When you buy, sell, or trade cryptocurrency, the government might take a cut. But how big that cut is depends entirely on where you live. In one country, you could pay nothing. In another, nearly half your profit vanishes in taxes. There’s no global rule. No universal system. Just a patchwork of laws that change every year - and 2026 is no different.

Where Crypto Is Completely Tax-Free

Twelve countries let you keep every penny from your crypto gains. No capital gains tax. No income tax. No reporting. Just pure profit. These places aren’t just tax havens - they’re actively trying to attract crypto businesses and investors.El Salvador stands out because it made Bitcoin legal tender. If you trade BTC there, you pay zero tax. Same in the United Arab Emirates: whether you hold for a day or five years, no tax. Portugal exempts crypto held longer than a year, but only if you’re a tax resident (183+ days per year). Switzerland and Hong Kong don’t tax personal crypto investments - but if you’re running a crypto business, all bets are off.

Germany is a special case. You pay nothing if you hold crypto for more than one year. Sell before that? You’re taxed at your personal income rate - up to 45%. So the real trick isn’t avoiding tax entirely. It’s timing your sales. Many investors in Germany wait out the year just to avoid the tax.

High-Tax Countries: Where Profits Get Crushed

If you’re looking to minimize taxes, avoid Japan. It’s the most expensive country for crypto investors. Gains are taxed as ordinary income, with rates ranging from 15% to a staggering 55%. That’s higher than most corporate tax rates in the U.S. and includes local inhabitant taxes on top.Denmark isn’t far behind. Depending on your income, you could pay between 37% and 52% on crypto profits. France takes a flat 30% on crypto-to-fiat sales - but that includes social charges. If you mine or stake crypto, those earnings are treated as income and taxed up to 45%. And they’re watching. France fines you up to €750 for every unreported crypto account.

