When talking about Bitcoin mining ban, a governmental or regulatory effort to prohibit or severely restrict the proof‑of‑work mining of Bitcoin. Also known as BTC mining prohibition, this move targets the core consensus mechanism that powers Bitcoin transactions. It directly ties into proof‑of‑work, the computational puzzle miners solve to add new blocks and the broader cryptocurrency regulation, laws and guidelines shaping how digital assets are created, traded, and governed. The ban’s intent is usually to curb energy consumption, the massive electricity use linked to Bitcoin’s mining operations and mitigate environmental concerns.

The environmental impact of Bitcoin mining is the main driver behind many bans. Countries with tight carbon goals see mining farms as a direct conflict with sustainability targets. By imposing a mining ban, regulators aim to force a shift toward greener consensus models or to push miners into regions with surplus renewable energy. This shift influences the entity‑attribute‑value pair: Entity – Bitcoin mining; Attribute – Energy usage; Value – up to 150 TWh per year in some jurisdictions. At the same time, the ban reshapes market dynamics: token prices react to supply‑side shocks, and mining hardware manufacturers face reduced demand, prompting a pivot to other crypto projects or to AI‑related ASICs.

From a legal standpoint, the ban exemplifies how cryptocurrency regulation covers licensing, taxation, and operational limits for digital asset activities is evolving. In places like the EU, the ban ties into the MiCA framework, while in emerging markets it aligns with new energy‑tax policies. The rule‑making process often requires proof that mining benefits outweigh ecological costs. Consequently, the ban creates a feedback loop: stricter regulations increase compliance costs, which in turn drive miners to relocate or switch to proof‑of‑stake alternatives, thereby reducing overall energy demand.

Economic repercussions ripple through the entire crypto ecosystem. A mining ban can compress Bitcoin’s hash rate, potentially increasing transaction fees and slowing block times until the network stabilizes. Investors watch these signals closely; a sudden drop in hash rate may signal heightened risk, while a resilient price suggests market confidence despite the ban. Meanwhile, decentralized finance platforms that rely on Bitcoin as collateral must reassess risk models, integrating the ban’s impact into their risk assessment, the systematic evaluation of exposure to market and regulatory shifts frameworks.

All these threads—environmental pressure, regulatory response, and market adjustment—intertwine to shape the future of Bitcoin mining. Below you’ll find a curated collection of articles that dig deeper into each angle, from technical breakdowns of proof‑of‑work to case studies of countries enforcing bans, and strategic guides for navigating the new regulatory landscape. Dive in to see how the Bitcoin mining ban is reshaping the crypto world today.

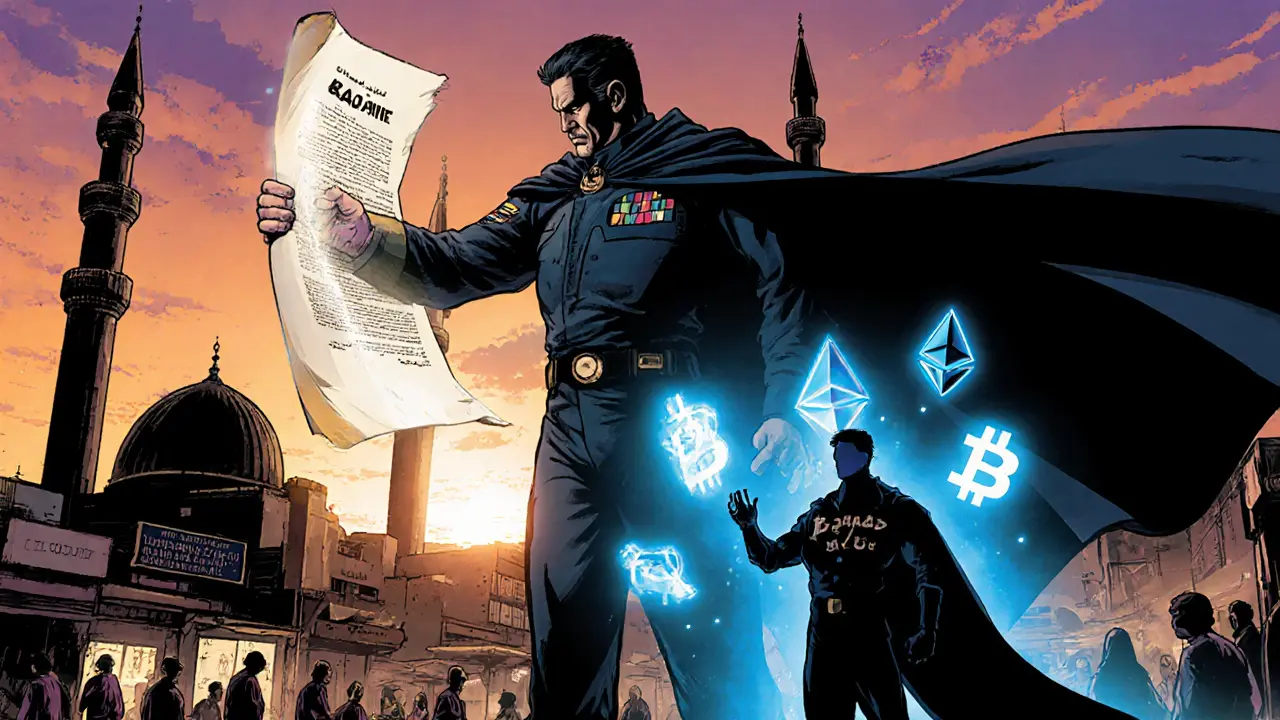

Explore Iraq's 2017 crypto mining ban, its enforcement, underground market, economic impact, and how it compares to other global restrictions.