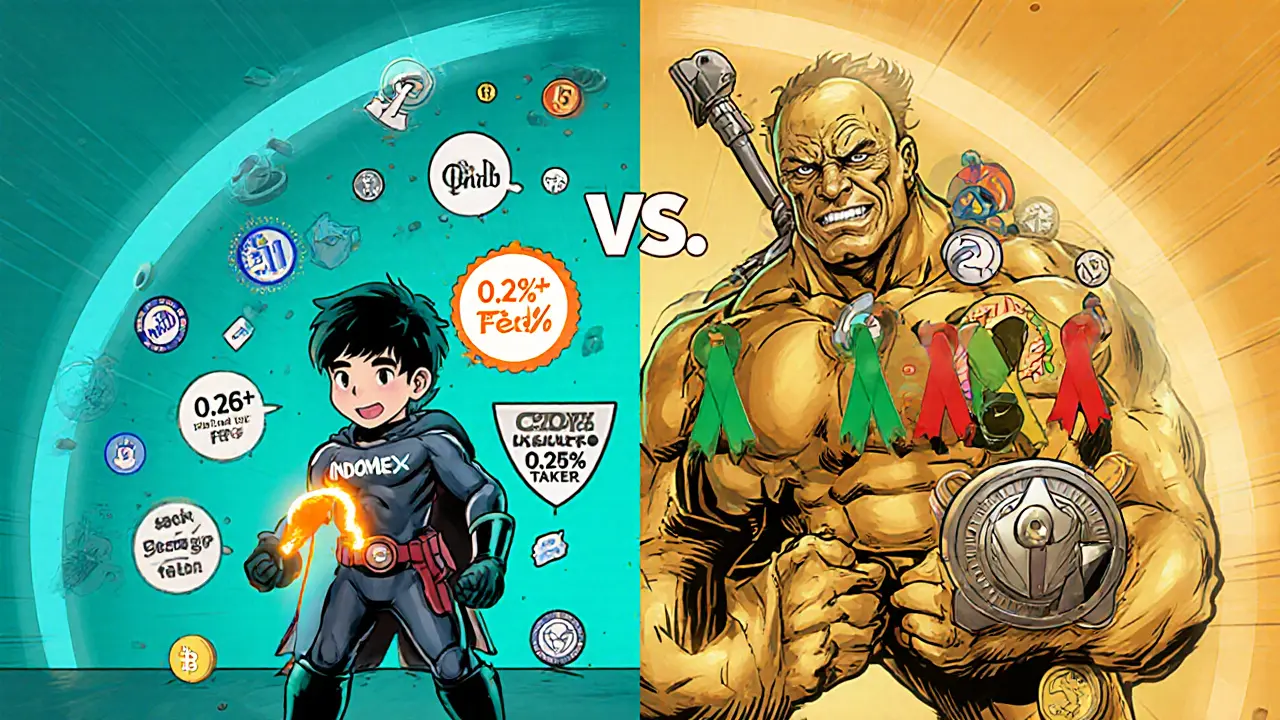

INDOMEX vs Indodax Comparison Tool

This tool helps you compare INDOMEX and Indodax based on key factors important to cryptocurrency traders.

INDOMEX

Indodax

- INDOMEX has a lower user base and limited asset offerings compared to Indodax.

- Fee Transparency: Indodax provides clearer fee structures with maker/taker spreads.

- Security: Indodax uses cold storage and insurance while INDOMEX lacks public security details.

- Mobile Experience: Indodax has better app ratings and more comprehensive features.

- Regulation: Indodax operates in a compliant gray area, whereas INDOMEX is unlicensed.

When you type “INDOMEX review” into Google, the results are... practically empty. That gap makes the exchange a mystery, especially for traders hungry for reliable platforms. This article pulls together everything we can verify about International Domestique Exchange (INDOMEX), outlines its core features, and then pits it against Indonesia’s well‑known Indodax to give you a practical sense of where the unknown stands.

International Domestique Exchange (INDOMEX) is a purported cryptocurrency exchange that claims to serve an international audience with a focus on low‑fee trading and easy onboarding. Public documentation is sparse, and independent security audits are not readily available. The platform’s website lists a handful of supported coins, but details on fees, regulation, or insurance are missing. Below we break down the handful of verifiable data points and compare them to a benchmark exchange.

