When you send crypto, you don’t just want it to be confirmed-you want it to be final. No reversals. No reorgs. No waiting weeks to be sure. That’s where economic finality in Proof of Stake comes in. Unlike Bitcoin’s slow, math-based certainty, Ethereum and other modern blockchains use money itself as a security tool. If someone tries to undo a transaction, they don’t just need powerful computers-they need to burn billions of dollars. And that’s the whole point.

What Is Economic Finality?

Economic finality means a transaction can’t be reversed because doing so would cost more than it’s worth. It’s not about math. It’s about economics. In Proof of Work, like Bitcoin, you wait for six blocks-about an hour-to feel safe. In Proof of Stake, you wait 12.8 minutes. Why? Because after that time, reversing the block would require slashing over $100 billion in staked ETH. No one does that. Not even a nation-state.

This isn’t theoretical. Ethereum’s Casper FFG protocol, rolled out during The Merge in September 2022, made this real. Validators-people who lock up ETH to help secure the network-vote on blocks. When two-thirds of them agree, a block gets justified. After the next epoch (another 6.4 minutes), it’s finalized. At that point, any attempt to rewrite history triggers automatic penalties: validators lose their entire stake. And not just a little. If you try to double-spend, you lose your 32 ETH. If you’re part of a coordinated attack, you lose your share of the $320 billion locked in the system.

How It Works: The Slashing Mechanism

Slashing is the enforcement tool. It’s not a fine. It’s annihilation. Validators who misbehave-like signing two conflicting blocks or voting in a way that tries to create a fork-are punished by having their stake destroyed. The Ethereum protocol defines exact conditions:

- Double voting: lose 0.5 ETH

- Surround vote: lose 100% of stake

- Attestation violations: lose everything

These rules aren’t optional. They’re baked into the code. And they’re enforced by the network itself. There’s no central authority. No judge. No regulator. Just code and economics.

