When you want to trade Bitcoin without leaving the Bitcoin network, most exchanges force you into Ethereum wallets, complex bridges, or high fees. Libre crypto exchange claims to fix that. It’s not another EVM-based DEX. It doesn’t need MetaMask. It doesn’t require you to wrap your BTC into some weird token. It’s built for Bitcoiners who hate the hassle. But here’s the catch: it’s still young, opaque, and risky. Is it the future of Bitcoin DeFi-or a gamble wrapped in clean design?

What Is Libre Crypto Exchange?

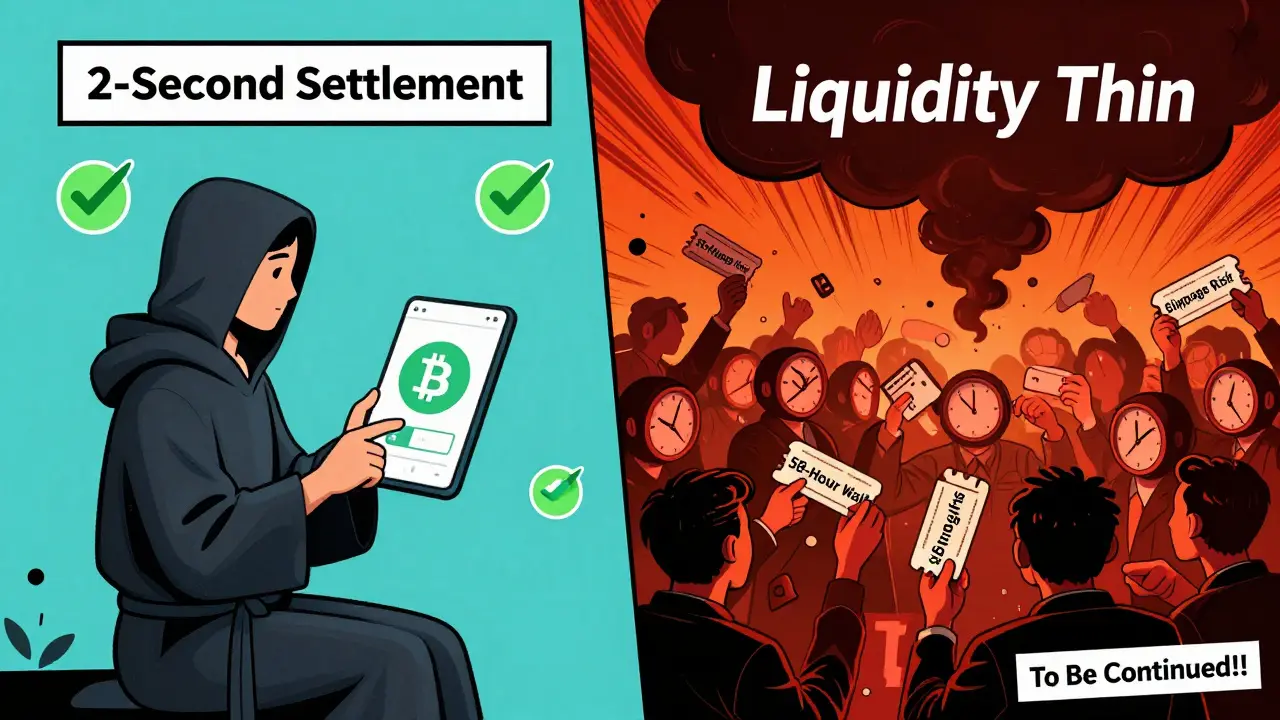

Libre is a Bitcoin-native decentralized exchange that launched in 2023. It lets you swap BTC for USDT (and vice versa) with a flat 0.1% fee. That’s cheaper than Thorchain, Sideshift.ai, and even most centralized exchanges. It runs on its own Layer-2 chain, not Ethereum, and doesn’t rely on any EVM technology. Instead, it uses pegged Bitcoin through decentralized p.network bridges and connects directly to the Lightning Network. This means transactions settle in under two seconds-way faster than Bitcoin’s 10-minute block time.

