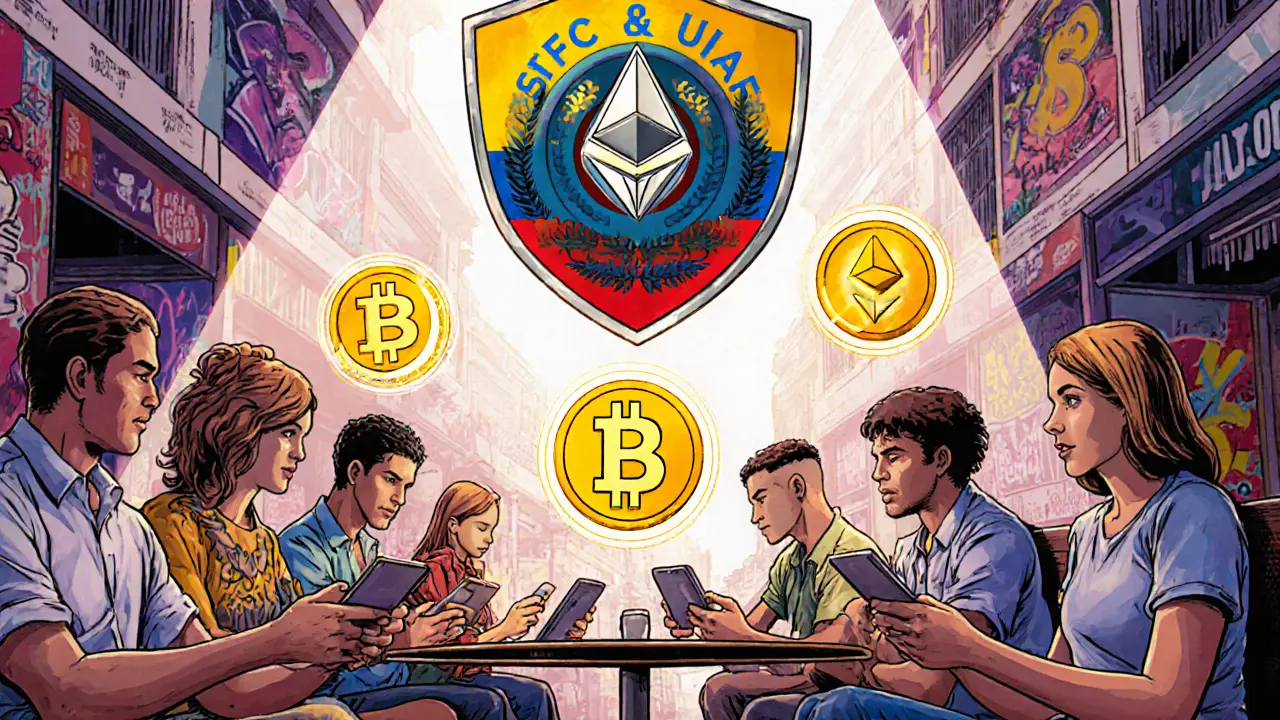

When it comes to Colombia crypto access, the way people in Colombia buy, sell, and hold digital assets despite government restrictions. Also known as crypto usage in Colombia, it’s not about legality—it’s about necessity. Even though the government hasn’t approved crypto as legal tender and banks are told to avoid it, over 5 million Colombians—nearly 10% of the population—use cryptocurrency regularly. They don’t wait for permission. They find a way.

How? Through P2P crypto Colombia, peer-to-peer trading platforms where users exchange crypto directly without banks. These platforms, like LocalBitcoins and Paxful, let Colombians trade Bitcoin and USDT for cash in person or via mobile payments. Crypto regulations Colombia, the lack of clear rules and banking bans. But that’s not stopping people. They use stablecoins to protect savings from inflation, send money abroad without high fees, or buy goods from international sellers. It’s not a trend—it’s a survival tactic. And it’s not just individuals. Small businesses, freelancers, and even farmers are accepting crypto because it’s faster and cheaper than traditional banking.

What’s missing? Official exchanges. Most global platforms like Binance or Coinbase aren’t legally allowed to operate in Colombia. But that doesn’t mean they’re not used. People access them through VPNs or trade through local intermediaries who handle the cash side. Meanwhile, crypto exchanges Colombia, the unofficial, decentralized networks that fill the gap. These aren’t regulated, but they’re reliable because they’re built on trust, not paperwork. Users know who they’re trading with. They leave reviews. They warn each other about scams. It’s a grassroots system.

And it works. Colombia ranks among the top countries in Latin America for crypto transaction volume. People aren’t just speculating—they’re using crypto to pay for groceries, rent, and even medical bills. They’ve turned restrictions into innovation. The government talks about regulation, but the people have already moved on. What you’ll find in the posts below are real stories, real platforms, and real risks people face when they choose crypto over banks in Colombia. No theory. No fluff. Just what’s actually happening on the ground.

Colombians access crypto exchanges legally through regulated local platforms like LuloX and Wenia, not by bypassing restrictions. With over 5 million users and institutional backing, Colombia’s crypto market is growing under clear tax and compliance rules.