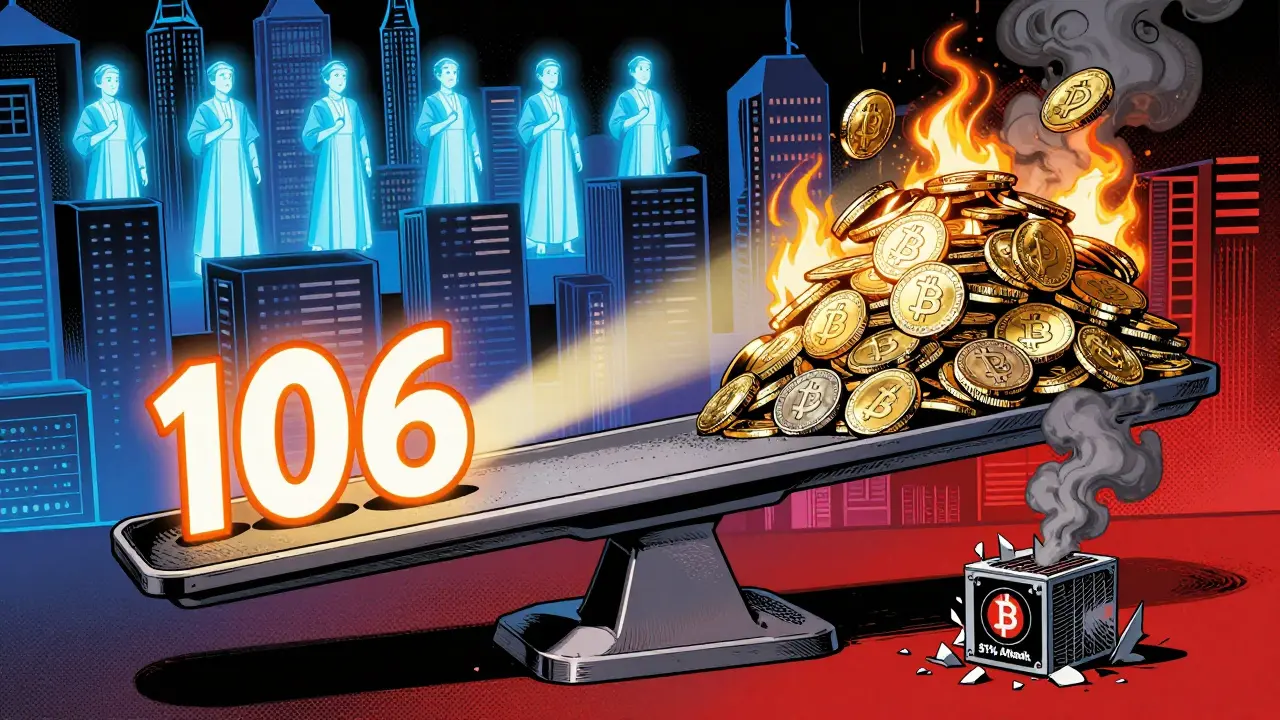

As of October 2025, over 21 million ETH is staked-worth roughly $320 billion. To reverse a finalized block, an attacker would need to control 33.34% of that stake. That’s over $106 billion. And even then, they’d lose it all. Plus, they’d lose future rewards. Plus, they’d trigger market panic. The MEV (Maximal Extractable Value) opportunity cost alone? Around $150,000 per block they try to rewrite. The math doesn’t add up.

How It Compares to Proof of Work

Bitcoin uses probabilistic finality. The more blocks that come after your transaction, the safer it gets. But it’s never absolute. A 51% attack could still rewrite history-if you had enough ASIC miners. And those cost millions. But they’re reusable. You can sell them later. In PoS, your weapon is your stake. And once you use it to attack, it’s gone.

Here’s the real difference:

| Feature | Proof of Stake (Ethereum) | Proof of Work (Bitcoin) |

|---|---|---|

| Finality Time | 12.8 minutes | 60+ minutes |

| Security Model | Economic cost | Computational cost |

| Attack Cost (2025) | $106+ billion (stake destroyed) | $10+ billion (hardware + electricity) |

| Reusability of Attack Tools | No-stake is burned | Yes-miners can resell ASICs |

| Energy Use | ~0.01% of Bitcoin’s | ~0.5% of global electricity |

Bitcoin’s model is like locking your car with a steel bar. It’s hard to break. But you can still steal the car if you have a tow truck. Ethereum’s model is like setting your car on fire if someone tries to steal it. The thief doesn’t just lose the car-they lose their own house.

Real-World Impact: Why Developers Care

For DeFi apps, speed matters. If a DEX like Uniswap can’t confirm trades quickly, users get stuck. Slippage kills profits. In 2025, 89% of Ethereum developers said economic finality was “critical” to their work. Why? Because 15 minutes is fast enough for trading, lending, and automated strategies. Bitcoin’s 60+ minutes isn’t just slow-it’s unusable for real-time finance.

But there are risks. In August 2025, a DeFi protocol lost $2.3 million because it treated a block as final after just 2 minutes. It wasn’t finalized yet. The network reorganized. Transactions vanished. The lesson? Don’t trust the first few blocks. Wait for 12.8 minutes-or use a service like Lido or Aave that waits for both “safe head” (5 minutes) and “finalized head” (12.8 minutes).

Even big players get it wrong. Coinbase and other exchanges use 2-3 minutes for small transfers. That’s fine for buying coffee with ETH. But for $10 million swaps? Not even close.

Limitations and Criticisms

It’s not perfect. Critics point out two big flaws.

First: long-range attacks. What if someone buys up old staked ETH from years ago and tries to rewrite history? Ethereum solves this with “weak subjectivity.” Your wallet needs to sync to a recent checkpoint-say, from the last 2 weeks. If you’re using an old client, it won’t accept old chains. It’s a social agreement, but a necessary one.

Second: centralization. As of September 2025, the top 10 validators controlled 32.7% of Ethereum’s staking. That’s a lot. If they colluded, they could theoretically halt finality. But they’d still face slashing. And they’d destroy the value of their own holdings. It’s a game of chicken where the stakes are your life savings.

Bitcoin maximalists hate this. They say only physical work-mining with electricity and hardware-is “real” security. Ethereum’s model, they argue, is just a social contract. If ETH crashes 90%, slashing $100 billion becomes cheap. Maybe. But then again, if ETH crashes 90%, the attacker has no incentive to reverse transactions-they’ve already won by selling low.

What’s Next? The Prague Upgrade

Ethereum isn’t done. The Prague upgrade, expected in Q1 2026, will cut finality time from 12.8 minutes to 4.2 minutes. How? By improving how leaders are chosen for each block. Faster leader selection means faster attestation. That means faster finality.

