The MVRV ratio isn’t just another crypto metric-it’s one of the most reliable indicators for spotting when the Bitcoin market is overheating or hitting rock bottom. Unlike price charts that show what people are paying right now, MVRV tells you what they originally paid. That difference is everything. When the average holder is sitting on massive profits, the market is ripe for a correction. When most coins are held at a loss, it’s often the quiet before the next bull run.

What Is the MVRV Ratio?

MVRV stands for Market Value to Realized Value. It’s a simple division: Bitcoin’s current market cap divided by its realized cap. Market cap is easy-it’s the current price multiplied by how many coins are circulating. Realized cap is trickier but more meaningful. It adds up the price each Bitcoin was last moved, not the current price. So if you bought a Bitcoin for $5,000 and never touched it, it counts as $5,000 in realized value-even if it’s now worth $70,000.

This creates a powerful lens. If the MVRV ratio is 3.0, it means the market value is three times higher than the average cost basis of all coins. That’s a red flag. If it’s below 1.0, most coins are underwater. That’s often a buying opportunity.

How MVRV Has Predicted Major Bitcoin Cycles

Since 2013, MVRV has nailed every major Bitcoin top and bottom. In late 2017, as Bitcoin surged past $19,000, the MVRV ratio hit 3.7. Within weeks, the price crashed 80%. In November 2021, when Bitcoin hit $69,000, MVRV soared to 4.2-a level never seen before. The correction that followed took Bitcoin down to $16,000 over ten months. Every time MVRV climbed above 3.5, the market reversed.

On the flip side, when MVRV dropped below 1.0, it signaled capitulation. In March 2020, during the COVID crash, MVRV fell to 0.82. Bitcoin had just lost half its value. But that was the bottom. Over the next 18 months, it rallied over 670%. The same pattern held in 2018, 2022, and even in the early days of 2015.

It’s not magic. It’s math. When the average holder is profitable, they start selling. When they’re underwater, they hold. That behavior shows up clearly in on-chain data.

MVRV-Z Score: Why Raw Numbers Aren’t Enough

Using a fixed threshold like 3.5 doesn’t work across all cycles. The 2021 cycle was wilder than 2017. Prices were higher, volatility was greater, and the market was more mature. That’s where MVRV-Z score comes in.

