When you hear blockchain, a public, digital ledger that records transactions across many computers so that no single entity controls it. Also known as distributed ledger technology, it’s the backbone of Bitcoin, but it’s doing far more than just powering crypto. It’s behind tokenized American Express stock, NFT concert tickets, and even government-sanctioned crypto wallets. This isn’t theory—it’s live, messy, and changing how finance works.

Take crypto addresses, unique strings of letters and numbers that act like digital bank accounts on a blockchain. The U.S. government now tracks over 1,200 of them linked to hackers and terrorists. That’s not sci-fi—it’s OFAC’s real-time sanctions list. Or look at tokenized stocks, real shares of companies like American Express turned into blockchain tokens that let you earn dividends without a brokerage. You can now borrow against your Apple stock using a crypto wallet—no Wall Street required. And NFT ticketing, digital tickets that can’t be faked and pay artists every time they’re resold, is turning concerts into collectibles. These aren’t side projects. They’re the new infrastructure.

But blockchain isn’t all innovation. It’s also full of ghosts. Projects like Battle Hero and Lenda claim to be on the blockchain but have zero users, zero code, and zero future. Scammers use blockchain’s reputation to sell fake airdrops—THN, WSPP, ZAM—each promising free tokens that never arrive. Even exchanges like Winstex and Burency Global vanish overnight, leaving users with nothing. The tech is powerful, but the people using it? Not always trustworthy.

That’s why this collection matters. You won’t find fluff here. Just real cases: how Vietnam moves $91 billion in crypto despite bans, why BitMEX still dominates derivatives, and how Singapore shut down 95% of crypto firms overnight. You’ll see how blockchain enables real financial freedom—and how easily it can be abused. Whether you’re checking a token’s legitimacy, wondering if your NFT ticket is worth anything, or trying to understand why your favorite exchange disappeared, the answers are here. No hype. Just what’s actually happening on the chain.

Merkle Trees are evolving beyond blockchain transaction verification into stateless clients, proof-of-reserves, and quantum-resistant systems. Learn how they'll shape finance, identity, and supply chains by 2030.

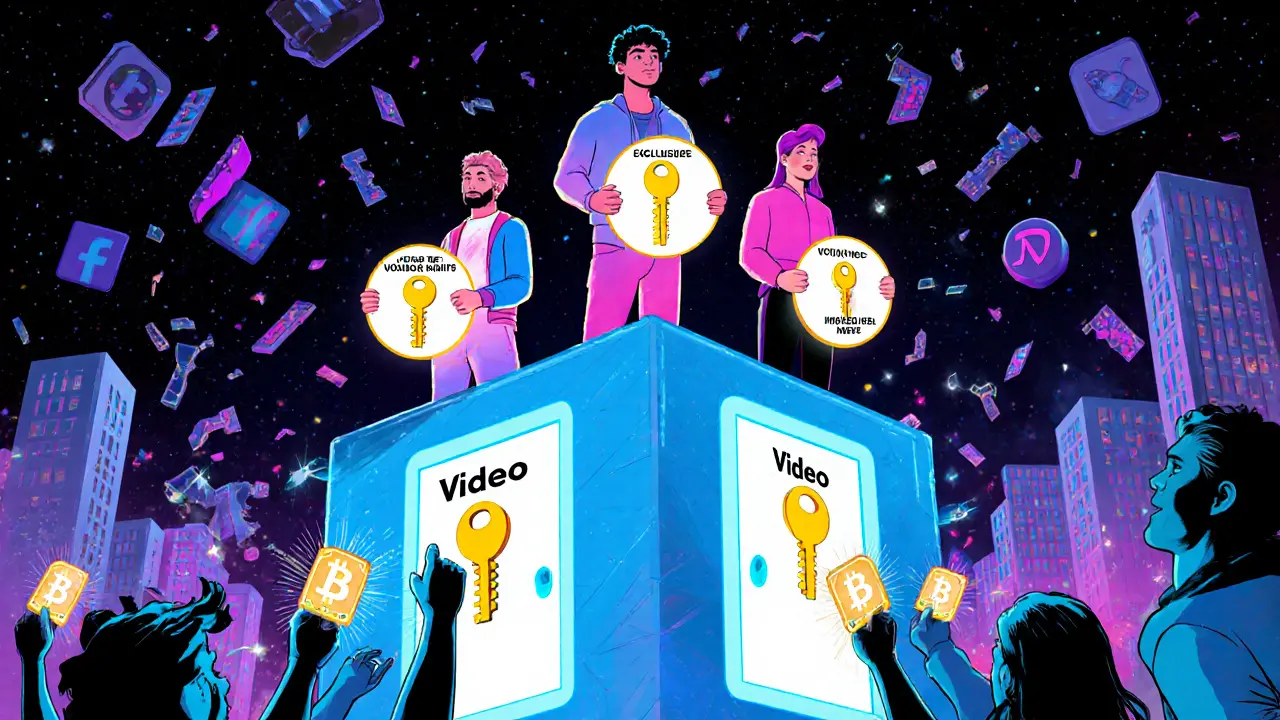

NFTs in 2025 aren't about digital art sales-they're a key revenue tool for creators building owned audiences. Learn how royalties, utility, and community are replacing platform-dependent income.