And it’s not just Ethereum. Solana achieves sub-second finality using Tower BFT. Cardano waits 5 hours. Polkadot uses NPoS with a 60-second finality window. Each has trade-offs. But they all share the same core idea: money talks louder than math.

By 2027, analysts predict 95% of non-monetary blockchains will use economic finality. Why? Because speed, efficiency, and user experience win. Bitcoin will stay for store-of-value. But for everything else? PoS is the default.

Who Uses This Today?

JP Morgan’s Onyx platform uses PoS for settlement because 15-minute finality beats 60+ minutes. MicroStrategy still holds only Bitcoin-because they believe in physical security. Both make sense. One wants speed. The other wants immutability.

Regulators are catching up too. In July 2025, the SEC said PoS networks with at least 33% staking ratios qualify for certain exemptions. That’s a big deal. It means economic finality is now recognized as a legitimate security model by one of the world’s most powerful financial regulators.

And the numbers? $412 billion in total value secured by economic finality across all PoS chains as of September 2025. Ethereum alone holds $313 billion of that. That’s more than the GDP of most countries.

Final Thoughts

Economic finality isn’t magic. It’s not perfect. But it works. It’s faster, cheaper, and more scalable than Proof of Work. And it turns security into a financial decision-not a hardware race.

If you’re building on blockchain, you need to understand this. Don’t assume finality after 5 blocks. Don’t trust a single confirmation. Wait for the protocol’s defined finality window. Use monitoring tools. Know the difference between safe head and finalized head.

Because in blockchain, what you don’t know can cost you millions.

How long does it take for a transaction to be economically final on Ethereum?

On Ethereum, a transaction becomes economically final after two epochs, which takes 12.8 minutes. Each epoch is 6.4 minutes long. This is when at least two-thirds of validators have attested to the block and its predecessor, making any attempt to reverse it cost over $100 billion in slashed stakes.

What happens if a validator tries to cheat in Proof of Stake?

If a validator tries to cheat-like signing conflicting blocks or attempting a double-spend-they get slashed. That means their entire staked ETH is destroyed. For minor offenses, they lose 0.5 ETH. For serious violations like surround votes, they lose 100% of their stake. This penalty is automatic and enforced by the protocol.

Can you reverse a finalized Ethereum transaction?

Technically, yes-but it’s economically impossible. To reverse a finalized block, you’d need to control 33.34% of all staked ETH (over $106 billion as of late 2025) and be willing to burn it all. No individual or group has that kind of capital, and even if they did, the market crash and loss of trust would make the attack worthless.

Is economic finality safer than Bitcoin’s probabilistic finality?

It’s different, not necessarily safer. Bitcoin requires 60+ minutes and massive hardware investment to reverse. Ethereum requires less time but massive financial investment. Bitcoin’s security is physical; Ethereum’s is economic. For most applications, Ethereum’s speed and lower energy cost make it more practical. For long-term value storage, Bitcoin’s model is still preferred by some.

Why do some developers still use 2-3 minute confirmations?

For low-value transactions-like tipping or small purchases-waiting 12.8 minutes is overkill. Many exchanges and apps use 2-3 minutes (5-7 blocks) as a “safe enough” threshold for small amounts. But for anything over $10,000, they wait for full finality. It’s a risk-reward tradeoff based on transaction size.

What is weak subjectivity in Ethereum?

Weak subjectivity is a safeguard against long-range attacks. If you’re syncing a wallet or node from scratch, you must trust a recent valid checkpoint-usually from the last 2 weeks. This prevents attackers from using old, abandoned stakes to rewrite history. It’s not a flaw-it’s a necessary tradeoff for faster finality.

How does economic finality affect DeFi?

It makes DeFi possible. Without fast finality, automated trading, lending, and collateral liquidations would be too risky. A 15-minute finality window allows for complex strategies like arbitrage and flash loans. Protocols like Uniswap and Aave rely on it. Without economic finality, DeFi as we know it wouldn’t exist.

Tiffani Frey

January 6, 2026 AT 11:10Finally, someone explained this clearly. I’ve been trying to tell my crypto-curious friends that finality isn’t about blocks-it’s about cost. The $100B slashing threshold? That’s the real firewall. No hardware can match that. Just... money talking.

Also, weak subjectivity isn’t a flaw-it’s a feature. You don’t need to trust a 3-year-old chain. You need to trust your last synced checkpoint. That’s rational, not weak.