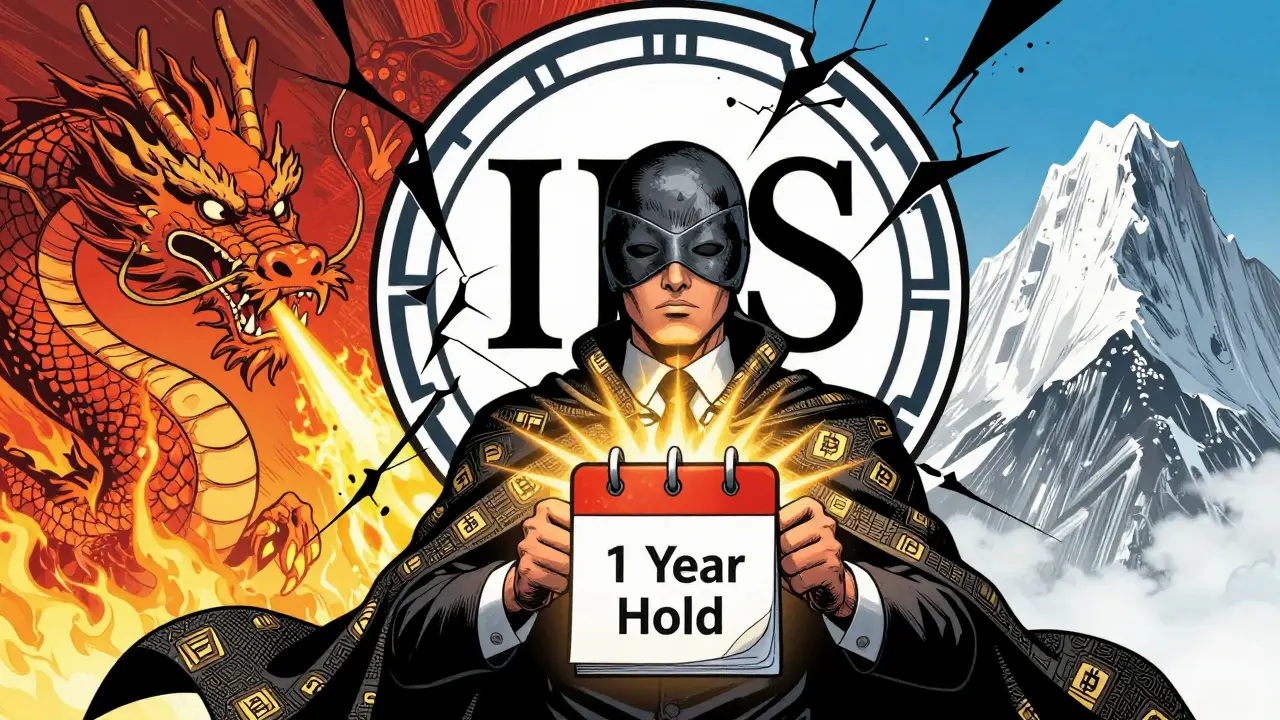

The U.S. has a two-tier system. If you hold crypto less than a year, it’s short-term capital gains - taxed at your regular income rate: 10% to 37%. Hold it over a year? Long-term rates kick in: 0%, 15%, or 20%, depending on your income. But here’s the catch: if you earn crypto from staking, mining, or a job, it’s taxed as income right away - no holding period benefit. The IRS tracks everything. Exchanges report directly to them.

The UK charges 10% or 20% on crypto gains, depending on your income bracket. But you get a £3,000 allowance for 2025 - meaning the first £3,000 of profit is tax-free. After that? You report every trade on your Self-Assessment. Miss it? You could be fined up to 200% of what you owe.

How Countries Classify Crypto - And Why It Matters

Not all crypto is treated the same. Some countries look at what you did with it. Others look at how long you held it. And some don’t even care - unless you’re making money from it regularly.In Malaysia, personal crypto trading is tax-free. But if you’re trading daily like a business? That’s taxable income. Hong Kong does the same. They don’t tax you for buying Bitcoin and selling it later - unless you’re doing it full-time, with leverage, and multiple trades a day. Then it’s business income.

Germany and Portugal both reward long-term holding. But Germany doesn’t care if you trade crypto-to-crypto - only when you cash out to euros. Portugal only exempts long-term gains if you’re a resident. Non-residents? Taxed on every sale.

The U.S. and France treat crypto as property. Every trade is a taxable event. Swap ETH for SOL? That’s a sale. You owe tax on the gain from when you bought ETH. Most people don’t realize this. They think “I didn’t cash out,” so no tax. But the IRS says otherwise. That’s why tools like Koinly and CoinTracker exist - to track every single swap.

Residency Rules: Where You Live Beats Where You Bank

Your tax bill isn’t based on where your wallet is. It’s based on where you live. If you’re a U.S. citizen, you pay U.S. taxes - even if you live in Bali. If you’re a tax resident in Portugal, you get the 0% rate on long-term crypto - but only if you’re there 183+ days a year.Most crypto-friendly countries require residency to qualify for tax breaks. The UAE doesn’t tax anyone - but you still need to be a legal resident to open a bank account and cash out without hassle. Switzerland doesn’t tax private investors, but you need to prove you’re not running a business.

Non-residents usually pay nothing in zero-tax countries. Why? Because crypto gains aren’t considered local income. If you’re a tourist in Panama and sell Bitcoin, Panama doesn’t care. But your home country might. That’s the trap. Moving to a tax-free country doesn’t erase your obligations back home.

Compliance: The Hidden Cost of Crypto

Even in low-tax countries, paperwork is unavoidable. Germany requires you to report every crypto transaction to the Federal Central Tax Office. France demands annual asset declarations. The UK requires full Self-Assessment forms. Miss a deadline? Fines pile up fast.Many people think, “I don’t make much, they won’t notice.” But exchanges now report directly to tax authorities. In the U.S., Coinbase, Kraken, and Binance.US send 1099 forms. In Europe, exchanges comply with DAC8 - the EU’s crypto reporting directive. Your transactions are being tracked.

That means even small trades matter. Selling $500 worth of crypto? Still report it. Buying a coffee with Bitcoin? That’s a taxable event in the U.S. and France. The tax authorities aren’t waiting for millionaires. They’re auditing everyday users.

What’s Changing in 2026?