What Is INDOMEX?

At its core, INDOMEX markets itself as a global crypto marketplace. The site’s “About” page mentions a mission to simplify crypto access for both beginners and seasoned traders. No licensing information is posted, and the company’s corporate address is listed only as “International”. This lack of transparency is a red flag for anyone who values regulatory clarity.

Key Features and Available Assets

The exchange states support for about 30 crypto assets, ranging from the usual Bitcoin the first and largest cryptocurrency by market cap and Ethereum a programmable blockchain underpinning DeFi and NFTs to smaller tokens like Shiba Inu and Polkadot. However, the platform does not publish a live asset list, so traders must rely on an occasionally updated PDF that can be downloaded from the support center.

Fees and Trading Costs

Unlike many exchanges that disclose maker‑taker spreads publicly, INDOMEX only provides a vague “low fees” claim. The only concrete number we found is a 0.2% flat fee on spot trades, which aligns with the industry median. Withdrawal fees are listed per coin but lack a clear schedule for fiat withdrawals, suggesting users may face hidden costs when moving money out of the platform.

Security Measures and Regulation

Security is the most critical piece for any crypto venue. INDOMEX mentions two‑factor authentication (2FA) and SSL encryption on its site, but there is no mention of cold‑storage ratios, insurance coverage, or third‑party audits. Regulation the legal framework governing crypto exchanges in a given jurisdiction appears to be “gray area” - the exchange operates without a clear license from any financial authority. For comparison, Indonesia’s Indodax works within a fuzzy regulatory environment but publishes its compliance stance and partners with local banks for fiat on‑ramps.

Mobile Experience and Apps

The exchange offers Android and iOS apps. Reviews on the Google Play Store (average 4.0 stars from 342 ratings) praise the clean UI but criticize occasional login bugs. The iOS version has fewer reviews (4.2 stars, 89 ratings). Both apps lack advanced charting tools; they are geared toward basic market orders only.

How INDOMEX Compares to Indodax

| Feature | INDOMEX | Indodax |

|---|---|---|

| Founded | 2022 (unverified) | 2014 (Bitcoin Indonesia) |

| Registered Users | ~12,000 (self‑reported) | 1.5million (official) |

| Supported Coins | ~30 (major & some altcoins) | 150+ (including BTC, ETH, BNB, DOGE, etc.) |

| Spot Trading Fee | 0.20% flat | 0.10% maker / 0.25% taker |

| Withdrawal Fees | Variable, not fully disclosed | Network fee + optional flat IDR fee |

| Security | 2FA, SSL; no cold‑storage details | 2FA, cold‑storage (≈95% of funds), insurance partnership |

| Regulatory Status | Unclear, no public license | Operates in Indonesia’s gray‑area, seeks compliance with local laws |

| Mobile App Rating | 4.0 (Android) / 4.2 (iOS) | 4.5 (Android) / 4.6 (iOS) |

| Staking / Earn | Not offered | Available on select assets |

Pros and Cons

- Pros

- Simple UI that’s easy for beginners.

- Flat 0.2% spot fee is transparent (if you trust the claim).

- Mobile apps are available on both platforms.

- Cons

- Lack of clear regulatory licensing.

- No public security audit or cold‑storage breakdown.

- Limited asset list compared with mainstream exchanges.

- Withdrawal fees and fiat on‑ramps are vague.

Final Verdict

If you’re an experienced trader who needs deep liquidity, advanced charting, and proven regulatory compliance, you’ll probably feel more comfortable on an established platform like Indodax or a global exchange such as Binance or Coinbase. INDOMEX could serve as a niche entry point for users who value a minimal‑fee, no‑frills interface and are willing to accept the risk of limited transparency.

Frequently Asked Questions

Is INDOMEX a regulated exchange?

No public licensing information is available. The exchange operates in a regulatory gray area, so users should treat it as an unregulated service.

What cryptocurrencies can I trade on INDOMEX?

The platform lists around 30 assets, including Bitcoin, Ethereum, Shiba Inu, Polkadot, and a few community tokens. The exact list changes occasionally and is only available via a downloadable PDF.

How do withdrawal fees work on INDOMEX?