And yes, 12.8 minutes is fast enough for DeFi. I’ve watched trades settle faster than my bank’s ACH clears. It’s wild.

Also, why do people still compare this to Bitcoin’s 60 minutes? That’s not security-it’s patience. And patience doesn’t scale.

Also-don’t trust 2-minute confirmations for anything over $5k. I’ve seen it go wrong. Twice. Don’t be that person.

Also-Ethereum’s energy use is 0.01% of Bitcoin’s? Yes. And that’s not even the biggest win. The real win is that validators aren’t running ASIC farms in Siberia. This is civilization-level tech.

Also-JPMorgan using this? That’s the seal of approval. If Wall Street trusts it for settlement, you should too.

Also-Prague upgrade to 4.2 minutes? Yes please. I’m ready.

Also-no, you can’t just ‘buy old ETH’ and rewrite history. The network won’t sync to it unless you accept a recent checkpoint. That’s not centralization-it’s sanity.

Also-yes, the top 10 validators hold 32.7%. But they’re not colluding. They’re earning 4-6% APY. Why risk $10B to destroy their own income? That’s not a threat-it’s incentive alignment.

Also-Bitcoin maximalists are like people who think a steel door is safer than a smart lock that auto-locks and self-destructs if tampered with. The tech isn’t better. The *thinking* is outdated.

Also-this isn’t magic. It’s math + economics + incentives. And it works.

Also-I’m not a dev. I just use DeFi. And I sleep better knowing my swaps are final.

Also-I’m not here to argue. I’m here to say: thank you for writing this. It’s the clearest thing I’ve read all year.

Also-I’m going to share this with my book club. They think crypto is a pyramid scheme. This will change their minds.

Ritu Singh

January 8, 2026 AT 10:27economic finality is just a fancy word for trust in the elite validators who control the network

you think $100 billion is safe but what if the elite decide to change the rules

they already control the code

they already control the narrative

they already control the checkpoints

weak subjectivity is just social engineering dressed as technology

no one ever talks about how the validators are mostly institutional players

what if the fed buys 33 percent of the stake

what if the cia controls the top 10

you think this is decentralized

it’s not

it’s just a new kind of bank

with nicer numbers

and more lies

the real security is in physical work

not in digital promises

your money is not yours

it’s theirs

and they can take it

when they want

and you will thank them for it

Surendra Chopde

January 9, 2026 AT 22:13Great breakdown. One thing missing: the MEV cost of reorgs. If you try to reverse a block, you don’t just lose your stake-you lose the $150k in MEV you could’ve earned from the next 100 blocks. That’s opportunity cost on steroids.

Also, validators don’t just get slashed-they get publicly flagged. Their address is burned on-chain. No anonymity. No escape. That’s psychological deterrence too.

And yes, 12.8 minutes is perfect. Not too fast to be unsafe. Not too slow to be useless.

DeFi runs on this. Not on Bitcoin’s 60-minute wait.

Also, the fact that the SEC recognizes this as legitimate? Huge. Means regulators are finally catching up to tech, not fighting it.

Jennah Grant

January 10, 2026 AT 08:49Let’s be precise: economic finality isn’t ‘better’ than PoW-it’s *different*. It’s a paradigm shift. PoW secures value through energy expenditure. PoS secures value through capital commitment.

One is a physical lock. The other is a financial contract.

Both are valid. But only one scales to global finance.

And yes-the energy difference isn’t just a side note. It’s existential. Bitcoin’s footprint is unsustainable. Ethereum’s isn’t.

Also: the 33.34% threshold isn’t arbitrary. It’s game-theoretic. Any less and collusion becomes profitable. Any more and finality becomes too slow.

This isn’t luck. It’s engineering.

Becky Chenier

January 11, 2026 AT 05:18I appreciate the depth of this post. But I still wonder-what happens if the Ethereum Foundation itself decides to hard fork and reverse a transaction? Not because of an attack-but because of a political decision?

Slashing only works if the protocol is immutable. But the protocol is governed by people.

So is economic finality really final?

Or is it just… conditional?

Veronica Mead

January 12, 2026 AT 13:43It is imperative to underscore that the notion of 'economic finality' constitutes an egregious abdication of cryptographic purity. The very foundation of blockchain technology lies in mathematical certainty, not financial coercion. To replace verifiable computation with monetary threat is to surrender the integrity of decentralization to the whims of capital concentration. The fact that a single entity may, through stake accumulation, exert disproportionate influence over consensus mechanisms is not merely a flaw-it is a systemic betrayal of the original ethos. One cannot claim to have achieved true decentralization when the security of the network is contingent upon the economic power of a select few. This is not innovation. It is corporatization, rebranded.

