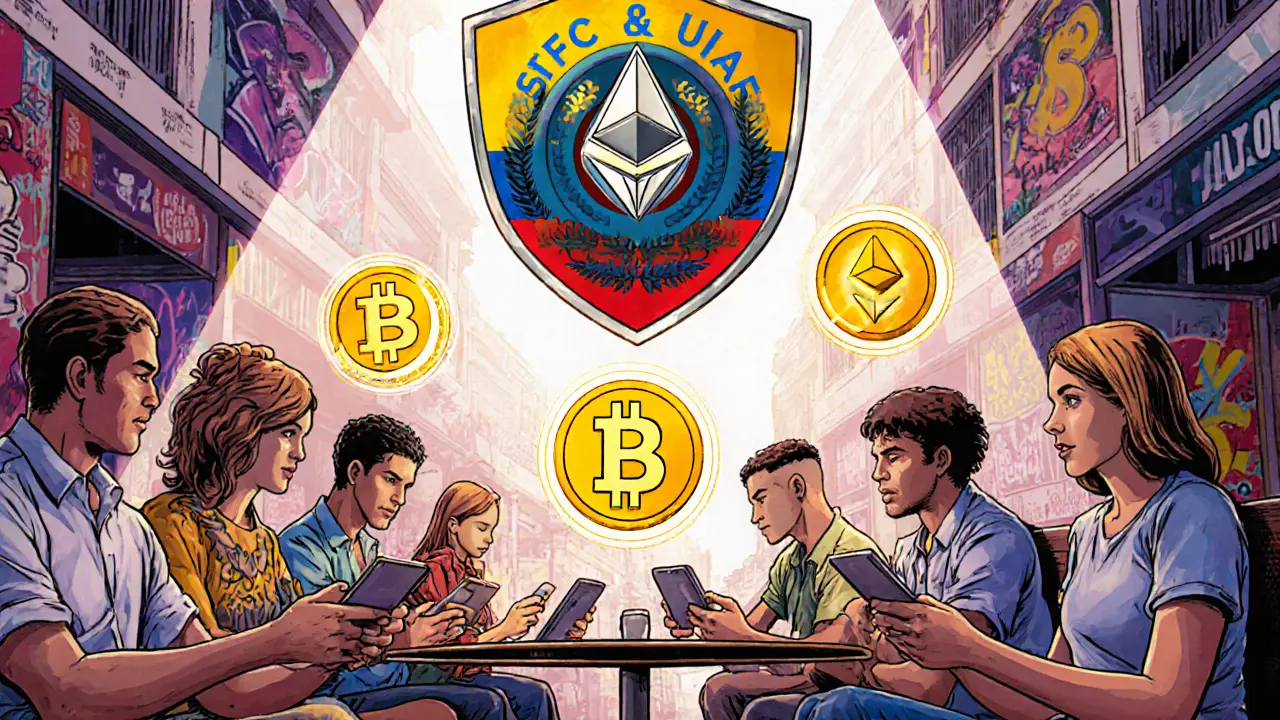

When people talk about cryptocurrency Colombia, the widespread use of digital money in Colombia despite government uncertainty. Also known as crypto adoption in Latin America, it’s not about speculation—it’s about survival, speed, and skipping broken systems. While Colombia’s central bank hasn’t legalized crypto as payment, millions use it daily to send money home, protect savings from inflation, and trade without banks.

That’s why crypto exchanges Colombia, platforms like Binance, Bitso, and local peers that let Colombians buy and sell digital assets thrive even without official approval. You won’t find a national licensing system, but you’ll find people using peer-to-peer apps like Paxful and LocalBitcoins to trade USD for Bitcoin with cash in person. crypto adoption Colombia, how everyday users in Medellín, Cali, and Bogotá rely on crypto for real needs isn’t a trend—it’s a necessity. Inflation hit 15% in 2023, and remittances from the U.S. hit $10 billion last year. Crypto cuts fees and waits. No more waiting three days for a Western Union transfer.

And it’s not just Bitcoin. People trade stablecoins like USDT to avoid peso swings. Some use crypto to pay for services online, from hosting to freelance gigs. Others join DeFi projects to earn yield, even if those platforms aren’t regulated. You’ll find crypto meetups in universities, Telegram groups full of traders, and even small shops accepting crypto as payment. But it’s risky. Scams like fake airdrops and fake exchanges—like Btcwinex or Burency Global—pop up fast. Many users lose money because they trust hype over verification. That’s why the posts below cover real cases: what works, what’s fake, and how to tell the difference.

What you’ll find here isn’t theory. It’s real stories from Colombia’s crypto underground—how people bypass restrictions, avoid scams, and use digital money to get ahead. You’ll see how regulations in Singapore or Nigeria compare, how airdrops are often traps, and why some tokens like SIN or LENDA are dead on arrival. This isn’t about getting rich overnight. It’s about understanding what’s real when the rules are blurry and the stakes are high.

Colombians access crypto exchanges legally through regulated local platforms like LuloX and Wenia, not by bypassing restrictions. With over 5 million users and institutional backing, Colombia’s crypto market is growing under clear tax and compliance rules.