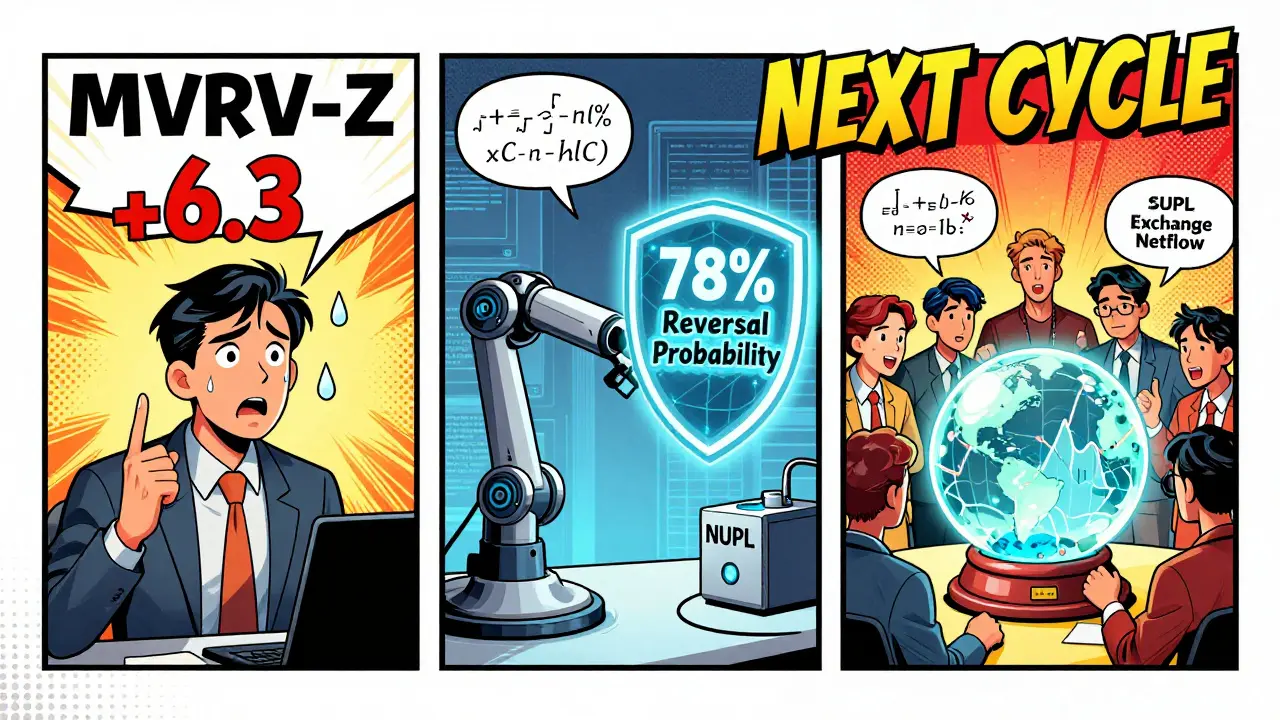

Developed by Glassnode, the MVRV-Z score measures how many standard deviations the current ratio is from its historical average. Think of it like a z-score in statistics. A Z-score of +6.3 in 2017 meant the market was extremely overvalued. In 2022, when Bitcoin dropped to $15,500, the Z-score hit -1.8-deeply undervalued. This lets you compare cycles fairly. A 3.8 MVRV in 2021 meant something different than a 3.8 in 2017. The Z-score adjusts for that.

Why MVRV Beats Other Crypto Metrics

People love Stock-to-Flow. It’s elegant. But it’s backward-looking. It says Bitcoin gets scarcer every four years, so price should go up. But it didn’t predict the 2020 halving crash or the 2022 bear market. It was off by billions.

NVT (Network Value to Transactions) looks at how much value moves through the network. Useful, but it ignores investor psychology. If no one’s selling, NVT stays low-even if everyone’s holding for $100,000.

MVRV doesn’t care about supply schedules or transaction volume. It only cares about what people paid. And that’s what drives selling pressure. When your cost basis is $20,000 and Bitcoin hits $60,000, you’re more likely to sell. MVRV captures that. No other metric does.

Limitations and When MVRV Fails

MVRV isn’t perfect. During extreme events like March 2020, price gaps on exchanges caused on-chain data to look noisy. Some coins moved during panic sells at fire-sale prices, distorting the realized cap. That’s why MVRV alone can give false signals-about 18% of the time, according to Presto Labs.

It also doesn’t work well on altcoins. Smaller coins have low on-chain activity, fake volume, and centralized exchanges that don’t reflect true ownership. MVRV is a Bitcoin metric. That’s where its power lies.

Another issue? Thresholds shift. Preston Pysh pointed out that in 2017, MVRV peaked at 3.7. In 2021, it hit 4.2. Is the market just more greedy now? Or is the metric itself becoming less reliable? That’s why new tools like Dynamic MVRV Thresholds now adjust based on the halving cycle stage-warning at 3.2 in early cycles, 4.0 in late ones.

How to Use MVRV in Practice

You don’t need a PhD to use MVRV. But you do need the right tools.

- Free options: Bitbo.io gives live hourly updates. Santiment’s free tier shows weekly trends.

- Professional tools: Glassnode ($990/month) includes MVRV-Z score. CryptoQuant ($299/month) offers smoothed data to cut noise.

Don’t trade on MVRV alone. Combine it with:

- NUPL (Net Unrealized Profit/Loss): Shows the same thing as MVRV but in percentage terms. When NUPL > 0.7, the market is overheated.

- Exchange Netflow: Are people sending Bitcoin to exchanges? That’s a sign they’re preparing to sell.

- SOPR (Spent Output Profit Ratio): Tells you if coins being moved are being sold at a profit. Above 1.0 = profit-taking.

Most experienced traders use MVRV + NUPL + Exchange Netflow. That combo has a 70%+ accuracy rate in spotting reversals.

What Professionals Are Saying

Murad Mahmudov, who co-created MVRV, says: “It’s a lens, not a crystal ball.” That’s the right mindset. You’re not predicting the future-you’re measuring the present state of investor behavior.