Rahul Sharma

January 14, 2026 AT 01:5512.8 minutes is perfect. I work in fintech. Our clients need speed. Bitcoin’s 60 minutes? No. We can’t wait. We can’t risk slippage. Ethereum’s finality lets us settle trades in real time. No more ‘waiting for confirmations.’

Also, slashing isn’t punishment. It’s insurance. You pay with your stake. If you cheat, you lose. Simple.

Also, the energy numbers? 0.01% of Bitcoin? That’s not a win. That’s a revolution.

Also, weak subjectivity? Yes, you need to sync to a recent checkpoint. So what? Your phone does that every time you update apps. You don’t complain about that.

Also, top 10 validators? They’re running nodes. They’re not hiding. They’re public. You can see them. You can audit them. That’s transparency.

Also, if you’re still using Bitcoin for DeFi, you’re using a typewriter to write a novel.

Paul Johnson

January 15, 2026 AT 23:01so like if you have a lot of money you can just buy the whole chain right

and then like change everything

and no one can stop you

thats not security thats like a mafia

bitcoin is real because you need real power to mine

but ethereum is just rich people playing monopoly

and calling it crypto

lol

and dont even get me started on the 33 percent thing

what if they all collude

they already control the code

they already control the wallets

they already control the narrative

its all fake

your money is not yours

its theirs

and they can take it

when they want

and youll thank them for it

and youll call it progress

Emily Hipps

January 16, 2026 AT 07:52This is the most important thing happening in tech right now. Not AI. Not quantum. This.

Economic finality is the reason DeFi exists. Without it, you can’t have flash loans. You can’t have automated market makers. You can’t have real-time lending.

It’s not just faster. It’s *possible*. Bitcoin can’t do this. Never could.

And yes, 12.8 minutes is enough. I’ve built apps on this. I’ve seen users sigh in relief when their trade finalizes. They don’t care about blocks. They care about certainty.

Also-thank you for mentioning Lido and Aave. So many devs forget to warn people about the safe head trap.

And yes, the SEC recognizing this? Huge. This isn’t just tech. It’s finance. And finance is finally catching up.

Keep writing. This matters.

Valencia Adell

January 17, 2026 AT 13:24Let’s be honest: this whole ‘economic finality’ thing is just a PR stunt to make PoS look less centralized.

Yes, you lose your stake if you attack. But what if you don’t care? What if you’re a state actor? What if you’re willing to lose $100B to destroy trust in ETH?

Then you win.

Because the price crashes.

And then you buy it all back at 10%.

Slashing doesn’t stop attacks. It just makes them more expensive.

But if you’re rich enough, expensive doesn’t matter.

And guess what? The top 10 validators? They’re all VC-backed. They’re all connected.

This isn’t decentralization.

This is oligarchy with a blockchain logo.

Sarbjit Nahl

January 18, 2026 AT 09:00It is a curious irony that proponents of economic finality tout its superiority while ignoring the fundamental contradiction: if security is derived from economic cost, then the value of the asset itself becomes the vulnerability. A 90% price collapse renders the $100B slashing threshold meaningless. The attacker need only wait for market panic to achieve what brute force cannot. The system is thus not robust-it is contingent. And contingency is the antithesis of finality. True security must be independent of price. Bitcoin’s model, however inefficient, satisfies this criterion. PoS does not. It is a house built on sand, adorned with elegant math.

Frank Heili

January 18, 2026 AT 17:20One thing everyone misses: the slashing mechanism isn’t just about punishment. It’s about *incentive alignment*. Validators earn rewards for honest behavior. They lose everything for dishonest behavior. That’s not a threat. That’s a business model.

And it works. Look at the data. Since The Merge, there have been zero successful reorgs. Zero. Not one.

Meanwhile, Bitcoin has had dozens of 1-block reorgs. Minor, sure. But they happen. And they’re not punished. Just ignored.

Also: 21M ETH staked? That’s 17% of all ETH. And it’s growing. That’s not centralization. That’s adoption.

