Crypto Transaction Traceability Calculator

Understand Your Transaction's Traceability Risk

Based on data from the article, this tool estimates how likely your cryptocurrency transaction is to be traced by regulators. Understand the legal risks before proceeding.

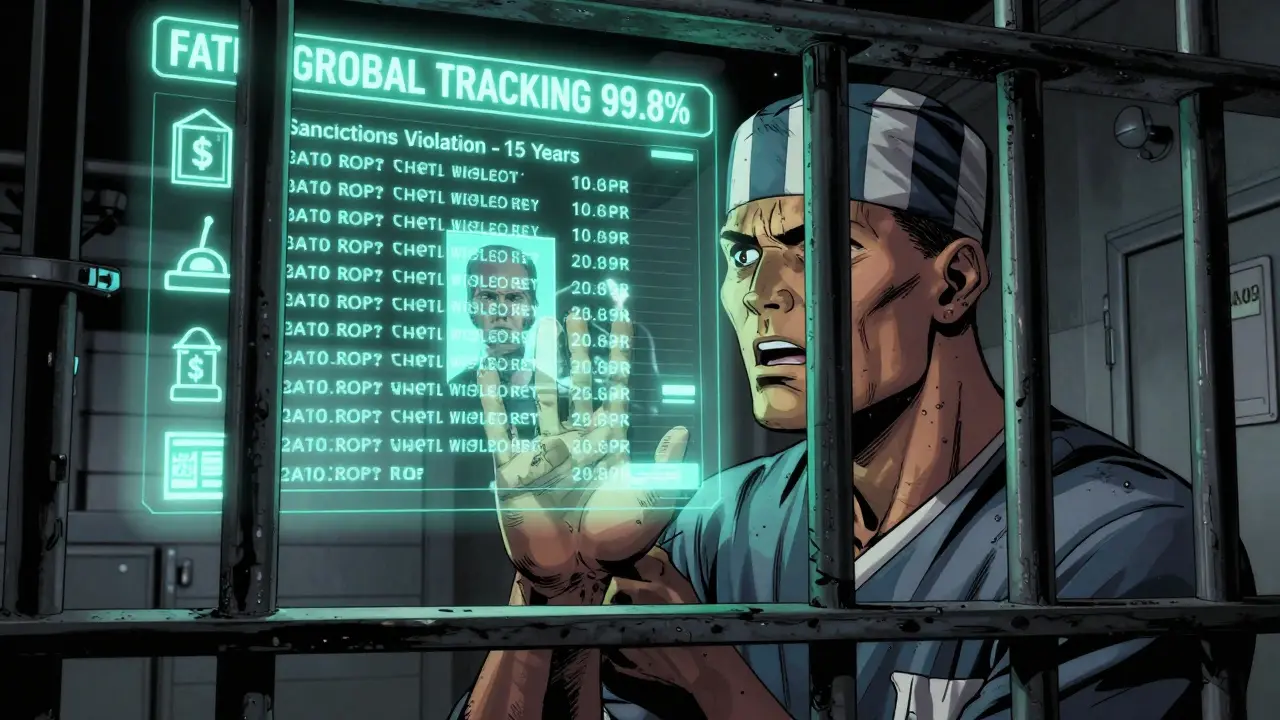

Trying to bypass crypto restrictions isn’t just risky-it’s legally dangerous. Governments and international bodies aren’t guessing anymore. They’ve built systems to track crypto transactions with near-perfect accuracy. If you think using Bitcoin or Ethereum to avoid sanctions is a clever workaround, you’re operating on outdated assumptions. The truth is, blockchain isn’t anonymous. It’s a public ledger that never forgets. Every transaction leaves a permanent, traceable record. And regulators now have the tools to follow every step.

Why Crypto Isn’t the Secret Weapon You Think It Is

Many assume cryptocurrency offers anonymity, making it ideal for slipping past financial controls. That’s a myth. Blockchain technology records every transfer on a public, immutable ledger. Even if your wallet address doesn’t show your name, it shows your activity. And that activity can be linked to real-world identities through IP addresses, exchange accounts, and transaction patterns. The U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC) has been listing crypto wallet addresses on its Specially Designated Nationals (SDN) list since 2018. By December 2023, that list included over 1,571 crypto addresses tied to sanctioned individuals and entities. Chainalysis and Elliptic-two leading blockchain analytics firms-report they can trace 98% of Bitcoin and Ethereum transactions. That number climbs to 99.2% when targeting Russian-linked wallets after the 2022 invasion of Ukraine. Even privacy coins like Monero, which were once seen as untraceable, are now 65% trackable thanks to advanced pattern recognition and clustering algorithms. Crypto doesn’t hide you. It documents you.What Happens When You Get Caught

