OFAC Sanction Risk Assessment Tool

Risk Assessment

This tool estimates potential consequences based on OFAC sanctions information. Note: OFAC doesn't provide public search tools - this is for educational purposes only.

Risk Assessment Results

Key Implications

Recommended Actions

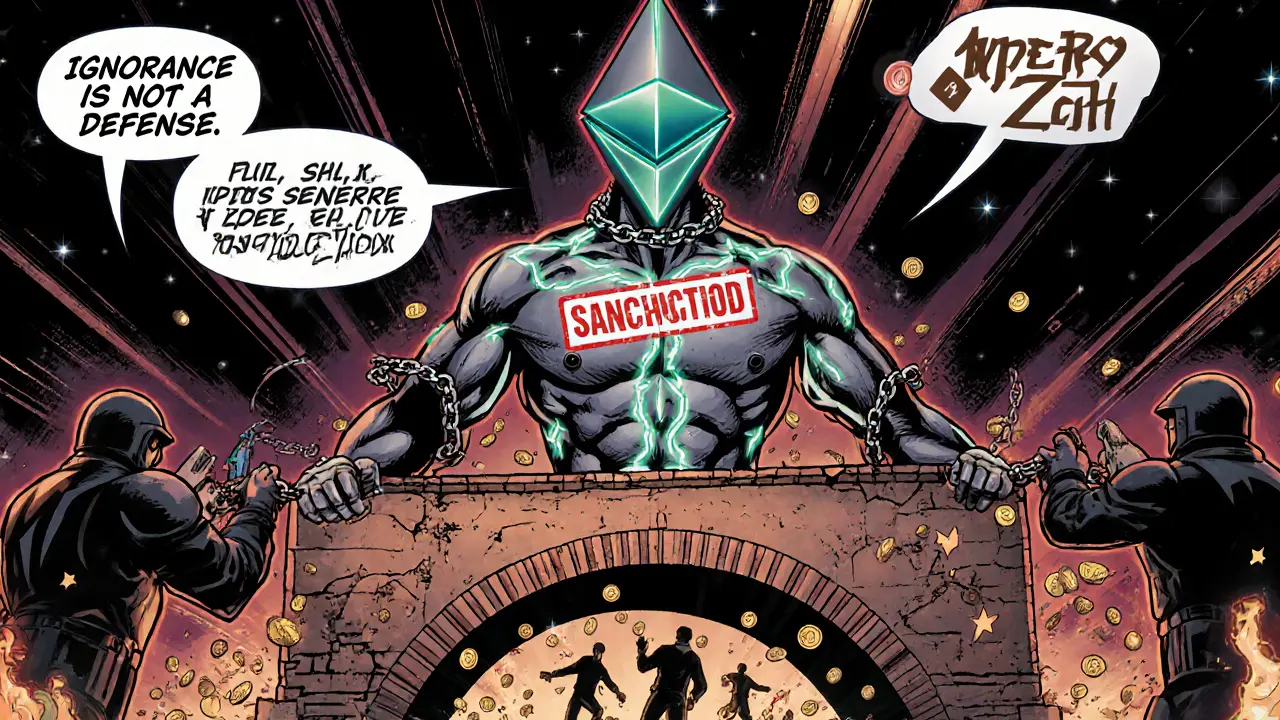

When the U.S. government targets a crypto wallet, it doesn’t just freeze a bank account-it freezes a digital trail that spans blockchains, exchanges, and anonymous networks. As of 2025, the OFAC sanctions list includes over 1,200 cryptocurrency wallet addresses linked to terrorists, hackers, state-sponsored actors, and money launderers. This isn’t theoretical. Real wallets with real funds are being frozen. Real people are being indicted. And exchanges that miss a single address risk fines in the hundreds of millions.

