When you buy an NFT, a unique digital asset stored on a blockchain that can represent art, music, or collectibles. Also known as non-fungible token, it isn’t just a picture or file—it’s a piece of ownership with rules baked into code. One of those rules? royalties, automatic payments to the original creator every time the NFT is resold. That’s the promise: creators keep earning long after the first sale. But in practice, it’s messy. Some platforms enforce royalties by design. Others ignore them completely. And some projects never had them to begin with.

Royalties aren’t just for NFTs. They show up in digital music, audio files sold as tokens where artists get paid each time the track changes hands, and even in game items, virtual weapons or skins that generate income for designers when traded on open markets. The idea is simple: if you build something valuable, you should benefit when others profit from it. But crypto’s open nature means enforcement depends on who’s running the platform. Ethereum-based NFTs used to honor royalties by default. Now, some marketplaces like OpenSea let buyers opt out. That’s why you see creators complaining about lost income—even when their work sells for thousands.

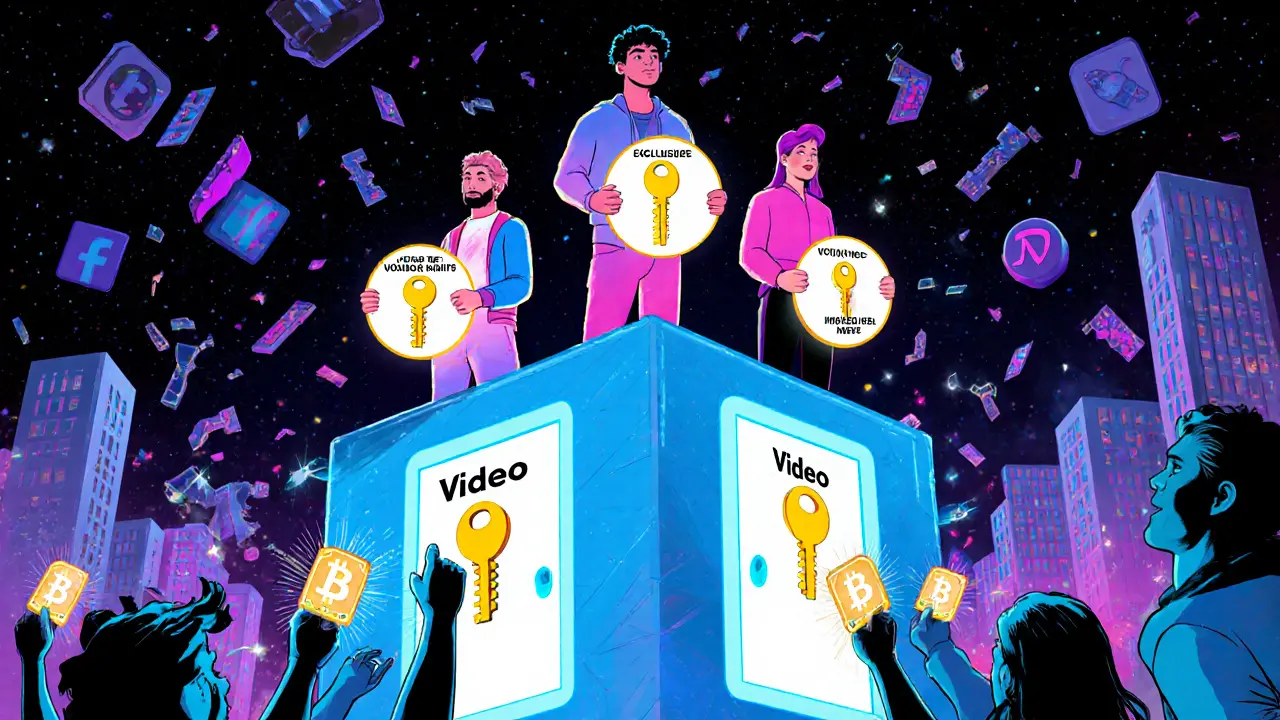

It’s not all bad news. Projects like Zamio TrillioHeirs NFT, a collection that gave holders governance rights and access to exclusive metaverse features, tied royalties directly to real utility. Same with Lepasa Polqueen NFT, where owning the art unlocked playable characters in a live game. These weren’t just JPEGs—they were keys to something ongoing. That’s where royalties matter most: when they’re part of a living ecosystem, not a one-time payout.

Meanwhile, many so-called royalty-backed tokens are just hype. Look at projects like Lenda or Battle Hero—no active development, no users, no royalties because there’s nothing left to sell. Even in NFT ticketing for live events, royalties only work if the event organizer actually coded them in. Too many assume royalties are automatic. They’re not. They’re written into smart contracts—and those contracts can be changed, ignored, or deleted.

So what should you care about? If you’re a creator, ask: is this platform committed to enforcing royalties? If you’re a buyer, ask: does this asset have ongoing value, or is it just a collectible with no future? And if you’re tracking crypto trends, watch how regulations and marketplaces shift. The U.S. and Singapore are already tightening rules on digital assets. Royalties might soon be legally required—or completely abandoned.

Below, you’ll find real examples of how royalties play out—or fail—in crypto. Some posts expose fake airdrops pretending to pay creators. Others break down NFTs that actually deliver ongoing income. Some show how blockchain ticketing turns concertgoers into investors. No fluff. No promises. Just what’s working, what’s broken, and who’s still getting paid.

NFTs in 2025 aren't about digital art sales-they're a key revenue tool for creators building owned audiences. Learn how royalties, utility, and community are replacing platform-dependent income.