Circumventing crypto restrictions isn’t a civil violation. It’s a criminal offense in the U.S., the EU, the UK, and many other jurisdictions. The U.S. Department of Justice explicitly stated in its 2020 Cryptocurrency Enforcement Framework that virtual currencies can “undermine traditional financial markets and harm the interests of the United States and its allies.” That’s not a warning-it’s a declaration of intent. In November 2023, the DOJ made history by charging two Russian nationals with attempting to evade $1.3 billion in sanctions through cryptocurrency. This was the first-ever criminal prosecution specifically for crypto-based sanctions evasion. The defendants allegedly used decentralized exchanges, mixers, and layered transactions to obscure the origin of funds. They were still caught. Penalties aren’t light. Fines can reach millions. Individuals face prison time. Companies face license revocations, asset freezes, and bans from operating in major markets. In January 2023, Nexo Inc. paid $22.5 million to settle charges with five U.S. states for offering unregistered securities. Coinbase, one of the largest exchanges, has frozen over 25,000 Russian accounts worth $225 million since February 2022. These aren’t isolated incidents-they’re part of a coordinated global enforcement strategy.How Regulators Are Catching You

Regulators don’t rely on luck. They use structured, technology-driven systems. The EU’s Markets in Crypto-Assets Regulation (MiCA), which took full effect in 2024, requires all crypto service providers to implement real-time sanctions screening. That means every wallet address, every transaction, every IP address is checked against OFAC’s list and similar global databases. The U.S. Financial Crimes Enforcement Network (FinCEN) has defined clear “red flags” for crypto sanctions evasion:- Transactions originating from IP addresses in jurisdictions with weak enforcement

- Transfers to wallets already on OFAC’s SDN list

- Use of decentralized exchanges (DEXs) based in high-risk regions

- Repeated small transactions designed to avoid thresholds

- Transactions involving mixers or privacy tools linked to sanctioned entities

Why Traditional Methods Are Still More Common

Despite the hype, crypto isn’t the main tool for sanctions evasion. According to a 2023 CSIS report, cryptocurrency accounted for only 0.01% of the estimated $148 billion in sanctions evasion attempts tied to Russia. Far more common were commodity trading (42%), third-country intermediaries (38%), and physical cash smuggling (15%). Why? Because crypto is harder to use at scale without leaving traces. Cash can be moved across borders without digital footprints. Shell companies can be layered across multiple jurisdictions. Crypto? Every move is recorded. And every move can be analyzed. Even if you’re technically skilled, you’re fighting against a growing ecosystem of tools, data, and international cooperation. The Financial Action Task Force (FATF) now requires 120+ member countries to enforce crypto sanctions uniformly. By 2026, they project 99.8% traceability for major cryptocurrencies through coordinated global monitoring.The Cost of Compliance-And What Happens If You Don’t

Compliance isn’t cheap. Coinbase spent $47 million and 18 months building its sanctions screening system. It now spends $12.3 million every quarter just to stay compliant. That’s not a cost-it’s a survival expense. For individuals and small operators, the barrier is even higher. Setting up a system to avoid sanctions legally requires legal counsel, blockchain monitoring software, and constant updates to regulatory changes. Most people don’t have those resources. So they take shortcuts. The result? A false sense of security. You think you’re anonymous. You’re not. You think you’re clever. Regulators have been expecting you. The 2023 Government Accountability Office found that 37% of Russian-linked crypto transactions during the first six months of the Ukraine war lacked sufficient identifying information. That doesn’t mean they were untraceable. It meant regulators couldn’t act quickly enough. Now, they’ve fixed those gaps.

What’s Next? The Next Frontier of Enforcement

The next wave of enforcement is targeting decentralized finance (DeFi) and privacy-enhancing technologies. The Digital Asset Sanctions Compliance Act, introduced in September 2023, proposes extending OFAC requirements to decentralized applications. That means even if you use a smart contract on Ethereum to move funds, you could be held legally responsible. Regulators are also cracking down on jurisdictions that enable evasion. El Salvador, the Cayman Islands, and other crypto-friendly regions are under increasing pressure to align with FATF standards. If you’re using a platform based in one of these places, you’re not avoiding scrutiny-you’re just delaying it. Professor Aaron Wright of Cardozo Law School put it simply: “Blockchain creates a digital paper trail that is far more permanent and traceable than traditional financial transactions.” There’s no delete button. No reset. No offshore loophole.Bottom Line: It’s Not Worth It

Circumventing crypto restrictions doesn’t make you smart. It makes you a target. The technology you think protects you is the same technology that exposes you. The legal systems you think you can outmaneuver are now built specifically to catch you. The risks aren’t theoretical. They’re real, documented, and actively enforced. Fines, prison, asset seizures, and global blacklisting are not hypothetical outcomes. They’re happening right now. If you’re considering using crypto to bypass sanctions, ask yourself this: Do you really want your name, your wallet, and your entire transaction history permanently recorded on a global ledger-alongside your criminal charges? The answer isn’t about technology. It’s about consequences.Is it illegal to use cryptocurrency to avoid financial sanctions?