Unlike other DeFi platforms that support dozens of coins, Libre only does BTC and USDT. That’s intentional. The team behind it wants to solve Bitcoin’s scaling problem, not turn it into another Ethereum. The native LIBRE token has a fixed supply of 1 billion, with about 628 million in circulation as of late 2025. You can stake it for rewards: 4.2% APY for 30 days, up to 12.7% if you lock for a full year. But staking isn’t required to trade-only if you want voting rights in governance.

How It Works (No EVM, No Bloat)

You don’t need to install anything fancy. Just connect your Bitcoin wallet-any one that supports Lightning Network. That includes Phoenix, Wallet of Satoshi, or even BlueWallet. Libre doesn’t ask you to bridge your coins to another chain. Instead, it uses a system where your BTC is temporarily locked and represented as a pegged asset on its own chain. When you swap, it’s not a cross-chain transfer. It’s an on-chain trade within Libre’s network, settled instantly.

The consensus mechanism is unique. Validators change every 10 to 30 seconds, which helps prevent centralization. It uses ring signatures and stealth addresses to hide transaction details. That’s not just privacy for show-it’s built into the protocol. This is why Libre claims to be more private than Monero in some aspects. But here’s where things get shaky: no public audit has been released. Coinbase says it’s been audited by Certik. But the report isn’t online. CryptoSlate and Blockchain Insights both called this a red flag.

Performance: Speed and Fees

Libre’s biggest win? Speed and cost. At 0.1% per trade, it’s the cheapest option for BTC-USDT swaps. Compare that to Thorchain’s 0.3-0.5%, or centralized exchanges like Binance, where fees drop only if you trade over $1 million a month. Libre’s flat fee applies to everyone.

Transaction finality? Two seconds. That’s faster than most Bitcoin Layer-2s and even some Ethereum DEXs. Throughput? 3,500 transactions per second. That’s not Solana-level, but it’s enough to handle daily volume of $28.7 million without breaking a sweat. The platform handles peak traffic better than most DeFi projects its size.

But there’s a downside. Liquidity is thin. If you want to trade more than $500,000 in one go, you’ll likely get slippage. The order book is shallow. And there are no limit orders, stop-losses, or advanced charting tools. This isn’t a trading platform for day traders. It’s for people who want to swap BTC to USDT quickly and cheaply-no frills, no fuss.

Security: Privacy vs. Transparency

Libre’s privacy features are impressive. Ring signatures mean your transaction can’t be traced back to you. Stealth addresses ensure your receiving wallet isn’t linked to past activity. These aren’t add-ons-they’re core to how the chain works.

But security isn’t just about privacy. It’s about trust. And Libre’s biggest weakness? Lack of transparency. The smart contracts powering the pegged BTC system have never been publicly audited. Coinbase says Certik audited them. But no report exists on Certik’s site. Security researcher Alex Thorn called this “unacceptable counterparty risk.” If the peg breaks-or if there’s a bug in the code-there’s no public record to prove it was safe.

Users have reported withdrawal delays during high volatility. One person waited two hours to get $12,000 USDT out. Support response times average 58 hours. That’s not normal for a crypto platform, even a small one. Reddit users love the low fees. Trustpilot users hate the slow withdrawals.

Who Is Libre For?

Libre isn’t for everyone. If you’re a Bitcoin maximalist who hates Ethereum, doesn’t care about altcoins, and just wants to swap BTC for stablecoins without paying 0.5% in fees, then Libre might be perfect. It’s simple. Fast. Cheap.

But if you want to trade SOL, ETH, or even LTC, forget it. Libre doesn’t support them. If you need advanced trading tools, forget it. No limit orders, no margin, no charts. If you’re managing institutional funds or want to audit the code yourself, forget it. The documentation is weak. Developer APIs are poorly documented. Only 3 companies have integrated it so far.

