When talking about Thailand cryptocurrency regulation, the set of laws and guidelines that govern digital assets, exchanges, and related services in Thailand. Also known as Thai crypto law, it defines who can issue tokens, how exchanges must operate, and the safeguards to protect investors.

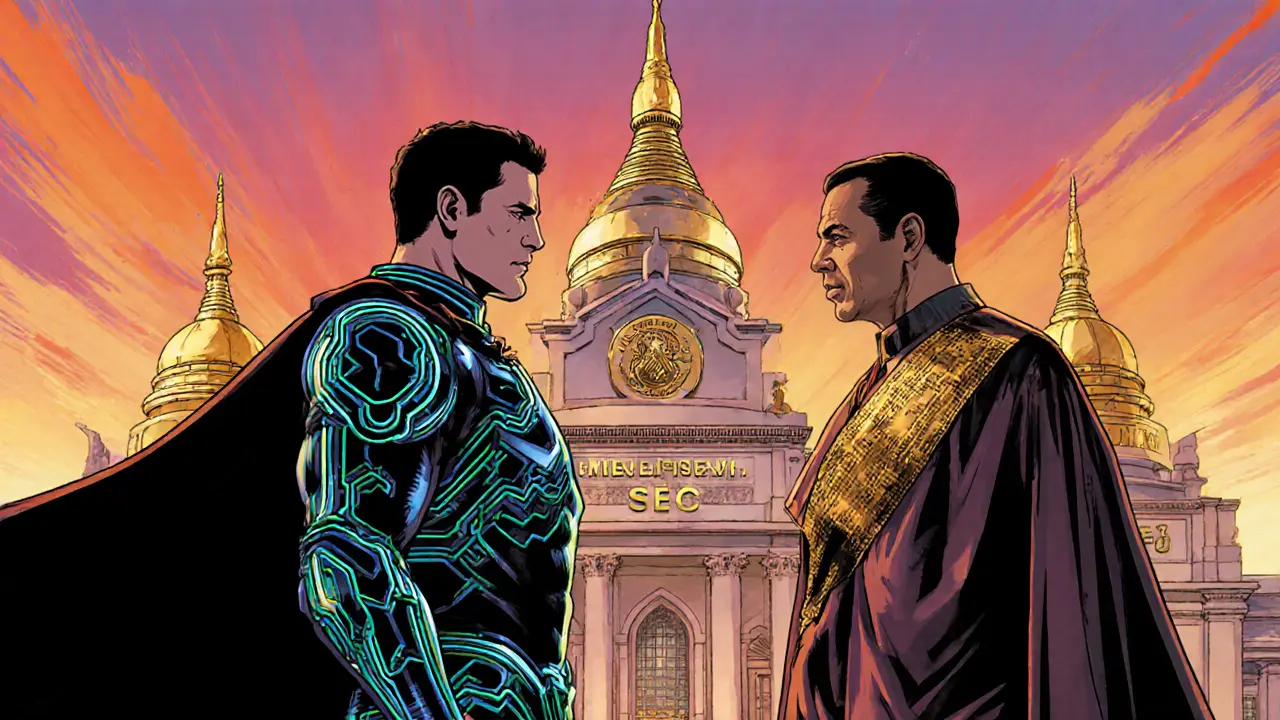

One key player in this landscape is the SEC Thailand, the Securities and Exchange Commission that issues digital asset licences. Its primary attribute is the licensing requirement, meaning any platform that offers trading, custody, or brokerage must obtain a licence before launching. Another crucial entity is anti‑money‑laundering (AML) compliance. AML rules demand rigorous customer‑due‑diligence, transaction monitoring, and reporting of suspicious activity. Together, these entities shape a framework where compliance enables market growth while protecting users.

Thailand cryptocurrency regulation encompasses licensing, AML, and taxation. It requires crypto exchanges to register with SEC Thailand, submit detailed risk‑management plans, and maintain separate wallets for client funds. This regulatory layer influences exchange operations: platforms that meet the standards can advertise openly, access banking services, and attract institutional traders. Conversely, unlicensed sites face fines, shutdowns, or legal action.

Regulation also drives investor behavior. Clear guidelines give confidence to retail users who can see that exchanges are monitored and that token offerings undergo scrutiny. At the same time, the law imposes tax reporting duties, meaning profit from trading must be declared under the personal income tax regime. Understanding these obligations helps traders avoid surprise penalties.

Finally, the framework influences broader blockchain adoption. By setting a legal baseline, the government encourages fintech startups to develop compliant solutions, from payment gateways to decentralized finance (DeFi) protocols. This creates a virtuous cycle: more compliant services attract users, which in turn encourages further innovation under the protective umbrella of the law.

Below you’ll find a curated set of articles that break down each piece of the puzzle—licensing steps, AML best practices, exchange reviews, and the latest regulatory updates—so you can stay ahead of the curve in Thailand’s evolving crypto scene.

Step-by-step guide to obtaining a Thai crypto exchange license in 2025, covering requirements, costs, compliance and common pitfalls.