Yes. Using cryptocurrency to evade financial sanctions is a criminal offense in the U.S., EU, UK, and many other countries. Regulators treat crypto assets the same as traditional money under sanctions laws. The U.S. Department of Justice, OFAC, and the EU’s MiCA regulations all explicitly prohibit such activity. Violations can lead to fines, asset freezes, and prison time.

Can cryptocurrency transactions really be traced?

Yes. Blockchain analytics firms like Chainalysis and Elliptic can trace 98% of Bitcoin and Ethereum transactions. Even privacy coins like Monero are now 65% traceable. Every transaction leaves a permanent public record. Wallet addresses may be pseudonymous, but they can be linked to real identities through IP logs, exchange records, and transaction patterns. The idea that crypto is anonymous is a myth.

What are the red flags for crypto sanctions evasion?

The U.S. FinCEN lists several red flags: transactions from IP addresses in high-risk jurisdictions, transfers to addresses on OFAC’s SDN list, use of decentralized exchanges in unregulated regions, repeated small transactions to avoid detection, and use of mixers or privacy tools linked to sanctioned entities. Exchanges are required to flag these activities and report them to authorities.

Have people been prosecuted for crypto sanctions evasion?

Yes. In November 2023, the U.S. Department of Justice charged two Russian nationals with attempting to evade $1.3 billion in sanctions using cryptocurrency. This was the first criminal prosecution specifically for crypto-based sanctions evasion. Multiple other cases are under investigation, and regulatory agencies are prioritizing these investigations.

Are decentralized exchanges (DEXs) safe from sanctions enforcement?

No. While DEXs don’t require KYC, they still interact with regulated infrastructure. Wallets connected to DEXs can be traced. Smart contracts can be analyzed. Transactions that later move to centralized exchanges are flagged. The U.S. Digital Asset Sanctions Compliance Act proposes extending sanctions rules directly to DeFi protocols. Using a DEX doesn’t make you invisible-it just adds another layer to the digital trail.

Can I use crypto in countries with lax regulations to avoid sanctions?

Not reliably. Countries like El Salvador or the Cayman Islands may have looser rules, but they’re under growing international pressure to comply with FATF standards. Assets moved through these jurisdictions can still be frozen if linked to sanctioned entities. Additionally, most major exchanges and financial institutions globally refuse to process transactions tied to these jurisdictions if they suspect sanctions violations. You’re not avoiding the system-you’re just making it harder to exit it.

What happens to my crypto assets if I’m flagged for sanctions evasion?

Your assets can be frozen, seized, or permanently blocked. Exchanges like Coinbase and Binance have already frozen hundreds of millions in assets tied to sanctioned entities. Once flagged, your wallet addresses may be added to global sanctions lists, making it impossible to trade, transfer, or convert your crypto through any regulated platform. Recovery is extremely difficult and rarely successful.

Is there any legal way to use crypto in sanctioned countries?

Only under specific, licensed exceptions-such as humanitarian aid approved by OFAC or the EU. Even then, transactions must be fully documented, traceable, and reported. There is no legal loophole for personal use, business transactions, or asset transfers by sanctioned individuals or entities. Any attempt to circumvent these rules, even with good intentions, is still illegal.

Lois Glavin

December 16, 2025 AT 13:06Wow, this post really laid it out plain and simple. I used to think crypto was some kind of secret shield, but now I get it-it’s more like a glowing sign that says ‘I’m here’.

Thanks for the clarity.

Abhishek Bansal

December 16, 2025 AT 23:20lol so you’re telling me my 0.5 BTC ‘hiding’ in a mixer is just a public billboard? newsflash: the government’s got better tech than my grandma’s phone.

also who even uses crypto to evade sanctions? that’s like using a smoke signal to avoid radar.

Bridget Suhr

December 18, 2025 AT 19:30i think this is super important but honestly i’m still kinda confused about how they link wallet addresses to real people?

like… do they just guess? or is it like… ip logs and stuff? i need a dumbed down version.

Ike McMahon

December 18, 2025 AT 23:26Just a quick note: if you’re thinking of using crypto to bypass sanctions, ask yourself this-do you really want your entire financial history permanently stored on a public database?

It’s not just risky. It’s a digital scarlet letter.

JoAnne Geigner

December 19, 2025 AT 19:52I’ve been thinking about this a lot lately… the idea that we’re all leaving digital footprints, and crypto just makes them brighter.