It’s also not for users who need customer service. The Telegram group has over 12,000 members, but most questions go unanswered. The official docs are okay, but not great. One independent review gave them a 6.8/10 for clarity.

The Bigger Picture: Bitcoin DeFi Is Growing

Libre didn’t come out of nowhere. Bitcoin DeFi is exploding. In early 2024, the total value locked in Bitcoin-based protocols was $1.2 billion. By late 2025, it hit $8.7 billion. Libre captures about 0.8% of that market. It’s not the biggest, but it’s one of the few that actually works without Ethereum.

Its roadmap includes adding USDC and DAI by mid-2026, and even a play-to-earn game. That’s ambitious. But it’s also risky. Most Bitcoin-native projects fail because they can’t attract users beyond hardcore believers. Libre’s biggest threat isn’t another exchange-it’s the Lightning Network itself. If the Lightning Network adds native DeFi features, Libre’s whole reason for existing vanishes.

Final Verdict: Worth Trying? Maybe.

Libre crypto exchange is bold. It’s clean. It’s fast. And it’s one of the few places where you can trade BTC and USDT without leaving Bitcoin’s ecosystem. The fee structure is unbeatable. The speed is real. The privacy tech is solid.

But it’s also a black box. No public audit. Slow support. Limited features. Thin liquidity. If you’re trading under $10,000 and you value simplicity over everything else, give it a shot. Use only what you can afford to lose.

If you’re managing larger sums, or you need to know the code is safe, wait. Until Certik releases its audit-or until Libre opens its contracts to public review-this remains a high-risk experiment, not a reliable platform.

Is Libre Crypto Exchange safe to use?

Libre offers strong privacy features like ring signatures and stealth addresses, but its biggest risk is lack of transparency. The smart contracts powering its pegged BTC system have not been publicly audited, despite claims from Coinbase that Certik reviewed them. No audit report is available online, making it impossible to verify security. Use only small amounts you can afford to lose.

Can I trade altcoins on Libre?

No. Libre only supports BTC and USDT trading. It was built specifically for Bitcoin users who want to avoid Ethereum-based platforms. If you want to trade ETH, SOL, or any other altcoin, you’ll need a different exchange.

Do I need a special wallet to use Libre?

No. You only need a Bitcoin wallet that supports the Lightning Network. Popular options include Phoenix, Wallet of Satoshi, and BlueWallet. Libre doesn’t require MetaMask, EVM wallets, or any Ethereum-related tools.

What are the fees on Libre?

Libre charges a flat 0.1% fee on every BTC-USDT trade, regardless of trade size. This is lower than Thorchain (0.3-0.5%) and most centralized exchanges. There are no hidden fees, deposit fees, or withdrawal fees.

How fast are transactions on Libre?

Transactions settle in under two seconds, thanks to Libre’s Layer-2 chain. This is much faster than Bitcoin’s 10-minute block time and even faster than many Ethereum-based DEXs. However, withdrawals to external wallets can take up to two hours during periods of high network activity.

Is Libre regulated?

Libre operates in a legal gray area. As a Bitcoin-native, non-EVM DeFi protocol, it doesn’t fall neatly under existing financial regulations. The SEC’s October 2025 framework for non-EVM DeFi created new uncertainty, but no official action has been taken against Libre yet. Users should assume it’s unregulated and proceed with caution.

Can I stake LIBRE tokens?

Yes. You can stake LIBRE tokens to earn rewards ranging from 4.2% to 12.7% APY, depending on how long you lock them. Staking is optional and only needed if you want to vote on governance proposals. It’s not required to trade on the platform.

Does Libre have customer support?

Libre offers limited customer support. Most inquiries go through their Telegram group, which has over 12,000 members, but responses are slow and inconsistent. Official support tickets take an average of 58 hours to be answered. There is no live chat or phone support.

Sakshi Arora

February 10, 2026 AT 14:28