When you hear digital ownership, the ability to prove you control a unique asset on a blockchain, not just access it. Also known as blockchain ownership, it means you hold the real key—not a password from a company that can delete your access anytime. This isn’t theory. It’s what lets you own a piece of art, a concert ticket, or even a share of American Express stock as a token on a public ledger—no bank, no broker, no middleman needed.

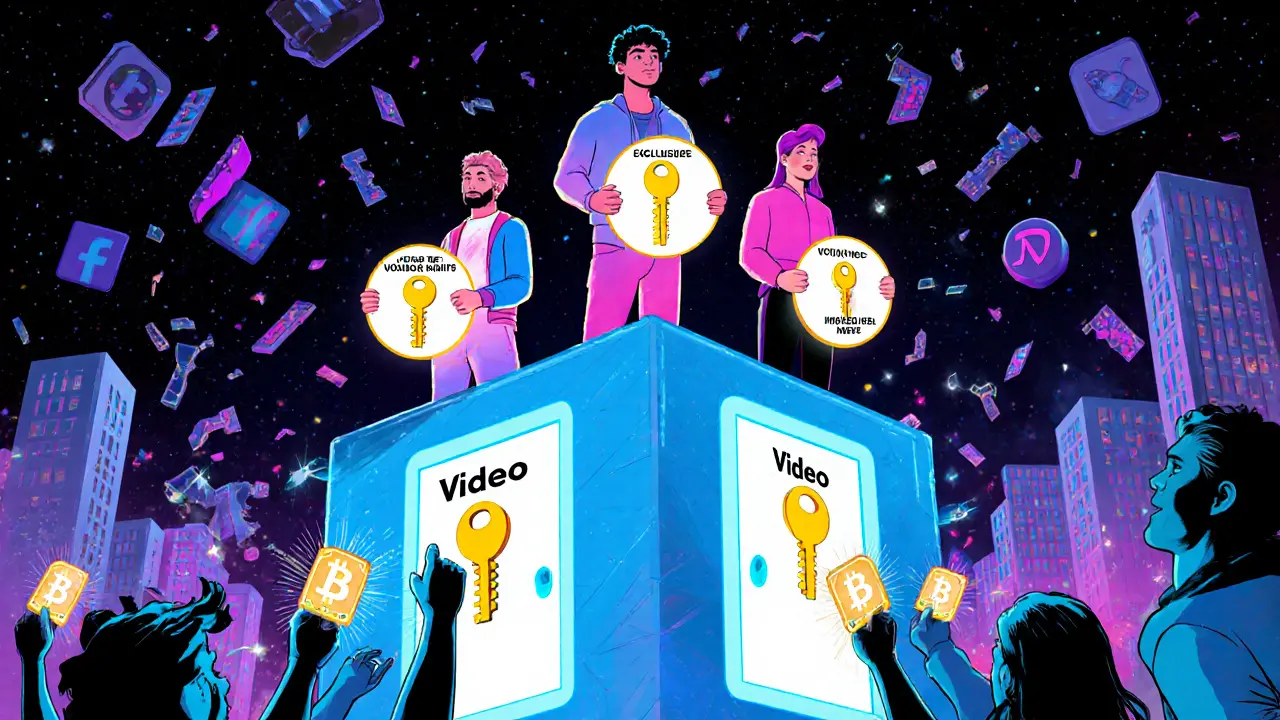

True digital ownership, the ability to prove you control a unique asset on a blockchain, not just access it. Also known as blockchain ownership, it means you hold the real key—not a password from a company that can delete your access anytime. This isn’t theory. It’s what lets you own a piece of art, a concert ticket, or even a share of American Express stock as a token on a public ledger—no bank, no broker, no middleman needed.

But here’s the catch: not every token is ownership. A lot of so-called NFTs are just pictures with a blockchain stamp. Real tokenized assets, digital representations of real-world property like stocks, real estate, or event tickets, verified on a blockchain. Also known as blockchain-backed assets, they give you rights that can be enforced, traded, or even earn you dividends. Think of AXPon—the token tied to actual American Express stock. You don’t just own a symbol; you own a claim on the company’s value. Same with NFT tickets for live events. If they’re built right, you get royalties every time someone resells it. That’s ownership. Not speculation.

Then there’s the flip side: fake claims. Projects like Lenda, Battle Hero, or WSPP pretend to offer value but have no team, no users, no utility. They’re digital ghosts. Real crypto assets, digital items with verifiable scarcity and transferable rights on a blockchain network. Also known as blockchain assets, they have a track record, active development, and actual demand. You can spot them by their activity—trading volume, community size, real use cases. If it’s just a tweet and a whitepaper, it’s not ownership. It’s a gamble.

And governments are paying attention. OFAC now tracks over 1,200 crypto addresses linked to criminals. Singapore bans new crypto licenses. Vietnam sees $91 billion in crypto flows despite being illegal. Digital ownership isn’t just about tech—it’s about law, control, and power. Who gets to own what? Who can freeze it? Who can trace it? These aren’t abstract questions. They’re daily realities for people holding tokens.

What you’ll find below isn’t a list of hype. It’s a collection of real cases—some working, some dead, some scams. You’ll see how NFT ticketing actually works, why tokenized stocks are still risky for beginners, and why most airdrops are traps. You’ll learn which platforms still operate, which are gone, and what digital ownership really looks like when it’s not just marketing.

NFTs in 2025 aren't about digital art sales-they're a key revenue tool for creators building owned audiences. Learn how royalties, utility, and community are replacing platform-dependent income.