It’s not about trust in the system-it’s about how the system is designed to remember everything, forever.

And honestly? That’s kind of beautiful, in a terrifying way.

Maybe we should be asking not ‘how do we hide?’ but ‘how do we build better systems?’

Because the tech isn’t the enemy-the lack of ethical guardrails is.

And if we keep treating crypto like a loophole, we’re just digging our own graves with blockchain shovels.

It’s not about rebellion-it’s about responsibility.

And I think most of us, deep down, want to do the right thing.

Even if it’s hard.

Even if it’s inconvenient.

Even if it feels like the system’s rigged.

We still choose to show up.

And that’s worth something.

Anselmo Buffet

December 20, 2025 AT 02:11They’re not guessing anymore. They’re watching. Every move.

And you’re not clever. You’re just loud.

Joey Cacace

December 21, 2025 AT 19:09Thank you for this meticulously researched and profoundly important breakdown. The clarity with which you’ve articulated the legal, technical, and ethical dimensions of crypto-based sanctions evasion is both sobering and necessary.

I hope this reaches those who still believe in the myth of anonymity.

With deep respect and gratitude for your work.

Taylor Fallon

December 23, 2025 AT 15:42sooo… crypto isn’t magic? 😅

i thought i was being sneaky with my usdt transfers… turns out i was just leaving breadcrumbs to my own downfall 🥲

thanks for the reality check, friend. i’ll stick to my savings account now.

Sarah Luttrell

December 24, 2025 AT 23:05Oh wow, another ‘government knows best’ sermon.

Let me guess-you also think the moon landing was real and that your WiFi password is safe?

Blockchain is traceable? Sure. Until it isn’t.

And guess who controls the ‘analytics firms’? The same people who told us 9/11 was an inside job.

Wake up, sheeple. They want you scared. And compliant.

And you’re handing them your keys.

Kathleen Sudborough

December 26, 2025 AT 11:32This is one of the most thorough explanations I’ve ever read on crypto and sanctions.

It’s not just about legality-it’s about identity. Your wallet isn’t just an account. It’s a digital fingerprint.

And once it’s linked to a crime, there’s no undo button.

I used to think privacy coins were the answer.

Now I know: the system doesn’t need to break you. It just needs to outlast you.

Vidhi Kotak

December 28, 2025 AT 02:08Actually, in India, many people use crypto for remittances because traditional banks are slow and expensive.

It’s not about evasion-it’s about survival.

But yeah, the traceability part? Totally real.

Maybe the solution isn’t avoiding crypto, but pushing for better, fairer rules.

Not punishment. Progress.

Kim Throne

December 29, 2025 AT 15:21According to the 2023 CSIS report cited, cryptocurrency accounted for only 0.01% of sanctions evasion attempts tied to Russia. This statistic is critical and warrants greater emphasis in public discourse. The disproportionate focus on crypto obscures the far more prevalent mechanisms of evasion, such as commodity trading and third-country intermediaries. A policy response must be proportionate to the threat, not the spectacle.

Toni Marucco

December 31, 2025 AT 15:17They call it a ledger, but it’s really a prison of pixels.

Every transaction is a brick in the wall they’re building around you.

And you? You thought you were a hacker.

Turns out you’re just a ghost in their machine.

And ghosts don’t get trials.

They get erased.

amar zeid

January 1, 2026 AT 08:48Interesting how they say ‘98% traceable’-but what about the other 2%?

Is that where the real power lies?

Who controls those gaps?

And who benefits when we’re all told ‘nothing is hidden’?

Maybe the real question isn’t ‘can they track you?’

But ‘who do they track-and why?’

Alex Warren

January 2, 2026 AT 14:17Chainalysis and Elliptic trace 98% of BTC and ETH transactions. That’s accurate.

But their methodology relies on clustering and heuristics, not direct identity linkage.

False positives happen.

And the legal system doesn’t always distinguish between technical traceability and legal culpability.

Context matters.

Steven Ellis

January 3, 2026 AT 12:09I’ve worked with compliance teams for over a decade, and let me tell you-this isn’t sci-fi.

Every day, systems flag transactions that look ‘off’-small transfers, mixers, IP mismatches.

It’s not magic. It’s math.

And the math is winning.

People think they’re clever. They’re just predictable.

The system doesn’t need to be perfect.

It just needs to be better than your excuses.

Claire Zapanta

January 4, 2026 AT 14:27Oh please. They ‘trace’ crypto? So why haven’t they caught the billionaires moving billions through shell companies in the Caymans?

Why are the real criminals still sipping champagne while peasants get jailed for sending 5 BTC?

This isn’t justice.

This is control.

And you’re the one who’s being played.