Willy Woo, one of the most respected analysts in crypto, gave MVRV a 4.7 out of 5. He calls it “unparalleled in identifying extremes.” Glassnode’s data shows it correctly predicted 9 out of the last 10 major Bitcoin tops, with an average lead time of 23 days.

But here’s the key insight: MVRV works best as a rate-of-change indicator. A sudden jump from 2.0 to 2.8 in a week-even if it’s below 3.5-is a warning. Accelerating momentum matters more than the absolute number.

Future of MVRV: AI, Machine Learning, and the Next Cycle

By 2027, Fidelity predicts 95% of institutional crypto strategies will use MVRV inside AI models that analyze 50+ metrics. That’s not hype-it’s evolution.

New tools are already here. CryptoQuant’s MVRV Confidence Bands use Bayesian math to give you a probability of reversal at each level. At MVRV 3.8, the system might say there’s a 78% chance of a correction. That’s far more useful than a binary “overbought” signal.

Researchers are even testing how Lightning Network data could improve MVRV for short-term signals. If a Bitcoin moves from a long-term holder to a Lightning node, does that mean it’s being used for spending-or prepped for sale? That’s the next frontier.

Some worry MVRV could self-destruct if too many traders act on it. MIT found that if over 65% of trading volume reacts to MVRV thresholds, it could distort the signal. We’re at 48% now. Still safe.

Final Take: MVRV Is a Tool, Not a Crystal Ball

MVRV doesn’t tell you when to buy or sell. It tells you where the market is emotionally. When the majority of holders are in profit, fear is low and greed is high. That’s when the smart money starts exiting. When most are underwater, panic sets in-and that’s often the best time to accumulate.

It’s not about timing the exact top. It’s about recognizing when the crowd is too far out ahead. That’s what MVRV shows you. And in a market full of noise, that’s worth more than any chart pattern or indicator.

If you’re serious about Bitcoin investing, learn MVRV. Watch it. Understand it. Combine it. Don’t chase it. The next cycle is already building. MVRV will be there-waiting to tell you what the market really thinks.

What is a good MVRV ratio for buying Bitcoin?

An MVRV ratio below 1.0 typically signals that most Bitcoin holders are at a loss, which historically has marked market bottoms. While not a guaranteed buy signal, it often precedes major rallies. Combine it with NUPL and exchange netflow for confirmation. For example, MVRV dropped to 0.82 in March 2020 before Bitcoin’s 670% rebound.

Is MVRV reliable for altcoins?

No. MVRV is designed for Bitcoin because of its mature, transparent on-chain data. Altcoins have low transaction volume, high exchange volatility, and centralized ownership that distorts realized value. CryptoQuant’s 2021 study found MVRV signals on altcoins are unreliable and prone to false readings.

How often is MVRV updated?

Platforms update MVRV at different frequencies. Bitbo.io refreshes hourly, Glassnode provides daily values, and CryptoQuant offers weekly smoothed data to filter out noise. For trading decisions, daily or hourly data is most useful. For long-term cycle analysis, weekly data reduces false signals.

What’s the difference between MVRV and NUPL?

MVRV is Market Value divided by Realized Value. NUPL (Net Unrealized Profit/Loss) is the percentage of total market cap that represents unrealized profit or loss. They measure the same thing-investor sentiment-but NUPL is normalized to a 0-1 scale. When NUPL is above 0.7, the market is overbought. When below 0.0, it’s oversold. Many traders use both together for confirmation.

Can MVRV predict the next Bitcoin bull run?

MVRV doesn’t predict bull runs-it identifies when the market is primed for one. When MVRV drops below 1.0 and stays there for weeks, it signals widespread capitulation. Historically, that’s followed by accumulation and then a bull run. But MVRV alone won’t tell you when the run starts. You need to combine it with rising active addresses, decreasing exchange outflows, and increasing SOPR to confirm the shift.

Do I need to pay for MVRV data?

No, you don’t need to pay. Bitbo.io offers free, real-time MVRV charts updated hourly. Santiment’s free tier shows weekly trends. Paid platforms like Glassnode and CryptoQuant add advanced features like MVRV-Z score, confidence bands, and historical overlays-but for basic cycle analysis, free tools are enough to get started.

