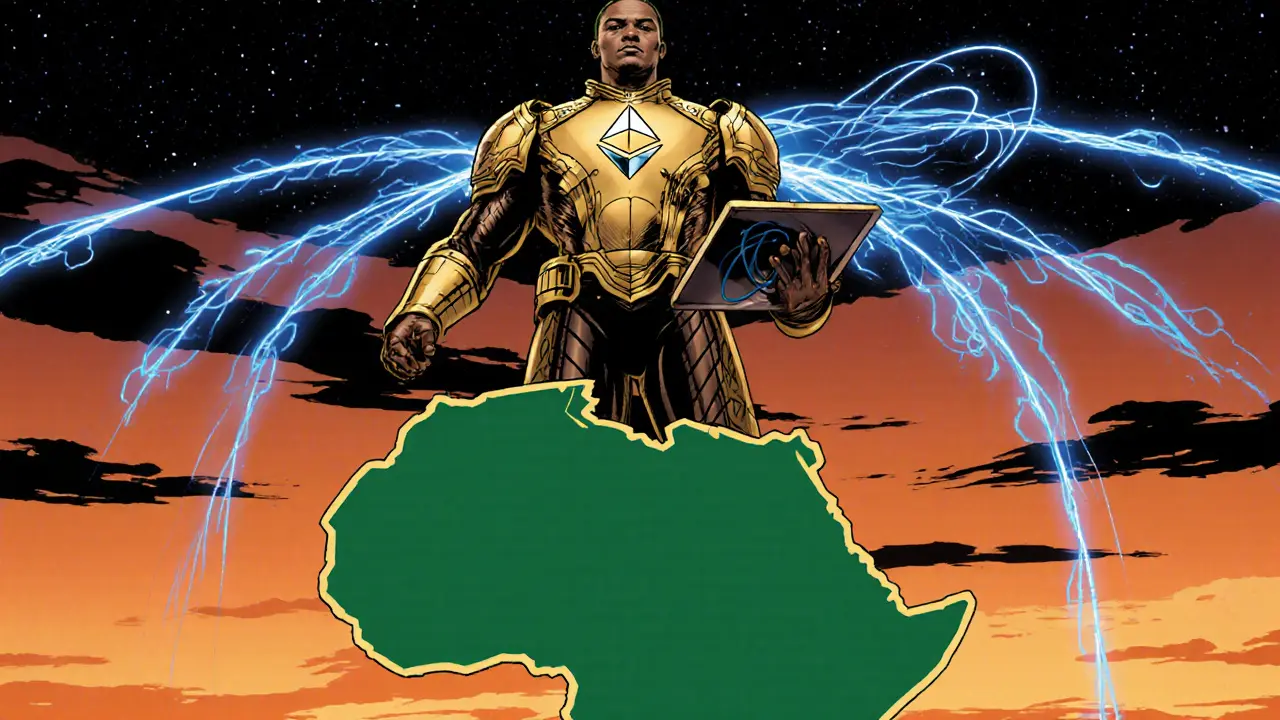

When you start to explore AfroDex, a decentralized exchange built to serve African traders and projects. Also known as AfroSwap, it promises low‑fee token swaps, native fiat‑on‑ramp options and a community‑driven governance model. Decentralized exchange (or DEX) is the broader category AfroDex belongs to, meaning trades happen directly on‑chain without a central order book. This structure brings two big benefits: users keep custody of their assets and the platform can run 24/7 regardless of local banking hours. But it also raises questions about security – how does AfroDex protect against hacks, front‑running or smart‑contract bugs? The answer lies in its audit reports, bug‑bounty program and multi‑sig wallet architecture. In today’s crypto scene, a solid security posture is a must‑have, especially for an exchange targeting markets where user education levels vary widely. By the end of this review you’ll see exactly how AfroDex balances accessibility with safety.

AfroDex’s core engine revolves around liquidity pools. These pools are collections of token pairs supplied by users, and they enable instant swaps without needing a traditional order book. The more depth a pool has, the less price slippage you’ll face on larger trades – a crucial factor for traders moving significant sums. AfroDex offers native pools for popular African stablecoins, plus cross‑chain bridges for assets like BNB and USDT. When it comes to token swaps, AfroDex uses an automated market maker (AMM) model similar to Uniswap, but with a fee structure tailored to local economies. Typical swap fees sit at 0.15%, which is noticeably lower than many global DEXes, and a small portion of those fees is redistributed to liquidity providers as rewards. This fee design aims to attract both traders looking for cheap swaps and yield‑seekers wanting to earn passive income. Additionally, AfroDex integrates a simple AfroDex review dashboard where you can monitor pool health, fee earnings and recent transaction volumes in real time.

Beyond the on‑chain mechanics, AfroDex tries to bridge the gap between crypto and everyday finance. The platform supports fiat‑on‑ramp partners that let users deposit African shillings directly into their wallets, turning a typical crypto onboarding hurdle into a smooth experience. This feature ties into the larger trend of “crypto‑banking convergence,” where DEXes become gateways for ordinary people to access digital assets without needing a traditional bank account. AfroDex also rolls out community governance tokens that let active participants vote on fee adjustments, new pair listings and future roadmap items. By giving the community a direct voice, the exchange hopes to stay aligned with regional needs and avoid the top‑down decisions that have plagued other projects. All these moving parts—security audits, liquidity incentives, low fees, fiat integration and governance—form a cohesive ecosystem that makes AfroDex more than just a swap tool; it’s a budding financial hub for African crypto users.

Now that you have a clear picture of what AfroDex offers, you’ll find a curated list of articles below that dig deeper into each of these topics. Whether you’re interested in the nitty‑gritty of its smart‑contract audits, want to compare its fee model against other DEXes, or are curious about how its liquidity incentives perform in volatile markets, the posts below provide actionable insights and real‑world data to help you decide if AfroDex fits your trading strategy.

An in‑depth AfroDex exchange review covering token economics, security, liquidity and how it compares to major DEXs like Uniswap.