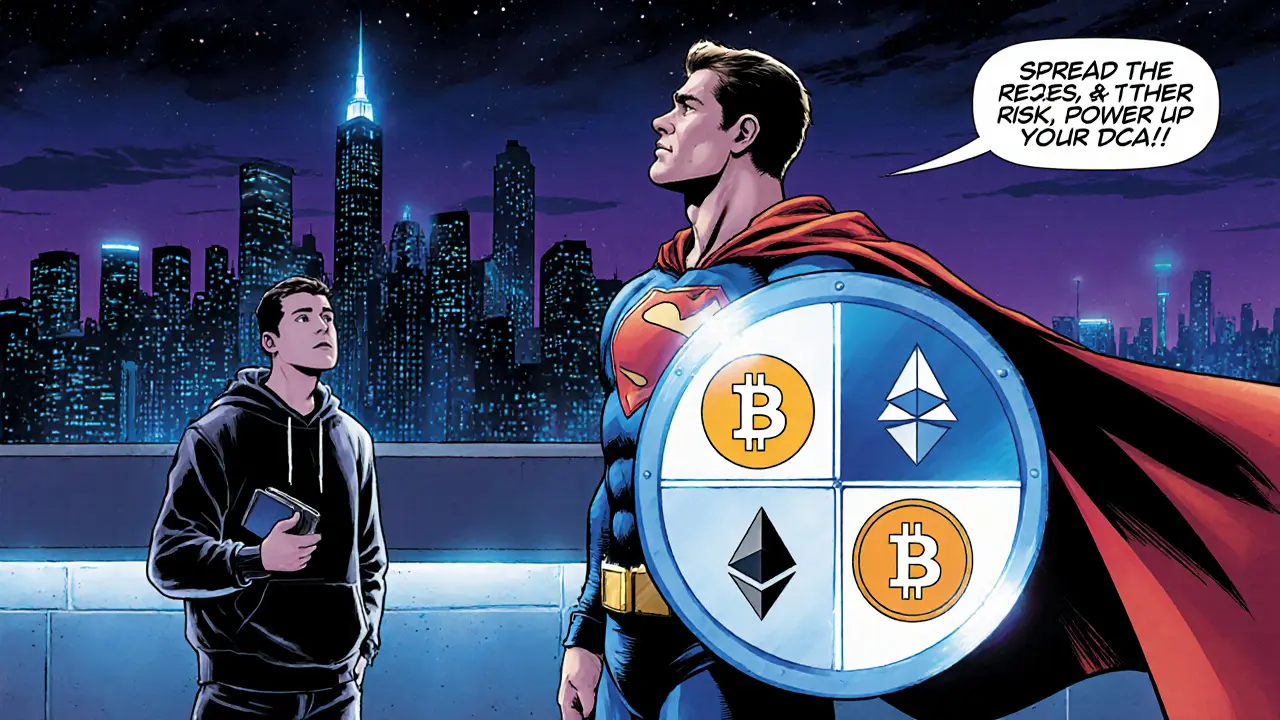

When working with Crypto Diversification, the practice of spreading crypto holdings across multiple assets to lower risk. Also known as portfolio diversification in crypto, it helps investors avoid big swings from a single token.

A solid crypto portfolio, a mix of coins, tokens, DeFi positions, and stablecoins tailored to personal goals is the foundation. Crypto diversification requires good risk management, the process of assessing and limiting exposure to market volatility. Stablecoins, for example, act as a low‑volatility anchor, letting you park earnings without exiting the crypto ecosystem. By pairing high‑growth assets with steady‑state ones, you create a safety net that smooths out daily price noise.

DeFi assets like liquidity‑provider tokens and yield‑farm shares add another layer of complexity, but they also boost returns when balanced correctly. The interplay between DeFi protocols, smart‑contract platforms that enable borrowing, lending, and staking and stablecoins shapes your overall risk profile. Understanding how each piece fits lets you adjust allocations on the fly, whether you’re chasing short‑term gains or building a long‑term store of value. Below you’ll find curated articles that dive deeper into airdrops, exchange reviews, and security tips—all aimed at helping you put a robust diversification plan into action.

Learn the most common crypto DCA mistakes, why they happen, and step‑by‑step fixes to keep your dollar‑cost averaging strategy effective.