Akhil Mathew

January 28, 2026 AT 07:50MVRV is the real deal. I’ve been tracking it since 2020 and every single time it dipped below 1, I bought small and held. No regrets. Even when everyone was screaming ‘it’s going to zero,’ the data didn’t lie. Bitcoin doesn’t care about your feelings, only what people paid for it.

Raju Bhagat

January 29, 2026 AT 13:59bro MVRV just told me to buy at 28k and now it's at 68k?? I'm crying in my crypto hoodie lmao 🥲💸

Gavin Francis

January 31, 2026 AT 00:52Free tools are enough to start. Bitbo is my homepage. No need to drop $990/month until you’re trading six figures. Keep it simple, stay consistent. 🚀

Elizabeth Jones

January 31, 2026 AT 11:00The elegance of MVRV lies in its simplicity-it abstracts human psychology into a quantifiable metric. Unlike technical indicators that retrofit patterns onto price, MVRV captures the collective memory of ownership. It’s not forecasting-it’s remembering. And memory, in markets, is everything.

Gustavo Gonzalez

February 1, 2026 AT 17:09Everyone’s acting like MVRV is some holy grail but you’re ignoring that 18% false signal rate. And you didn’t even mention how exchange withdrawals spiked right before the 2021 top-MVRV was flatlining while the market was collapsing. You’re cherry-picking wins and ignoring the noise. Amateur analysis.

josh gander

February 1, 2026 AT 17:43I love how this post breaks it down without the jargon. I’m not a trader, just a guy who bought 0.1 BTC in 2019 and forgot about it. Last month I checked MVRV and saw it was below 1.0 again. I bought another 0.05. Not because I’m smart-because the data was screaming. And now I’m not scared anymore. Thanks for reminding me to trust numbers over headlines.

Also, if you’re new to this: don’t panic when it drops 20% in a week. That’s normal. MVRV doesn’t care if your portfolio looks ugly today. It cares if you’re still holding when everyone else is selling. That’s the real win.

And yeah, I use Bitbo for free. No need to pay until you’re serious. Even then, start small. I still don’t know what NUPL is, but I know when my coins are underwater-and that’s enough for now.

Bitcoin’s not a get-rich-quick scheme. It’s a patience test. MVRV is just the timer.

Joshua Clark

February 2, 2026 AT 07:59Let’s be real-MVRV is powerful, but it’s not infallible, and the idea that it’s somehow ‘the’ indicator is dangerously reductive. The metric assumes all coins are created equal, but in reality, the distribution of holdings is wildly skewed. A tiny fraction of wallets hold the majority of Bitcoin, and their behavior doesn’t reflect ‘average cost basis’-it reflects institutional strategy. So when MVRV spikes, is it because retail is euphoric, or because whales are quietly dumping on the rally? The metric can’t tell you that. And that’s a massive blind spot.

Also, the Z-score adjustment helps, but it still relies on historical averages that may no longer be relevant. The market has evolved: more ETFs, more institutional liquidity, more algorithmic trading. The 2017 and 2021 cycles aren’t comparable anymore. Applying the same thresholds ignores structural shifts. We’re not just dealing with a bigger market-we’re dealing with a different kind of market.

And then there’s the feedback loop problem. If too many traders rely on MVRV, they become self-fulfilling prophecies. If everyone sells at 3.8, then 3.8 becomes the new top, regardless of fundamentals. That’s not insight-that’s herd behavior dressed up as math.

Don’t get me wrong, I use MVRV daily. But I pair it with on-chain supply distribution, exchange reserves, and miner revenue. MVRV is one piece of the puzzle. Not the whole picture. And anyone who treats it like a crystal ball is setting themselves up for a brutal lesson.

Brandon Vaidyanathan

February 3, 2026 AT 02:31Wow. Just wow. Another crypto guru telling people to ‘trust the data’ while ignoring that MVRV has been wrong more times than it’s been right in the last 2 years. You’re selling snake oil with fancy charts. And don’t even get me started on NUPL-same garbage, different name. People are losing money because they think math = magic. It’s not. It’s just a mirror. And mirrors don’t predict storms-they just show you how wet you already are.