When navigating crypto licensing requirements, the set of rules and approvals that crypto exchanges must meet to operate legally in a jurisdiction. Also known as exchange licensing, it covers everything from capital thresholds to anti‑money‑laundering procedures. Understanding these rules is the first step to launching a compliant platform because crypto licensing requirements dictate who can offer services, what documentation is needed, and how ongoing reporting works.

A major piece of the puzzle is the regional framework. For instance, Indonesian crypto exchange licensing, mandated by the DFA and overseen by OJK, forces new operators to hold a minimum capital of 5 billion rupiah, implement KYC/AML suites, and file monthly tax reports. Meanwhile, the UAE crypto regulations, run by VARA and the Crypto‑Asset Reporting Framework, require a licensing fee, audited proof of solvency, and a strict segregation of client funds. Both cases illustrate a semantic triple: regional framework influences licensing requirements, which in turn shape compliance processes. Another core element is exchange capital requirements, the minimum financial buffer an exchange must maintain to cover operational risks and protect users. Capital adequacy enables the exchange to survive market shocks, satisfies regulators, and builds user trust. In practice, meeting these thresholds means securing investor backing, conducting regular stress tests, and publishing transparent financial statements.

Putting it all together, crypto licensing requirements encompass regulatory compliance, capital adequacy, and ongoing reporting. They require a clear understanding of the legal landscape, a robust compliance program, and the financial muscle to meet capital rules. Whether you’re eyeing Indonesia’s fast‑growing market or the UAE’s strategic hub status, the same fundamentals apply: know the specific entity‑level rules, align your internal processes, and continuously monitor changes. Below you’ll find a curated list of articles that break down modular blockchain design, airdrop mechanics, exchange reviews, and deeper dives into regional licensing—each piece giving you actionable insight to stay ahead of the curve.

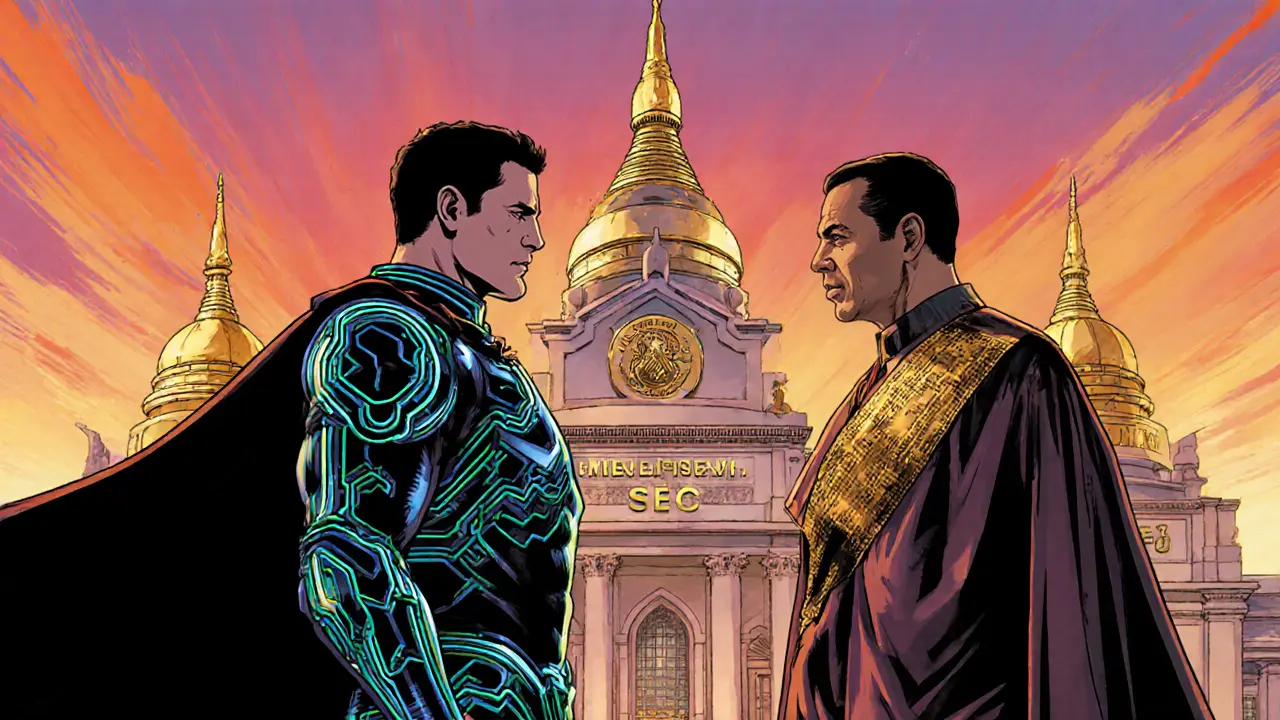

Step-by-step guide to obtaining a Thai crypto exchange license in 2025, covering requirements, costs, compliance and common pitfalls.