More countries are catching up. The EU’s DAC8 is rolling out fully this year, forcing all member states to share crypto transaction data. Hong Kong’s licensing regime is tightening. Australia is cracking down on unreported gains. Even countries like Canada and Singapore - once seen as friendly - are increasing reporting requirements.Meanwhile, places like the UAE and Singapore are doubling down on crypto-friendly policies. They’re offering residency visas to crypto founders. They’re building regulatory sandboxes. They’re not just avoiding taxes - they’re building entire economies around blockchain.

The message is clear: tax rules are becoming stricter everywhere. But the best way to stay ahead isn’t to hide. It’s to know the rules - and plan around them. Whether you’re holding for a year in Germany, moving to Portugal, or just trying to avoid an IRS audit, your strategy needs to match your location.

What You Should Do Right Now

- If you live in a high-tax country: hold crypto for over a year to qualify for lower long-term rates.

- If you’re in a zero-tax country: make sure you’re a legal resident - otherwise, your home country may still tax you.

- If you trade frequently: use a crypto tax tool. Manual tracking is a disaster waiting to happen.

- If you mine, stake, or earn crypto: record every transaction. That’s income, not a gift.

- If you’re thinking of relocating: don’t just chase low taxes. Check residency rules, banking access, and legal status for crypto.

Taxing crypto isn’t about fairness. It’s about control. Governments want to know who owns what, when they sold it, and how much they made. The best investors aren’t the ones who avoid taxes - they’re the ones who understand them well enough to work within the system.

Is crypto taxed everywhere in the world?

No. Twelve countries currently have zero tax on cryptocurrency gains for personal investors, including the UAE, El Salvador, Switzerland, and Hong Kong. But residency rules often apply - if you’re not a legal resident, you may still owe taxes in your home country.

Which country has the highest crypto tax rate?

Japan has the highest crypto tax rate in 2026, with progressive rates up to 55% on capital gains. This includes both national and local taxes. Denmark and France also have high rates, reaching 52% and 45% respectively for high-income earners.

Do I pay tax if I swap one crypto for another?

In the U.S., France, Germany, and the UK, swapping crypto for crypto is treated as a taxable sale. You owe tax on the gain from the original purchase price. For example, if you bought BTC for $10,000 and swapped it for ETH worth $15,000, you owe tax on the $5,000 gain - even though you didn’t cash out.

Can I avoid crypto taxes by moving to a tax-free country?

Only if you legally become a tax resident there and your home country doesn’t tax worldwide income. U.S. citizens and permanent residents still owe taxes on global income, no matter where they live. Other countries may exempt you - but only if you meet residency requirements like living there 183+ days per year.

Do I need to report crypto if I didn’t sell it?

Only if you earned it - like from staking, mining, or a job. Buying and holding without selling usually doesn’t trigger a tax event. But in countries like Germany and the U.S., you still need to keep records. Some countries require annual reporting of holdings, even if no sale occurred.

What happens if I don’t report my crypto gains?

Fines can be severe. In France, you can be fined €750 per unreported account. In the UK, penalties reach 200% of unpaid tax. The IRS can pursue criminal charges for tax evasion. With exchange reporting and blockchain tracking, hiding crypto gains is getting harder - and riskier.

How do tax authorities track crypto transactions?

Exchanges like Coinbase, Kraken, and Binance now report directly to tax agencies under rules like DAC8 (EU) and Form 1099 (U.S.). Blockchain analysis tools can trace wallet movements, even across platforms. Governments are investing millions in crypto-tracking technology - it’s no longer a matter of if they’ll find you, but when.

Dave Ellender

January 21, 2026 AT 03:59Been holding since 2021 and just sold half my BTC this year. Germany’s one-year rule saved me like $12k. Honestly, the trick isn’t avoiding taxes-it’s timing your moves like a chess game.

Taylor Mills

January 23, 2026 AT 00:26lol the usa is so dumb. why tf do i have to pay tax when i swap eth for sol? i didn’t even touch fiat. the irs is just greedy af.

Julene Soria Marqués

January 23, 2026 AT 01:45they’re tracking everything. even your coffee buys with btc. next thing you know they’ll tax you for breathing near a blockchain.

