When you’re looking for a crypto exchange, the biggest risk isn’t price swings—it’s fake crypto exchange, a platform that looks real but has no infrastructure, no users, and no legal backing. These aren’t just shady startups—they’re often complete fabrications built to steal your funds before vanishing. You don’t need to be a tech expert to spot them. Just look for the same warning signs that show up again and again in platforms like Burency Global, a crypto exchange with no trading volume, no reviews, and no customer support, or YOOBTC, a platform that doesn’t even exist as a verified entity. If it sounds too good to be true—low fees, no KYC, 10,000 trading pairs—it probably is.

One of the clearest red flags is no-KYC exchange, a platform that refuses to verify your identity, often because it’s designed to avoid regulation and hide criminal activity. While some traders prefer privacy, exchanges that make anonymity their main selling point are usually hiding something. Combine that with zero public team members, no social media presence, and no third-party audits, and you’ve got a classic scam setup. Even worse, some of these platforms pretend to be regulated. Look at OFAC sanctions, the U.S. government’s list of blocked crypto addresses tied to hackers and terrorists. If an exchange is dealing with wallets on that list, you’re not just at risk—you’re already in danger.

Another pattern? Dead tokens and fake airdrops. Projects like WSPP, a fake airdrop claiming to help end poverty or THN airdrop, a non-existent token drop from Throne, use hype to lure people into fake wallets. These aren’t giveaways—they’re traps. And if you’re drawn in by promises of free tokens, you’re already on the list of targets. The same goes for exchanges that promote these scams as part of their ecosystem. No legitimate platform pushes unverified airdrops.

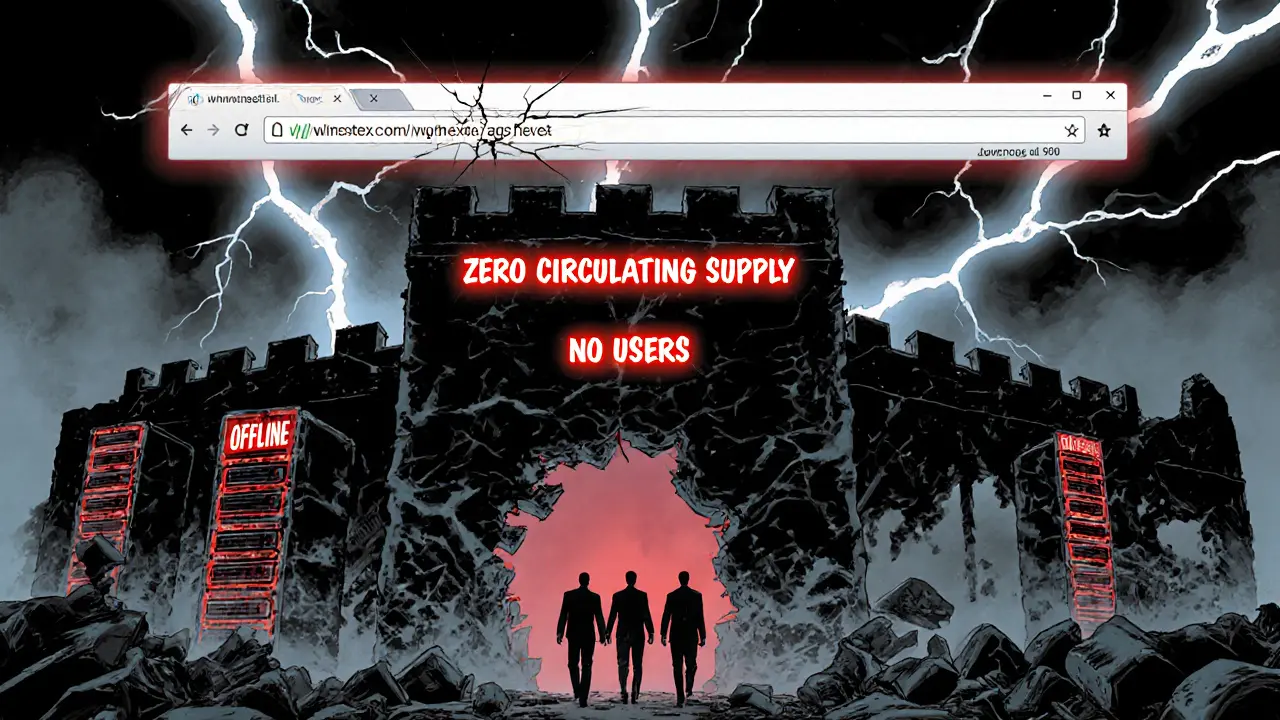

You’ll also see exchanges with zero trading volume, like REI Tokens, a project with zero supply and no distribution, or ones that shut down without warning—like Bitfront, a now-defunct exchange that left users stranded. These aren’t failures—they’re planned exits. The team walks away with the funds, and you’re left with nothing but a broken website.

What separates real exchanges from fake ones? Transparency. Real platforms publish their legal status, licensing info, and team members. They have customer support you can reach. They don’t promise impossible returns. And they don’t rely on hype or memes to attract users. If you’re unsure, check if the exchange is listed on trusted directories, has real user reviews, or is mentioned in official regulatory updates—like MAS crypto regulations, Singapore’s strict rules that only allow a handful of firms to operate.

Below, you’ll find real reviews and deep dives into exchanges that failed, scams that tricked thousands, and the exact signs you need to check before you click "Deposit." This isn’t theory—it’s what happened to real people. Don’t be next.

Winstex crypto exchange is offline with zero token circulation and no user activity. This review reveals why Winstex is not a legitimate or safe platform to use or invest in.