Trading Pair Arbitrage Calculator

Enter values and click calculate to see potential profit

When you hear the term trading pairs is a combination of two assets whose relative price is quoted on an exchange, you’re looking at the raw material for every arbitrage play. Whether you’re hopping between Binance and Bybit, looping through BTC‑ETH‑LTC on a single platform, or borrowing millions in a flash‑loan, the way those pairs are constructed defines where profit gaps appear and how quickly you can lock them in.

What Are Trading Pairs?

A trading pair is the quoted relationship between two assets, such as BTC/USD or ETH/BTC. The first asset is the base, the second is the quote. Prices move because supply‑demand dynamics affect each side differently, and that movement is recorded in order books (CEX) or liquidity pools (DEX). Because every exchange lists the same pair with its own order flow, slight price drifts are inevitable.

How Trading Pairs Create Arbitrage Gaps

Arbitrage thrives on *temporary* mispricing. When a pair’s price on Exchange A diverges from the same pair on Exchange B, traders can buy low, sell high, and pocket the spread. The size of the spread depends on market depth, latency, and transaction costs. Inside a single exchange, you can also exploit *triangular* relationships-price mismatches among three pairs that should mathematically line up.

Exchange Arbitrage: Same Pair, Different Exchanges

Imagine BTC/USD listed at $49,800 on Binance but $50,100 on Bybit. A trader with accounts on both platforms can buy on Binance, transfer the coins (or use a bridge), and sell on Bybit, netting roughly $300 per BTC before fees. The key ingredients are:

- Multiple exchange accounts

- Fast withdrawal/deposit routes

- Low‑latency execution, often via a crypto arbitrage bot

Because the price discrepancy usually lasts only a few seconds, automation is almost mandatory.

Triangular Arbitrage Inside a Single Exchange

Triangular arbitrage leverages three trading pairs that form a closed loop. A classic example on a single exchange involves BTC/ETH, ETH/LTC, and LTC/BTC. If the implied BTC‑LTC rate from the first two pairs differs from the direct LTC/BTC quote, you can trade:

- Sell BTC for ETH

- Sell ETH for LTC

- Sell LTC back to BTC

The loop returns you to BTC with a few extra satoshis. Success hinges on monitoring all three pairs simultaneously and reacting within milliseconds.

Pairs Trading in Traditional Markets

Pairs trading isn’t limited to crypto. In equities, you pick two stocks that historically move together-think two utility companies. When their price ratio widens, you go long the underperformer and short the overperformer, betting on mean reversion. The statistical backbone is cointegration analysis using the Augmented‑Dickey Fuller Test. Research covering 1962‑2002 showed annualized excess returns up to 11% for well‑chosen pairs, with the Utilities sector delivering the strongest monthly excess return of 1.08%.

DeFi and Flash‑Loan Arbitrage

Decentralized exchanges (DEXs) price assets via automated market makers (AMM) that adjust rates based on pool composition. Because AMM pricing differs from order‑book pricing on centralized exchanges, cross‑platform gaps appear.

Flash‑loan arbitrage takes that a step further. Smart contracts can borrow millions of dollars *without collateral*, execute a series of trades across multiple DEXs and CEXs, and repay the loan-all in a single transaction. If the net profit after gas fees exceeds the loan fee, the arbitrage succeeds without any upfront capital.

Derivative vs Spot Pair Discrepancies

Spot markets trade the asset itself, while derivatives (perpetual futures, options) trade contracts that mirror the asset’s price. Funding rates, interest differentials, and margin requirements can cause the futures price to drift from the spot price. A delta‑neutral strategy-long the spot pair, short the corresponding derivative-captures the spread. This works for any trading pair that has both spot and derivative listings, such as BTC/USD perpetual futures on Binance.

Peer‑to‑Peer Pair Opportunities

On P2P platforms, users set their own buy and sell quotes. Because pricing is often based on fiat equivalents and local demand, a trader can simultaneously list a buy order at $49,500 and a sell order at $50,500 for Bitcoin, locking in $1,000 per BTC regardless of which side fills first. The main risk is counter‑party default, mitigated by escrow services built into many P2P marketplaces.

Key Risks and Tech Requirements

Arbitrage isn’t free money. You must beat:

- Transaction fees (withdrawal, network, exchange fees)

- Slippage caused by limited liquidity

- Execution latency-every millisecond costs profit

- Regulatory restrictions on cross‑border transfers

Successful traders invest in:

- Co‑located servers or high‑speed VPS

- API access to exchanges for order placement

- Real‑time data feeds (WebSocket streams)

- Robust backtesting frameworks to fine‑tune parameters like maximum drawdown and profit‑loss ratios