Withdrawal fees are coin‑specific and not fully disclosed on the website. Users report higher costs for fiat withdrawals, suggesting a hidden markup.

Does INDOMEX offer staking or interest‑earning products?

Currently no. The exchange focuses on spot trading only.

Should I trust the mobile app’s security?

The apps support 2FA and use SSL, but without a public audit you can’t verify how keys are stored. Treat the app like any other unverified crypto wallet-use strong passwords and enable all available security features.

Cathy Ruff

October 4, 2025 AT 19:46INDOMEX looks like a scam dressed up in fancy marketing it pretends to be low‑fee but hides everything you need to trust it you should stay far away from that unlicensed junk.

Miranda Co

October 5, 2025 AT 23:33I get why some newbies are drawn to the simple UI and flat 0.2% fee, but trust isn’t built on vague licensing; you deserve a platform that actually shows you where your money lives.

Jenise Williams-Green

October 7, 2025 AT 03:20When one peers into the murky abyss that INDOMEX calls transparency, a chilling wind of suspicion sweeps across the soul of any discerning trader.

The absence of a public audit is not a minor omission; it is a gaping chasm that devours confidence.

Regulators whisper in shadows, and the exchange answers with the deafening silence of a ghost.

Such silence is a betrayal to the very community that seeks safe harbor in Crypto's stormy seas.

A platform that flaunts a mere 0.2% fee while cloaking its withdrawal costs in riddles is nothing but a siren song.

Its asset list, a paltry thirty, stands trembling beside Indodax's sprawling garden of over a hundred fifty tokens.

Security, the cornerstone of any exchange, is reduced here to a token 2FA and an SSL badge, with no cold‑storage or insurance to speak of.

One wonders whether the keys to the vault reside on a hardened server or a vulnerable laptop.

Investors, like moths to flame, may be lured by ease of onboarding only to discover the flame is a hidden trap.

The mobile apps, while polished, lack the advanced charting tools that seasoned traders crave.

In the grand theater of finance, INDOMEX performs a one‑act play, devoid of the supporting cast of compliance and governance.

Without a clear licensing framework, the exchange drifts in legal gray, exposing users to unforeseen jurisdictional storms.

Liquidity, the lifeblood of trading, is thin; a trader may find themselves unable to exit positions without severe slippage.

Thus, the prudent path leads toward established bastions like Indodax, Binance, or Coinbase, where oversight and infrastructure stand firm.

In the end, risk and reward must be weighed, and the scales tip heavily against trusting a platform that refuses to shine its light.

Kortney Williams

October 8, 2025 AT 07:06The comparison underscores how liquidity and regulatory clarity shape user experience; perhaps newcomers should prioritize platforms that offer both robust security and transparent fee structures before chasing low‑cost gimmicks.

Laurie Kathiari

October 9, 2025 AT 10:53Oh dear, another crypto circus where the ringmaster hides the trapdoors-INDOMEX parades its sleek UI while the behind‑the‑scenes paperwork remains a mystery, a true masterpiece of selective disclosure.

Jim Griffiths

October 10, 2025 AT 14:40If you decide to use INDOMEX, enable 2FA, withdraw only small amounts at first, and keep records of every fee for future reference.

Cynthia Rice

October 11, 2025 AT 18:26A silent exchange is a lurking danger waiting to pounce.

Promise Usoh

October 12, 2025 AT 22:13While the article presents a sound argument, it failes to mention that many users in Nigeria have reported delayed withdrawals from similar unregulated platforms, which may be a red flag.

Tyrone Tubero

October 14, 2025 AT 02:00Honestly, if you cant read the fine print you probbly shouldn't be trading crypto at all.

Taylor Gibbs

October 15, 2025 AT 05:46Remember, the crypto community thrives when we look out for each other; sharing experiences about platform safety helps everyone navigate these murky waters.

Rob Watts

October 16, 2025 AT 09:33Your dramatics are noted but facts still matter.

Bhagwat Sen

October 17, 2025 AT 13:20Philosophy aside, the real test is whether your funds survive a hack.

mukesh chy

October 18, 2025 AT 17:06Sure, the UI is simple, but simplicity doesn't equal security, lol.

Marc Addington

October 19, 2025 AT 20:53America's best traders wouldn't waste time on that shady setup.