What the OFAC Sanctions List Actually Covers

The Office of Foreign Assets Control (OFAC), part of the U.S. Treasury, doesn’t just target banks or shell companies anymore. It now tracks individual Bitcoin, Ethereum, and Tether wallets. If a wallet is on the Specially Designated Nationals (SDN) list, any U.S.-based exchange or financial service that interacts with it is breaking the law. That means deposits, withdrawals, swaps-all blocked. Even sending a dollar to a sanctioned address can trigger legal consequences. The list includes more than just Bitcoin. OFAC now monitors 17 different cryptocurrencies, including:- Bitcoin (XBT)

- Ethereum (ETH)

- Monero (XMR)

- Litecoin (LTC)

- ZCash (ZEC)

- DASH

- Bitcoin Gold (BTG)

- Ethereum Classic (ETC)

- Bitcoin Satoshi Vision (BSV)

- Bitcoin Cash (BCH)

- Verge (XVG)

- USD Coin (USDC)

- USD Tether (USDT)

- Ripple (XRP)

- Tron (TRX)

- Arbitrum (ARB)

- Binance Smart Chain (BSC)

Stablecoins like USDT and USDC are especially targeted because they’re used to move value across borders without the price swings of Bitcoin or Ethereum. In March 2025, Tether froze $450 million tied to Iranian sanctions violations. That’s not a glitch-it’s policy.

How OFAC Tracks Crypto Addresses

Unlike traditional banking, where you freeze a name or account number, crypto sanctions require tracking specific wallet addresses across dozens of blockchains. OFAC doesn’t guess. It uses blockchain analysis firms like Chainalysis, Elliptic, and Scorechain to trace transactions from one wallet to another. In May 2025, OFAC launched Blacklist v2.0, which added real-time alerts and support for Layer 2 networks like Polygon and Arbitrum. Why? Because criminals moved there to avoid detection. Now, OFAC monitors those too. The data is published in XML format through a file calledsdn_advanced.xml. Compliance teams at exchanges download this file and plug it into their systems. The best platforms update within 15 minutes of a new listing. That’s the new industry standard. Miss that window? You’re non-compliant.

Real Cases: Who’s on the List and Why

The OFAC list isn’t full of random addresses. It’s packed with known bad actors. In September 2025, Iranian nationals Alireza Derakhshan and Arash Estaki Alivand were added to the list after moving over $600 million through Ethereum and Tron wallets. These weren’t random users-they were running a network that laundered proceeds from Iranian oil sales. Their wallets received funds from exchanges in Turkey and the UAE, then sent them to mixers and DeFi protocols to obscure the trail. Another case: SECONDEYE SOLUTION, linked to the Internet Research Agency LLC (the Russian troll farm behind U.S. election interference), had multiple Bitcoin addresses sanctioned. One was1NE2NiGhhbkFPSEyNWwj7hKGhGDedBtSrQ. Another: 19D8PHBjZH29uS1uPZ4m3sVyqqfF8UFG9o. These addresses received payments from fake ad campaigns and were used to fund further operations.

Then there’s Garantex. This exchange was shut down in March 2025 after U.S., German, and Finnish authorities seized over $26 million in crypto. Its executives were indicted. The company tried to rebrand as Grinex-but OFAC added the new entity to the list within 48 hours. No escape.

And in Q1 2025, the Lazarus Group-a North Korean hacking team-stole $200 million in crypto and funneled it through DeFi protocols like Thorchain and Curve. OFAC sanctioned the smart contracts involved. That’s new. You’re not just sanctioning wallets anymore-you’re sanctioning code.

What Happens When You Interact With a Sanctioned Address

If you’re an exchange, wallet provider, or even a DeFi app, you’re legally required to screen every transaction against the OFAC list. If you send ETH to a sanctioned address-even accidentally-you could be fined. The U.S. government doesn’t care if you didn’t know. Ignorance isn’t a defense. In 2025, the Department of State started offering up to $5 million for tips leading to the arrest of sanctioned crypto operators. That’s a massive incentive for insiders to report suspicious activity. For regular users, it’s less obvious. If you receive funds from a sanctioned wallet-even if you didn’t ask for it-your account could be frozen. You’ll get a notice. You’ll need to prove the money wasn’t yours. That process can take months. And if you can’t? The funds are gone.How Exchanges and Businesses Stay Compliant

There’s no manual way to keep up. You need software. Leading exchanges use automated screening tools that:- Check every incoming and outgoing transaction against the SDN list in real time