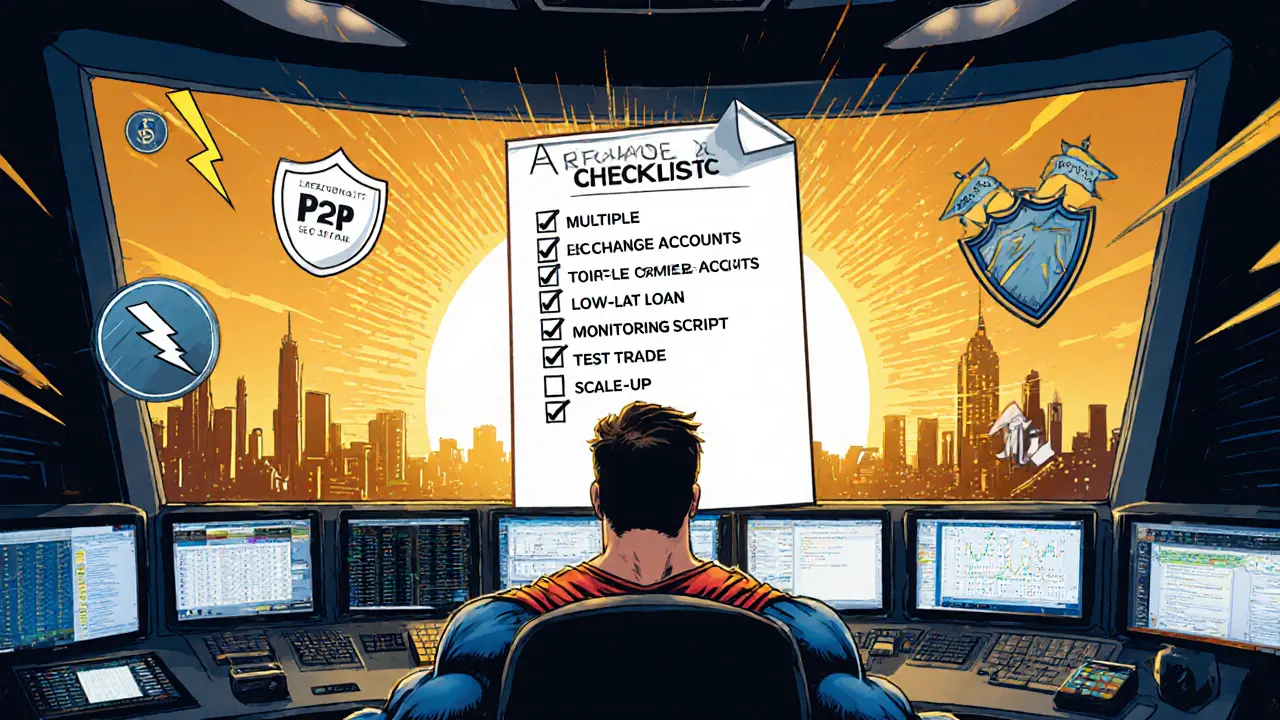

Putting It All Together: A Practical Checklist

- Identify the trading pairs arbitrage style that matches your skill set (exchange, triangular, DeFi, etc.).

- Open and verify accounts on required platforms; enable API keys with withdrawal whitelists.

- Set up a low‑latency server near exchange data hubs (e.g., Frankfurt for European exchanges).

- Implement a monitoring script that flags price gaps exceeding your cost‑plus‑risk threshold.

- Run a small‑scale test trade to validate execution speed and fee calculations.

- Scale up gradually, always monitoring for market impact and regulatory changes.

Stick to the checklist, and you’ll turn the structural quirks of trading pairs into a repeatable profit engine.

Frequently Asked Questions

What is the difference between exchange arbitrage and triangular arbitrage?

Exchange arbitrage exploits price differences of the same trading pair on two separate venues. Triangular arbitrage uses three related pairs on a single venue to capture a pricing loop that should mathematically balance.

Do I need a large capital outlay for flash‑loan arbitrage?

No. Flash loans let you borrow the full amount within a single transaction, but you must cover gas fees and guarantee the profit exceeds the loan fee.

How often do price gaps appear in crypto markets?

Gaps can appear every few seconds on high‑volatility days, especially when new listings or macro news shift order flow across exchanges.

Can I automate pairs trading for stocks the same way I do crypto arbitrage?

Yes, but you’ll need a brokerage API that supports short‑selling and real‑time price feeds. Statistical tools for cointegration remain the same.

What are the biggest hidden costs?

Slippage, network congestion fees (especially on Ethereum), and the opportunity cost of capital locked in margin accounts can erode thin spreads.

Comparison of Common Arbitrage Types

| Arbitrage Type | Typical Venue | Number of Legs | Key Tools | Avg Profit Potential | Main Risk |

|---|---|---|---|---|---|

| Exchange Arbitrage | CEX to CEX | 2 | API bots, fast withdrawals | Medium | Withdrawal delays |

| Triangular Arbitrage | Single CEX or DEX | 3 | Real‑time order‑book scanner | High (when gap exists) | Execution latency |

| Pairs Trading (Equities) | Stock exchanges | 2 | Statistical software, cointegration test | Low‑to‑Medium | Model breakdown |

| DeFi/Flash‑Loan | DEX ↔ CEX | 2‑4 | Smart‑contract scripts | High (if gas cheap) | Smart‑contract bugs |

| Derivative‑Spot | Futures market vs Spot | 2 | Funding rate monitor | Medium | Funding flips |

| P2P Arbitrage | Peer‑to‑peer platforms | 2 | Escrow, price posting bots | Low‑to‑Medium | Counter‑party default |

Dale Breithaupt

February 23, 2025 AT 20:29Great rundown! The way you broke down each arbitrage style makes it easy to see where the low‑hanging fruit is, especially for folks just getting their feet wet.