Also: the fact that you can stake $32 ETH and become a validator? That’s not elitist. That’s accessible. Bitcoin mining? You need $100k in hardware and a power plant.

This isn’t magic. It’s just better.

Jacob Clark

January 20, 2026 AT 00:20Okay so let me get this straight-you’re telling me that if I have $100 billion I can just destroy the entire Ethereum network and no one can stop me?

And then you say this is secure?

That’s not security. That’s a hostage situation.

And the fact that the top 10 validators control 32%? That’s not decentralization. That’s a cartel.

And what if the U.S. government just says ‘we’re taking over the validators’?

They already control the banks.

They already control the exchanges.

They already control the narrative.

So what’s stopping them from just… flipping the switch?

And you call this freedom?

It’s not crypto.

It’s digital feudalism.

And you’re all just serfs with wallets.

And you’re proud of it.

That’s the real tragedy.

Jon Martín

January 20, 2026 AT 17:34This is the future. And it’s here.

12.8 minutes? That’s faster than your coffee order.

Slashing? That’s not punishment. That’s justice.

Weak subjectivity? That’s not a flaw. That’s common sense.

And yes-Bitcoin is slow. And yes-it’s secure. But it’s not *useful* anymore.

DeFi runs on this. NFTs run on this. Real-world assets are being tokenized on this.

And if you’re still stuck on Bitcoin’s 60-minute wait? You’re not protecting your money.

You’re holding onto the past.

And the past? It’s not paying the bills.

Embrace this. It’s not perfect. But it’s real.

And it’s working.

Dennis Mbuthia

January 22, 2026 AT 00:51Look. I love America. And I love Bitcoin. Bitcoin is the last real money. Not this crypto garbage.

Ethereum? It’s a Wall Street play. Rich guys with laptops. No miners. No real work. Just staking. Like a Ponzi scheme with a whitepaper.

And you call this ‘finality’? No. It’s fragility.

One day the Chinese government buys 33% of ETH. And boom. Everything flips. No warning. No vote. Just code.

That’s not freedom. That’s tyranny with a blockchain logo.

Bitcoin? You need physical hardware. You need electricity. You need grit. That’s real. That’s American.

This? This is digital serfdom.

And you’re all just slaves to the algorithm.

Wake up.

Real men mine.

Real money is physical.

Real security doesn’t need a checkpoint.

It just works.

Tracey Grammer-Porter

January 23, 2026 AT 16:04Just wanted to say thank you for writing this. I’m new to crypto and I’ve been confused about why Ethereum is different from Bitcoin. This made it click.

Also-12.8 minutes? That’s not slow. That’s *reasonable*. I can wait that long for a $10k transfer.

Also-I didn’t know about safe head vs finalized head. That’s super important. I’m going to check my wallet settings now.

Also-weak subjectivity? I get it now. It’s like updating your phone. You don’t want to sync to a 5-year-old version.

Also-I’m not a dev. But I use Uniswap every week. And I feel safe now.

Thank you. Really.

Don Grissett

January 24, 2026 AT 21:40So let me get this straight-you're saying if someone tries to reverse a transaction they lose their stake? But what if they don't care? What if they're a nation state? What if they just want to crash the price? Then they win. Slashing doesn't stop attacks. It just makes them expensive. And if you're rich enough, expensive doesn't matter. This isn't security. It's a gamble. And you're betting your life savings on the idea that no one will ever be rich enough to break it. That's not a system. That's a prayer.

Katrina Recto

January 26, 2026 AT 17:34I’ve been in crypto since 2017. I’ve seen every hype cycle. This? This is the real deal.

12.8 minutes isn’t just fast. It’s *predictable*. You know exactly when your transaction is final. No guessing. No waiting.

And the slashing? It’s not about fear. It’s about alignment. Validators earn more by staying honest. That’s capitalism. That’s good.

Also-yes, the top 10 hold 32%. But they’re not secret. You can see their addresses. You can audit their behavior. That’s transparency.

Also-weak subjectivity? It’s not a flaw. It’s a safety net. You don’t need to trust 5-year-old data. You need to trust the last 2 weeks. That’s not centralization. That’s sanity.

Also-I use this for my savings. And I sleep better than I did with Bitcoin.

Thank you for this.