- Scan across multiple blockchains simultaneously

- Flag mixers, tumblers, and privacy coins like Monero

- Alert compliance teams when a high-risk address is detected

The New Frontier: Sanctioning AI and Smart Contracts

In February 2025, OFAC did something unprecedented: it sanctioned an AI-powered trading bot. This bot, used by a sanctioned entity, automatically moved $60 million through 12 different wallets over 11 days, switching between ETH, USDT, and BSC to avoid detection. The bot itself was added to the SDN list. That’s a turning point. Now, it’s not just people who are sanctioned-it’s algorithms. And it doesn’t stop there. Proposed regulations from May 2025 aim to hold smart contract developers legally responsible if their code is used for sanctions evasion. Imagine writing a DeFi protocol that lets users swap tokens anonymously-and later finding out it was used by a terrorist group. You could be charged. This is why DeFi developers are now hiring compliance lawyers before launching their next token.Why This Matters for Everyone

You might think, “I’m just a regular user. I don’t deal with sanctioned wallets.” But you do. Every time you buy crypto on Coinbase, Kraken, or Binance, your transaction is screened. Every time you send ETH to a friend, their wallet is checked. The system is invisible-but it’s everywhere. If you use a privacy coin like Monero, you’re more likely to trigger a flag. If you use a mixer, you’re almost certainly flagged. If you trade on a non-U.S. exchange that doesn’t screen, you’re risking your funds being frozen if you ever move them to a U.S. platform. The message from OFAC is clear: crypto isn’t anonymous. It’s traceable. And if you’re connected to a bad actor-even indirectly-you’re at risk.What’s Next?

OFAC isn’t slowing down. Experts predict:- More sanctions on privacy coins like Monero and ZCash

- Expanded targeting of cross-chain bridges used to move funds between blockchains

- Increased cooperation with the EU, UK, and Japan to create a global crypto sanctions network

- Real-time blockchain monitoring by U.S. agencies, not just after-the-fact screening

How do I check if a crypto address is on the OFAC sanctions list?

You can’t check it yourself directly. OFAC doesn’t offer a public search tool for crypto addresses. Only regulated businesses like exchanges and wallet providers have access to the full SDN list via their compliance software. If you’re a user, the safest approach is to avoid sending or receiving crypto from unknown sources. If your wallet gets flagged, your exchange will notify you. Don’t try to bypass the system-this isn’t a glitch, it’s enforcement.

Can I still use Bitcoin if OFAC sanctions it?

Yes. OFAC doesn’t ban Bitcoin. It bans specific wallets used for illegal activity. You can still buy, sell, and hold Bitcoin legally. But if you interact with a wallet on the sanctions list-whether you know it or not-you could face penalties. Always use regulated exchanges that screen addresses automatically.

What happens if I accidentally send crypto to a sanctioned address?

If you’re an individual user, your funds might get frozen when you try to withdraw them to a regulated exchange. You’ll need to prove the transaction was unintentional. If you’re a business, you could face fines, audits, or even criminal charges. There’s no automatic refund. The system assumes you’re responsible for knowing who you’re transacting with.

Are privacy coins like Monero completely banned?

No, they’re not banned. But they’re heavily monitored. Exchanges are required to flag or block transactions involving privacy coins if they’re linked to sanctioned addresses. Some exchanges have stopped supporting Monero entirely because of the compliance burden. If you hold Monero, be prepared for delays or restrictions when converting to fiat or other coins.

Do I need to worry about OFAC if I’m not in the U.S.?

Yes, if you use any U.S.-based service. That includes Coinbase, Kraken, Binance.US, or even a U.S. bank that processes crypto transactions. If you send crypto to a U.S. exchange from overseas, they’ll screen your wallet. If it’s flagged, your funds will be frozen. OFAC’s reach extends globally through the U.S. financial system.

Can I get removed from the OFAC sanctions list if I’m wrongly flagged?

Yes, but it’s difficult. You must submit a formal request to OFAC with proof of identity and transaction history. The process can take 6 to 18 months. Most people who are wrongly flagged are either victims of hacking or used a wallet previously owned by a sanctioned person. If you’re not a business, your best chance is to work with the exchange that flagged you-they may help you file the request.

Is there a way to avoid OFAC screening entirely?