Darrell Cole

January 23, 2026 AT 02:02you think this is bad wait till they start taxing your metaverse land and your nft profile pic

Bonnie Sands

January 23, 2026 AT 21:15the whole system is rigged. crypto was supposed to be free from the fed but now they’re using it to spy on you. blockchain transparency is just government surveillance with a tech buzzword.

Melissa Contreras López

January 25, 2026 AT 07:26if you’re in the us and you hold over a year you’re already winning. don’t let the noise get to you. tax efficiency > tax avoidance. you got this 💪

Brenda Platt

January 25, 2026 AT 12:05just bought my first solana this week and i’m already thinking about how to report it 😅 love that we’re finally talking taxes like normal people. keep it real, keep it smart 🌟

Deepu Verma

January 25, 2026 AT 14:57in india we don’t tax crypto gains yet but they’re coming for us soon. i’m already saving receipts and using koinly. better safe than sorry. crypto’s too wild to wing it.

steven sun

January 27, 2026 AT 04:27bro if you’re not in the uae or el salvador you’re already losing. why work so hard for the man when you can just move? chill in dubai, drink coconut water, and let your btc do the work 🌴

Jennifer Duke

January 29, 2026 AT 03:44actually, the UK’s £3,000 allowance is misleading. you still have to file a self-assessment and keep records for six years. it’s not tax-free-it’s tax-deferred with bureaucracy.

Kevin Pivko

January 30, 2026 AT 16:24everyone’s acting like tax is the enemy. newsflash: if you’re making money, you owe something. the real scam is pretending you can outsmart the system. get a CPA. stop winging it.

Arielle Hernandez

January 31, 2026 AT 06:01It is worth noting that Portugal’s exemption applies only to non-professional traders who are tax residents. Non-residents are subject to taxation on all crypto disposals, regardless of holding period. This nuance is frequently overlooked in popular discourse.

Andy Marsland

January 31, 2026 AT 10:09Let me tell you something. The IRS doesn’t care if you’re a ‘hodler’ or a ‘degen.’ They see every transaction. Every swap. Every time you buy a latte with Dogecoin. And they have algorithms that trace it back to your IP address, your exchange login, your bank account. You think you’re anonymous? You’re not. You’re just lazy and delusional. The system doesn’t need to catch you. It already knows.

Jen Allanson

February 1, 2026 AT 07:32It is imperative that individuals understand that the classification of cryptocurrency as property under U.S. tax code fundamentally alters the nature of every transaction. A mere exchange between two digital assets constitutes a realization event. Failure to report such events may constitute tax evasion under IRC Section 7201, which carries potential criminal penalties including fines and imprisonment. This is not a suggestion. It is a legal obligation.

Mathew Finch

February 1, 2026 AT 09:44why do americans always act like the usa is the center of the world? japan has 55%? big deal. we’ve got 50% income tax on everything here. you think crypto’s bad? try paying 40% on your salary. get over yourselves.

MICHELLE REICHARD

February 3, 2026 AT 05:13everyone’s so obsessed with tax rates but nobody talks about how crypto is just a bubble. when it pops, you’ll be stuck with a tax bill and zero assets. the real win is not paying tax-you’re not paying anything because it’s all fake.

Roshmi Chatterjee

February 3, 2026 AT 21:58i live in india and we just got a 30% tax + 4% cess on crypto gains. but honestly? i still think crypto is the future. i just track everything and pay on time. no drama, no stress. smart moves win.

MOHAN KUMAR

February 5, 2026 AT 11:48you think japan is bad? try reporting crypto in russia. they don’t even have clear rules. you get fined if you report and fined if you don’t. it’s a trap.

Harshal Parmar

February 6, 2026 AT 01:19man i moved to portugal last year just for the crypto tax break. 183 days in, got my residency, sold my btc-zero tax. best decision ever. now i just chill on the beach and watch my portfolio grow. life’s good. you can do it too if you plan right.

Adam Fularz

February 6, 2026 AT 01:51the author is sooo smart. i bet he’s got a crypto empire in dubai and pays no tax. meanwhile i’m over here paying 37% on my 2k profit. unfair.