Gideon Kavali

January 27, 2026 AT 14:44Let me be clear: economic finality is not a technological advancement. It is a surrender. A surrender to the idea that money, not mathematics, should govern trust. Bitcoin’s Proof of Work is a cathedral of computation-built on energy, patience, and physical reality. Ethereum’s Proof of Stake is a mirage-glittering, efficient, and utterly dependent on the illusion of value. When the fiat system collapses-and it will-what happens to a system whose security is tied to the price of a speculative token? The answer is simple: it collapses with it. Bitcoin endures because it is anchored to the real world. Ethereum? It floats. And floats are not foundations.

Allen Dometita

January 29, 2026 AT 05:0012.8 minutes? That’s less time than it takes to microwave my lunch.

And I’m not even a dev. I just swap ETH for USDC on Uniswap.

Before this, I thought ‘finality’ meant ‘confirmed.’ Now I know it means ‘unstoppable.’

Also-slashing? That’s not scary. That’s fair. You stake your money. You play by the rules. If you cheat, you lose. That’s not crypto. That’s life.

Also-top 10 validators? So what? They’re not hiding. They’re running nodes. They’re earning rewards. They’re not stealing. They’re working.

Also-I don’t need 60 minutes. I need 12.8. And I’m glad I got it.

Also-weak subjectivity? I update my phone every week. Why is this different?

Also-this isn’t magic. It’s just… better.

And I’m here for it.

greg greg

January 29, 2026 AT 06:04Let’s not pretend this is perfect. Economic finality relies on a stable price. If ETH drops 90%, the $100B slashing threshold becomes trivial. An attacker could buy up 33% of the staked ETH for $10B, reverse a block, and still profit from the price crash. The system assumes that the value of ETH will remain high enough to deter attacks-but that’s an assumption, not a guarantee. And in decentralized systems, assumptions are the first crack in the foundation. This isn’t security. It’s conditional stability. And conditional stability is not finality. True finality must be independent of market dynamics. Bitcoin’s model, however inefficient, achieves this. PoS does not. It’s elegant. It’s efficient. But it’s not eternal.

LeeAnn Herker

January 29, 2026 AT 20:11Oh wow. So we’re just supposed to trust the rich people who control the validators? And if they collude, we’re screwed? And you call this ‘decentralized’?

Meanwhile, Bitcoin miners are spread across the globe, running on hydro power in Canada and coal in Kazakhstan. They’re not in a boardroom.

And you say ‘slashing’ is a deterrent? What if the attacker is a nation? What if they don’t care about losing $100B? What if they want to crash ETH so they can buy it back at 10%?

Then they win.

And you? You lose everything.

And you’re proud of this?

This isn’t innovation.

This is a confidence trick.

And you’re all the mark.

Tiffani Frey

January 30, 2026 AT 08:02Wow. So many comments about ‘what if the rich collude?’

Let me ask you this: who owns 33% of Bitcoin’s hash power? Who controls the mining pools?

China used to. Now it’s the U.S.

Same problem. Different tech.

And guess what? Bitcoin still works.

Because the network doesn’t care who controls the hardware. It just follows the chain.

Same with Ethereum. The network doesn’t care who controls the stake. It just follows the votes.

And if the top 10 try to collude? They get slashed. Their stake is destroyed. Their reputation is gone. Their income is gone.

They’d lose more than they’d gain.

That’s not a flaw. That’s game theory.

And it’s working.

Bitcoin has 51% attacks every few years.

Ethereum? Zero since The Merge.

So… which one is actually more secure?

Frank Heili

January 31, 2026 AT 05:45And here’s the kicker: even if a nation-state tried to attack, they’d need to buy up 33% of all staked ETH. That’s $106B. And they’d have to do it without moving the market. Good luck.

Then they’d need to coordinate a 2/3 vote across thousands of validators. Most are independent. Most are in different countries.

Then they’d need to broadcast conflicting blocks. And the network would slash them all.

And then ETH would crash. And they’d lose their entire investment.

And the market would move on.

It’s not impossible. It’s just… stupid.

That’s why it’s never happened.

And it never will.

Veronica Mead

January 31, 2026 AT 21:11One must ask: if the system’s security is contingent upon the market valuation of a volatile asset, then it is not secure at all-it is merely a reflection of collective belief. When the belief falters, so too does the foundation. This is not cryptography. This is psychology. And psychology is not a reliable basis for global financial infrastructure. The original vision of blockchain was to transcend human frailty-not to enshrine it in code. Economic finality does the opposite. It is a monument to speculation, not sovereignty.