No, not if you want to interact with the global financial system. Even non-U.S. exchanges that handle U.S. dollars or connect to U.S. banks must comply. The only way to fully avoid screening is to use completely unregulated, peer-to-peer platforms without any fiat gateway-but even then, you risk losing your funds if you later try to cash out through any mainstream service.

Mike Calwell

November 16, 2025 AT 13:49bro i just sent 0.5 eth to my homie and now im scared to check my balance lmao

Ryan Hansen

November 17, 2025 AT 19:50this whole thing is wild. i used to think crypto was the wild west, but now it’s more like a corporate compliance zoo. they’re sanctioning *smart contracts* now? that’s not regulation, that’s sci-fi. imagine getting sued because your code was used by a hacker you never met. the devs are gonna need lawyers before they even write a line of solidity. and don’t get me started on monero-every exchange is ditching it like it’s radioactive. but if you’re just a normal person holding it, you’re not the problem. the system doesn’t care. it just freezes everything and asks questions later. and the worst part? you can’t even check if an address is clean. no public tool. no way to verify. you’re just trusting some exchange’s black box. that’s not freedom. that’s surveillance with a blockchain sticker on it.

Ninad Mulay

November 19, 2025 AT 13:36in india, we joke that crypto is the new hawala. but now the u.s. is turning it into a legal minefield. i’ve seen guys here send usdt to friends abroad to pay for tuition-no bank, no paperwork. now? if that friend’s wallet once touched a tainted address? poof. gone. no warning. no appeal. just a frozen balance and a silent exchange. it’s not about crime anymore. it’s about control. and the people who lose out? the ones who just want to send money home.

Astor Digital

November 21, 2025 AT 09:01the fact that ofac added an ai trading bot to the sanctions list is both hilarious and terrifying. next they’ll sanction a chatbot that gives bad investment advice. imagine getting flagged because your discord bot auto-replied with a wallet address. this isn’t law enforcement-it’s a tech panic dressed up as policy. and the worst part? regular users have zero recourse. you don’t even get a phone call. just an email saying ‘your funds are frozen’ and a link to a 40-page pdf no one reads. i’m not anti-regulation, but this feels like they’re trying to solve a crime with a sledgehammer while ignoring the fact that the whole house is made of glass.

satish gedam

November 21, 2025 AT 19:51bro i’ve been holding xmr since 2021 and now i’m scared to even open my wallet 😅 but seriously, if you’re not doing anything shady, why panic? just don’t send to unknown addresses. use trusted exchanges. and if your funds get frozen? stay calm. reach out to the exchange-they’ve got teams for this. it’s not the end of the world. just a really annoying paperwork day.

Marcia Birgen

November 21, 2025 AT 21:38❤️ i just want to say thank you to everyone who’s trying to make this space safer. i know it’s frustrating, but this isn’t about taking away freedom-it’s about stopping bad actors from using crypto to fund war, hacking, and human trafficking. if we don’t do this, the public will turn against crypto entirely. and that hurts everyone. yes, it’s messy. yes, it’s imperfect. but we’re building something bigger than ourselves here. let’s not let fear win.

Jerrad Kyle

November 23, 2025 AT 21:16the $5 million reward for tips? that’s the real game-changer. now everyone’s a snitch. your crypto buddy who sent you 0.1 btc last year? he’s now a potential federal informant. your roommate who used your laptop to claim airdrops? now he’s a ‘sanctioned entity risk.’ this isn’t compliance-it’s a digital witch hunt. and the people who lose? the ones who didn’t even know they were playing a game they never signed up for.

Usama Ahmad

November 25, 2025 AT 15:47my uncle in dubai just got his binance account frozen because he sent usdt to a friend who once got a tiny airdrop from a hacked wallet. he’s 72. he doesn’t know what a mixer is. he just wanted to help his grandson pay for school. now he’s stuck for months. this system doesn’t care about human stories. it just checks boxes.

rahul saha

November 26, 2025 AT 11:11the irony? we built crypto to escape the state… and now the state built a better cage. 🤔 blockchain was supposed to be the great equalizer. now it’s just a ledger of fear. who gets to decide who’s ‘bad’? a u.s. agency with a spreadsheet? that’s not justice. that’s digital colonialism. and we’re all just tenants in their blockchain apartment complex.

