When talking about decentralized exchange, a peer‑to‑peer platform that lets users trade crypto assets without a central authority. Also known as DEX, it relies on blockchain tech to match orders directly on‑chain.

One of the building blocks of any DEX is the liquidity pool, a collection of tokens locked in a smart contract that traders draw from. Pools replace traditional order books, so you can swap assets instantly, even when no counter‑party is online. The size of a pool directly impacts slippage, making pool depth a crucial metric for traders.

The automated market maker, an algorithm that sets prices based on pool ratios, drives price discovery on DEXs. Unlike centralized exchanges that rely on human market makers, AMMs adjust rates automatically, ensuring continuous liquidity. This mechanism enables features like yield farming and token swaps in a single click.

All of this runs on smart contracts, self‑executing code that enforces trade rules without intermediaries. Smart contracts lock funds, validate swaps, and distribute fees, making the whole process transparent and trustless. Because contracts are immutable, users can verify the exact logic before interacting, which is why security audits are a big part of DEX development.

Because DEXs remove custodial risk, they attract users who want full control over their assets. You keep your private keys, you decide when and where to trade, and you avoid the KYC hoops typical of centralized platforms. This freedom fuels innovation, from cross‑chain bridges to decentralized finance (DeFi) protocols that layer lending, borrowing, and synthetic assets on top of the base exchange.

However, the open nature of DEXs also brings challenges. Gas fees on congested networks can spike, making small swaps costly. Front‑running bots watch pending transactions and try to profit, which can affect price stability. Solutions like layer‑2 rollups, batch auctions, and privacy‑preserving techniques are emerging to mitigate these issues.

Our collection below reflects the breadth of the DEX ecosystem. You’ll find deep dives into modular blockchain architecture that powers next‑gen scaling, reviews of niche DEX platforms like PhotonSwap.finance, and practical guides on implementing Bitcoin DCA strategies that complement decentralized trading. Whether you’re hunting a new airdrop or comparing exchange licensing rules, the articles give you actionable insights to trade smarter.

Ready to explore specific DEX tools, security tips, and market signals? Scroll down to see the curated posts that break down each piece of the puzzle and help you make informed decisions in the fast‑moving world of decentralized finance.

dYdX claims to be a decentralized crypto exchange but blocks users from over 20 countries, including the U.S. and U.K. This article explains how its corporate structure and geo-restrictions contradict decentralization-and what it means for DeFi users.

Clarifying the 'Sishi Finance' confusion: SushiSwap is a real decentralized exchange on Ethereum with SUSHI token. Learn how it works, risks, and how it compares to Uniswap.

JediSwap is a low-fee decentralized exchange on StarkNet offering near-zero gas costs for Ethereum traders. Perfect for advanced users, but too limited for beginners. Learn its pros, cons, and whether it's worth using in 2026.

OraiDEX is an AI-powered decentralized exchange built on Oraichain. It offers cross-chain swaps and unique AI data verification, but with low liquidity, no audits, and minimal user adoption, it's a high-risk experiment - not a mainstream trading tool.

A concise review of ioBanker DEX covering its features, fees, security, and who should use it in 2025.

A concise review of Miaswap v3 covering its features, fees, liquidity, security, tokenomics, and how it compares to top DEXs like Uniswap and PancakeSwap.

Learn what the X Super Official CEO (MRBEAST) crypto coin is, its AI‑powered website builder, tokenomics, price data, how to trade it, and the key risks to consider.

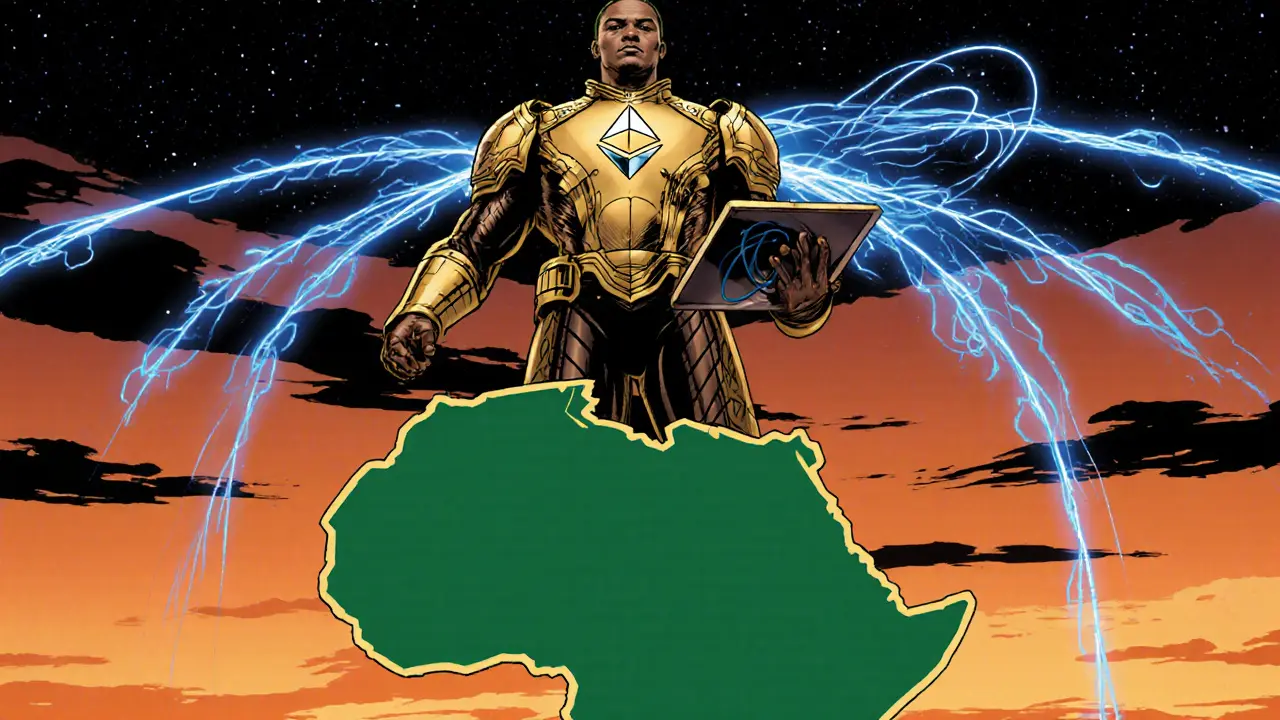

An in‑depth AfroDex exchange review covering token economics, security, liquidity and how it compares to major DEXs like Uniswap.

A detailed Helix Markets crypto exchange review covering tech, fees, assets, safety, comparisons, and who should trade on this decentralized platform.