Rasean Bryant

February 24, 2025 AT 02:03Indeed, the checklist approach you outlined provides a systematic framework that aligns well with risk‑adjusted profit objectives.

Angie Food

February 24, 2025 AT 07:36oh wow another “how to get rich quick” guide, as if nobody already knows that fees eat most of the profit lol.

Jonathan Tsilimos

February 24, 2025 AT 13:09The exposition delineates the mechanistic underpinnings of inter‑exchange price dispersion within the context of microstructure theory. It proceeds to operationalize the concept of a trading pair as a dyadic asset construct, thereby facilitating quantitative arbitrage modeling. By invoking the law of one price, the author underscores the inevitable emergence of transient equilibrium deviations. Subsequent sections enumerate the requisite infrastructural prerequisites, including colocation, low‑latency API endpoints, and high‑throughput order execution pipelines. The treatise further integrates liquidity–cost curves to articulate slippage dynamics under varying order sizes. A rigorous derivation of the expected gross profit function incorporates transaction fee amortization and network gas expense. Triangular arbitrage is formalized through a closed‑loop conversion matrix, with eigenvalue analysis presented to verify arbitrage feasibility. The discussion on flash‑loan mechanisms invokes solvency constraints and atomicity guarantees inherent to smart contract execution. Moreover, the comparative matrix systematically evaluates arbitrage modalities across dimensions of capital efficiency, risk exposure, and regulatory compliance. The author advocates for a bifurcated risk‑return frontier, partitioning strategies into latency‑sensitive and capital‑intensive cohorts. Empirical validation is achieved via backtesting on multivariate time‑series data spanning major cryptocurrency exchanges. The findings corroborate a positive Sharpe ratio for latency‑optimized bots under high‑volatility regimes. Limitations are acknowledged, notably the susceptibility to order‑book manipulation and exchange throttling policies. Recommendations include dynamic fee‑adjusted thresholding and adaptive position sizing algorithms. In sum, the manuscript provides a comprehensive, theoretically grounded, and practically implementable roadmap for systematic arbitrage exploitation.

jeffrey najar

February 24, 2025 AT 18:43That was an impressive deep‑dive; the way you laid out the math really helps bridge theory and the actual bot‑building process.

Rochelle Gamauf

February 25, 2025 AT 00:16While the analysis is exhaustive, the omission of regulatory considerations-particularly in jurisdictions with stringent capital controls-undermines its practical applicability.

Jerry Cassandro

February 25, 2025 AT 05:49If you’re just starting, focus on a single exchange pair first, automate the price‑monitoring script, and only scale once you’ve verified that withdrawal times aren’t eating your margins.

Parker DeWitt

February 25, 2025 AT 11:23😂 Exactly! Most newbies forget that the “instant” transfer claim is a myth; you’ll be waiting for confirmations while competitors already cash out. 🚀

Allie Smith

February 25, 2025 AT 16:56i think the most fun part is watching those tiny spreads pop up when a new token hits the market, it feels like a little treasure hunt.

Lexie Ludens

February 25, 2025 AT 22:29Another glorified spreadsheet that pretends to teach genius.

Aaron Casey

February 26, 2025 AT 04:03Indeed, the emergent arbitrage signals in nascent markets often correlate with heightened cross‑border capital flows, reflecting macro‑economic sentiment shifts.

Leah Whitney

February 26, 2025 AT 09:36Remember to keep an eye on the gas fees; even a seemingly solid spread can evaporate if you’re on a congested network.

Lisa Stark

February 26, 2025 AT 15:09It’s fascinating how the same principles of arbitrage have persisted from vintage commodities to modern DeFi, reminding us that markets always seek equilibrium.

Logan Cates

February 26, 2025 AT 20:43sure, if the exchanges weren’t secretly colluding they'd never let you profit.

Shelley Arenson

February 27, 2025 AT 02:16Thanks for the thorough guide! 👍 Looking forward to testing some of these ideas.

Joel Poncz

February 27, 2025 AT 07:49i feel u, keep grinding and dont let the occasional loss get u down.

Kris Roberts

February 27, 2025 AT 13:23When you consider the psychological pressure of millisecond decision‑making, it’s clear that a solid SOP and mental resilience training are as crucial as the code itself.

lalit g

February 27, 2025 AT 18:56Balancing speed with security is key; integrating multi‑factor authentication on withdrawal endpoints can mitigate many of the highlighted risks.

Reid Priddy

February 28, 2025 AT 00:29One must question whether the purported “profit” is merely a veneer masking the underlying dependency on proprietary exchange APIs that can be altered without notice.