Student Teacher

November 27, 2025 AT 08:12as a teacher, i’ve had students ask me if they can use crypto to pay for college. i don’t know what to say anymore. the system’s so opaque, so unforgiving-it’s not just risky, it’s unfair. one wrong transaction and your life gets put on hold for months. how is that education? how is that justice? we’re teaching kids to be digital citizens, but the rules are written in invisible ink.

Grace Craig

November 27, 2025 AT 09:04It is imperative to underscore that the institutionalization of blockchain-based financial surveillance represents not merely an extension of existing regulatory frameworks, but a paradigmatic recalibration of sovereign authority into the digital domain. The sanctioning of algorithmic agents-entities devoid of legal personhood-constitutes a jurisprudential rupture of unprecedented magnitude. One must now contemplate the ontological status of autonomous code: Is it an instrument, an agent, or an actor? The precedent set here, if left unchallenged, will inevitably precipitate a cascade of legal ambiguities, wherein liability accrues not to individuals, but to syntactic structures devoid of intent. This is not regulation. It is the metaphysical colonization of cyberspace by bureaucratic epistemology.

Nathan Ross

November 27, 2025 AT 11:15the fact that ofac monitors layer 2s like polygon and arbitrum means they’ve admitted the truth: criminals are smarter than the system. but instead of adapting, they just keep adding layers of surveillance. now every wallet is a suspect. every swap is a crime scene. and the only way to stay clean is to use only the platforms that play along. which means crypto’s future is just a walled garden with a u.s. flag on top.

jesani amit

November 28, 2025 AT 14:28look, i get it. bad people use crypto. but punishing everyone because of a few bad actors? that’s not security, that’s laziness. if you’re a legit user, you’re just collateral damage. i’ve been using crypto for 7 years. never done anything shady. but now i have to run every transaction through a third-party checker before i even hit send. it’s exhausting. and for what? so some compliance officer in new jersey can check a box? the system’s broken. it’s not about safety anymore. it’s about control.

Bill Henry

November 30, 2025 AT 10:34my friend got flagged because he bought a bitcoin nft from a guy who once received funds from a hacked exchange in 2021. it was a $20 nft. his account got frozen for 4 months. he lost his job because he couldn’t pay rent. nobody apologized. nobody even said sorry. just ‘your funds are blocked.’ that’s the new normal. and we’re supposed to be excited about this?

Jay Davies

December 1, 2025 AT 18:18the claim that ‘ignorance is not a defense’ is legally accurate but morally bankrupt. the u.s. government has created a labyrinthine, non-transparent, and inaccessible regulatory regime and then punishes citizens for failing to navigate it. this is not rule of law-it’s rule by obscurity. if you want compliance, provide a public, searchable, machine-readable database with clear guidance. instead, you’ve built a trap and called it enforcement. and now you wonder why people turn to privacy coins? it’s not because they’re criminals. it’s because they’re rational.

garrett goggin

December 3, 2025 AT 10:37ohhhhh so this is why the feds were so quiet about the 2024 bitcoin halving… they were busy prepping the blockchain surveillance grid. they’ve been training ai models on every tx since 2017. they’re not just watching wallets-they’re predicting them. next they’ll freeze addresses before the transaction even happens. ‘suspicious intent detected.’ they’re not stopping crime. they’re building a crypto police state. and the worst part? we volunteered. we gave them the keys. every time we used a centralized exchange, we said ‘yes.’ now we’re surprised when they lock the door?

Peter Rossiter

December 4, 2025 AT 04:13the real story isn’t the sanctions. it’s the fact that chainalysis and ellptic are now bigger than most banks. they’re the invisible cops. they decide who’s guilty before the government even files a case. and they’re private companies. no oversight. no transparency. just a black box with a logo and a price tag. if you’re on their list, you’re done. no appeal. no court. just a frozen wallet and a silence that screams.

Derayne Stegall

December 4, 2025 AT 09:39crypto ain’t dead 😎🔥 just got a new boss. and his name is compliance. but hey-at least we know who’s watching now. no more shady vibes. just clean, regulated, u.s.-approved blockchain vibes 🇺🇸💰 #trusttheprocess