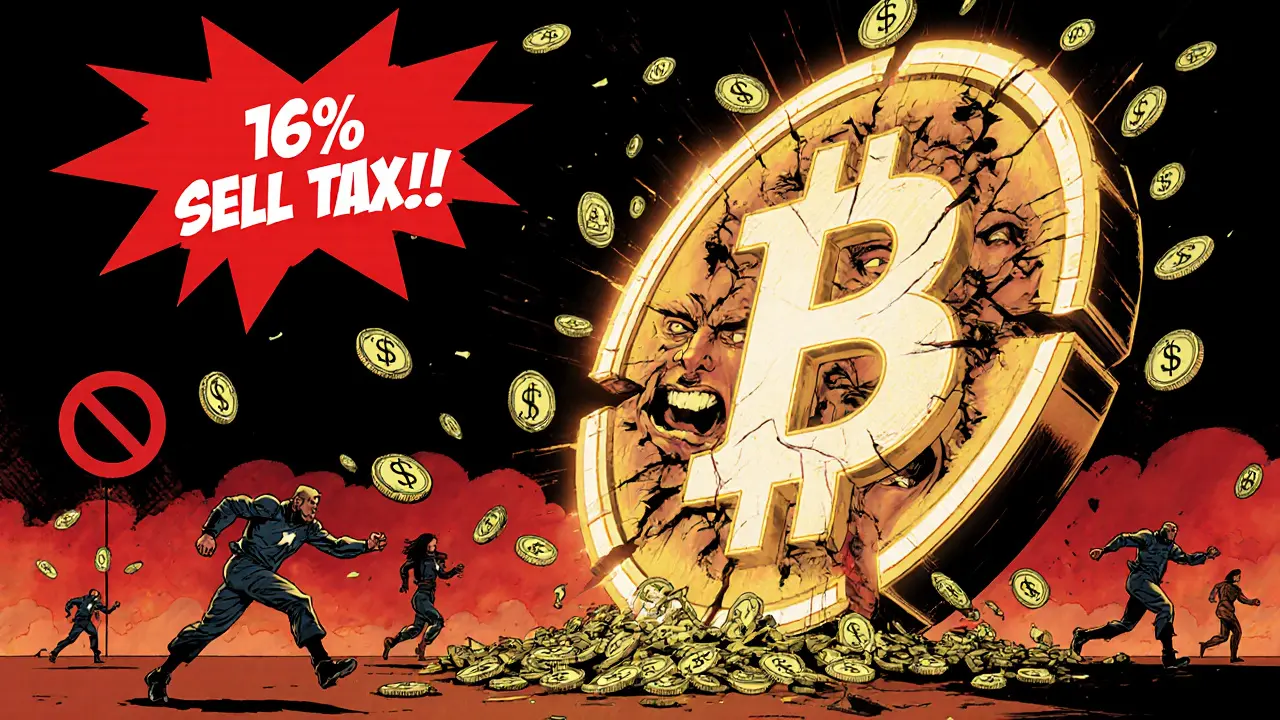

Steakd (SDX) is a crypto token promising low restaurant fees and USDT rewards, but it has no working app, near-zero trading volume, and extreme risk. Experts warn it's likely a dead project.