When you hear about a new crypto project promising 100x returns with no team and no code, that’s not a miracle—it’s a cryptocurrency scam, a deceptive scheme designed to steal your money by pretending to be a legitimate digital asset. Also known as crypto fraud, these scams thrive on hype, fake social proof, and urgency. They don’t need to be complex—just convincing enough to make you click "Buy Now" before you think. The most common types? Fake tokens pretending to be linked to big names like Shiba Inu, fake airdrops that ask for your wallet private key, and projects that vanish the moment you send funds.

Take Shytoshi Kusama (SHY), a meme token with no team, no utility, and no connection to the real Shiba Inu project. It’s a fake crypto token built to trick people into buying something worthless. Or look at the REI token airdrop, a dead project that never existed, yet still lures people into signing up with fake websites. These aren’t outliers—they’re standard playbooks. Scammers copy real names, clone logos, and use fake Telegram groups to look official. Even CoinMarketCap campaigns get hijacked to make scams seem legit. You’ll also find scams hiding behind crypto airdrop, a legitimate way to distribute free tokens, but often abused to harvest wallets or spread malware. Real airdrops never ask for your seed phrase. If they do, it’s a scam.

And it’s not just new tokens. Old ones like Steakd (SDX), LaserEyes (LSR), and BabyBUILDon (BB) look like trading opportunities—but they’re dead projects with near-zero volume, no working apps, and no real community. They’re kept alive only by bots and pump groups. Meanwhile, North Korea runs organized crypto theft operations, turning stolen coins into cash through layered bridges and hidden exchanges. These aren’t random hackers—they’re state-backed operations with billion-dollar budgets.

So how do you stay safe? Check the team—real projects have LinkedIn profiles and public GitHub activity. Look at the contract—use Etherscan or BscScan to see if it’s renounced or if the owner can drain funds. Check trading volume—low volume means low liquidity and easy manipulation. And never, ever share your private key. If something sounds too good to be true, it is. The market is full of real innovation—but it’s also full of predators waiting for you to look away.

Below, you’ll find real case studies of the most common scams, broken down so you can recognize them before you lose money. No fluff. No hype. Just facts from the trenches.

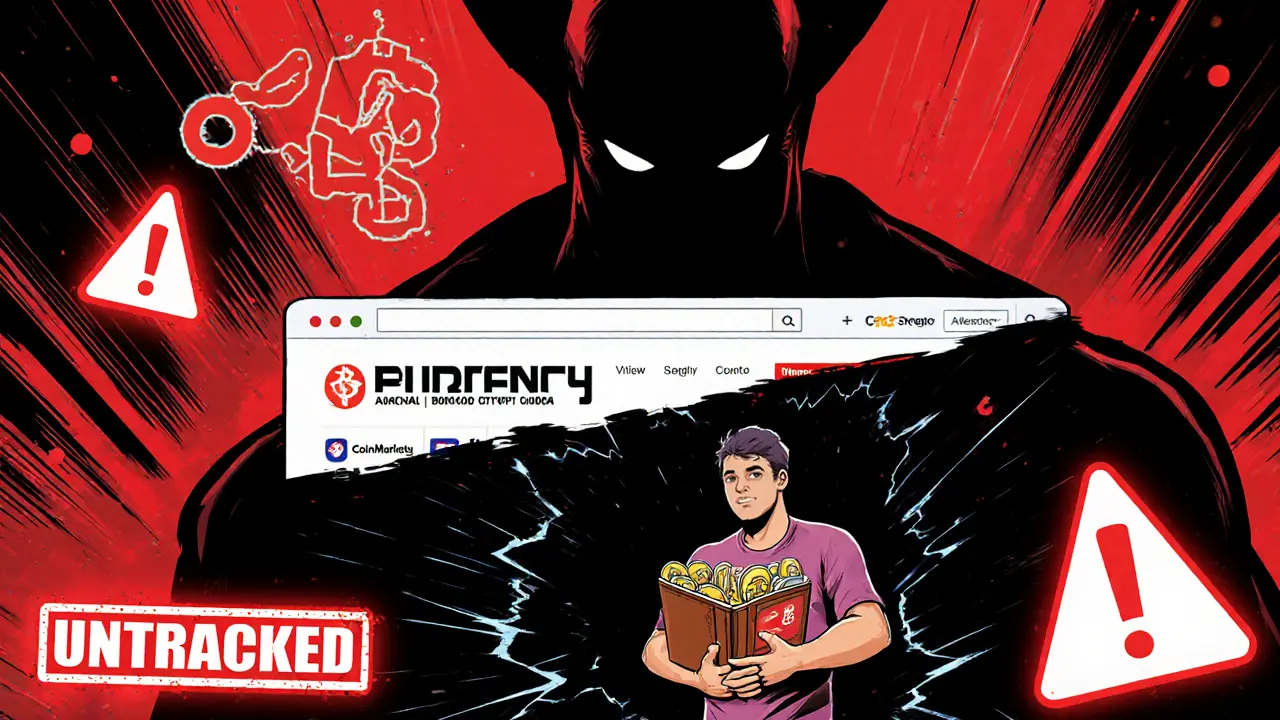

Burency Global claims to be a regulated crypto exchange, but as of 2025, it has no trading volume, no user reviews, no regulatory proof, and no customer support. It shows all signs of being a scam. Avoid it and use trusted platforms like Coinbase or Gemini instead.